As a researcher with a background in blockchain technology and experience working on Ethereum projects, I’ve closely observed the rise of layer-2 solutions to address the scalability challenges of the Ethereum network. These platforms have proven successful in handling high transaction volumes and enabling the deployment of resource-intensive decentralized applications.

Ethereum, as a veteran blockchain, has evolved to cater to the growing requirements of its worldwide user community. In order to alleviate the congestion on the mainnet caused by an increasing number of transactions, several second-layer solutions have emerged.

These platforms offer more affordable transaction costs and greater scalability, enabling users to develop and run resource-intensive decentralized apps that might not be viable using the main layer.

Ethereum Layer-2s Are A Success, But There Is A Problem

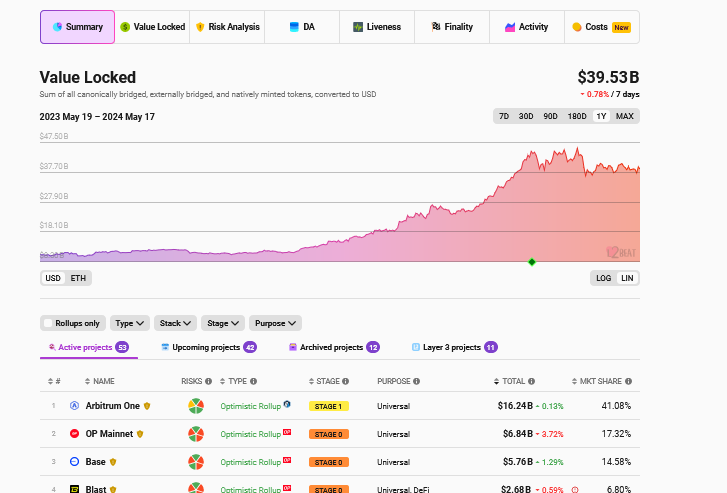

Based on L2Beat’s report, Ethereum’s layer-2 platforms presently hold over $39 billion in combined value. However, Nikita Zhavoronkov, a senior developer at Blockchair, expresses apprehension, viewing these platforms as potential significant legal risks.

According to Zhavoronkov, there’s a risk that layer-2 protocols on Ethereum and Bitcoin may face regulatory scrutiny due to their similarities to money service businesses (MSBs). Since these platforms currently operate without regulation, there is a possibility they could be breaking the law.

According to Zhavoronkov, many current layer-2 solutions fail to live up to the ideal of decentralization. He contends that these systems rely on mechanisms such as multi-signature contracts and “emergency councils” with restricted membership as signs of centralized authority.

Additionally, the developer brought up the point that many layer-2 solutions function in a custodial manner. This means that users don’t have direct control over their funds when using these platforms for scalability. The risk here is that this degree of centralization could make these entities attractive targets for regulatory scrutiny, potentially leading to vulnerabilities.

Zhavoronkov points out that while layer-2 platforms serve as essential enablers, operating on a trustless foundation, they function as profit-making entities, earning income through transaction fees. Notably, some platforms such as Optimism and Arbitrum mint tokens, thereby influencing token values with their revenue generation.

The developer argues that layer-2 platforms share more similarities with conventional businesses than fully decentralized platforms do.

More Headwinds For ETH, United States SEC Reported Investigation

If Zhaborovkov’s assessment is correct that layer-2 solutions fall under the definition of Money Service Businesses (MSBs) according to US legislation, this designation poses a significant issue. MSB status brings with it rigorous rules, mandatory compliance procedures, and potential penalties.

As a crypto investor in Ethereum, I can tell you that this situation poses a significant risk to the platform’s ability to innovate and may seriously impede its scalability.

The perspective of Zhavoronkov that has been criticized by some as biased gains more intrigue due to recent reports of an SEC investigation into Ethereum in the US.

Experts suggest that the Securities and Exchange Commission (SEC) classifying Ethereum as a security instead of a commodity, similar to Bitcoin, may prolong the process for approving spot Ethereum exchange-traded funds (ETFs).

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- USD COP PREDICTION

- EUR CLP PREDICTION

2024-05-17 21:11