As a seasoned analyst with over two decades of experience in the financial markets under my belt, I’ve seen my fair share of market fluctuations and whale movements. The recent sell-off of 199 BTC by the anonymous “diamond hands” investor is a testament to the strategic thinking that has driven their success in Bitcoin investing over the past five years.

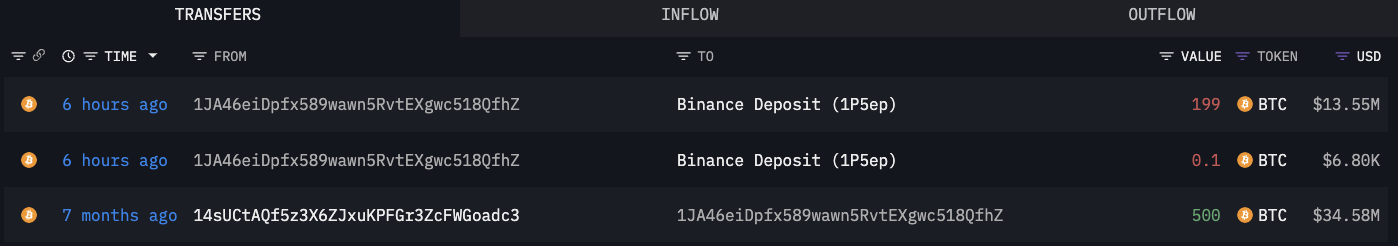

An investor who has been steadfastly holding Bitcoin for the past five years, often referred to as someone with “diamond hands,” recently made news by offloading 199 BTC, currently valued at approximately $13.55 million, about an hour ago according to Lookonchain. This unidentified investor had previously withdrawn 801 BTC, equivalent to around $8.25 million at the time, from the Huobi exchange five years ago when the price was $10,297 per Bitcoin.

In the past month, they’ve offloaded 500 Bitcoin, which was worth approximately $32.13 million. After these sales, the investor is left with around 301 Bitcoin, valued at roughly $20.42 million. This means they made a total profit of about $44.28 million from these transactions.

Currently, the significant cryptocurrency’s price hovers near the important $68,000 figure. Given the absence of sellers, there’s a general belief that if the price maintains this level and continues its upward trend towards $70,200, it could initiate a fresh surge in growth.

The reasoning behind this stems from Bitcoin (BTC) hitting its technical end-point at $68,550, having started at $52,500 with significant support now found at $65,800.

As a researcher examining Bitcoin price trends, I find myself considering two contrasting scenarios. If the market continues consolidating at these levels in the long run, it could potentially lead us to prices as low as $63,000 and even $55,800 per BTC. However, with the current position hovering around $70,200, the battle seems to be favoring the bulls for now. The struggle between buyers and sellers appears to be on the side of the bulls at present.

Looking at it this way, if Bitcoin’s price is stable or balanced, the behavior of the “diamond hand” whale becomes quite logical and sensible. They are simply managing their risk according to the unclear current situation, yet keeping most of their holdings because the overall bullish sentiment remains dominant.

Read More

- EUR ARS PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- EUR CAD PREDICTION

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- FIS PREDICTION. FIS cryptocurrency

- POWR PREDICTION. POWR cryptocurrency

- EUR VND PREDICTION

- CHR PREDICTION. CHR cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- DF PREDICTION. DF cryptocurrency

2024-10-20 17:54