Digital Cash to Skyrocket to $3.6 Trillion by 2030-Yes, Really! 🚀💰

What to Know:

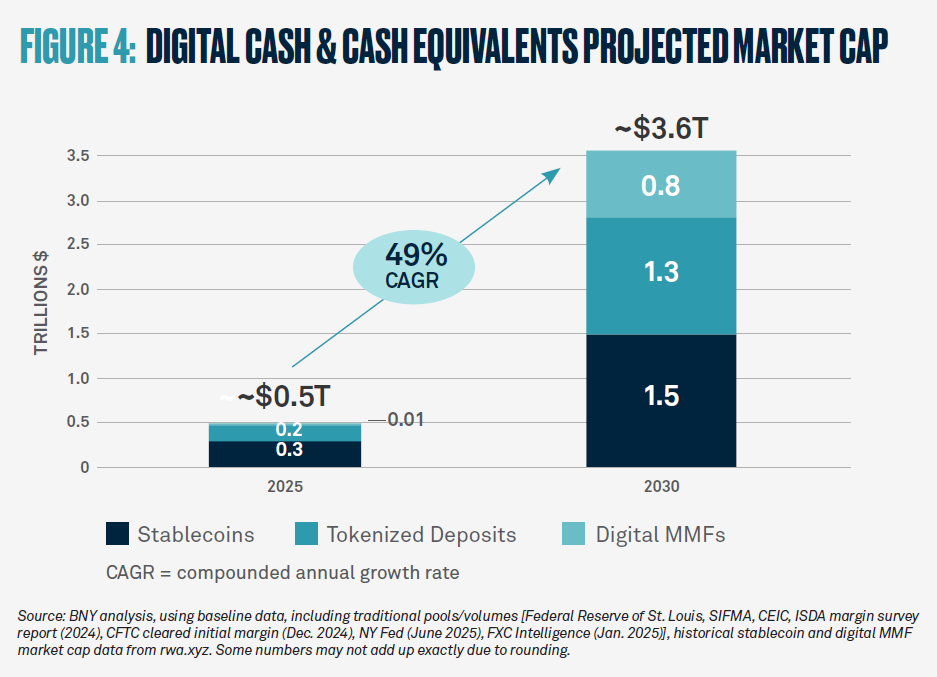

- BNY predicts that stablecoins and digital cash toys might swell to a staggering $3.6 trillion in just five years. Yes, trillion-because why not dream big? 💸

- The report credits eager institutions and some promising regulatory breadcrumbs as the turbo boosters. 🎯

- Oh, and don’t worry-traditional banking isn’t going anywhere; it’s just getting a shiny digital sidekick. Think Batmobile with a GPS upgrade. 🚗✨

Brace yourself, because stablecoins and their shiny cousin, tokenized cash, are expected to practically take over the financial playground by 2030. According to a freshly baked report from the titanic financial services giant, BNY, these digital marvels could hit a colossal $3.6 trillion. That’s right-trillion with a ‘T’. 🚨

They’re even predicting stablecoins alone could reach $1.5 trillion, which, let’s be honest, sounds like Monopoly money but isn’t. The rest will be tokenized deposits and money-market funds, because why settle for boring old cash? These are called digital cash equivalents, and they promise to make settling transactions faster than you can say “blockchain.” Faster, safer, and with fewer paper cuts. Their goal? Reduce counterparty risk, speed up settlements, and make collateral moves smoother than a jazz solo. 🎷

The report notes that tokenized assets, like Uncle Sam’s Treasury bonds and bank deposits, could help big institutions play their collateral cards more efficiently. Imagine a pension fund, almost in a hurry, using a tokenized money market fund to post margins faster than you can blink-or maybe while you’re blinking. This could be the new normal as systems get smarter and faster, which is a lovely way of saying “less waiting and more doing.”

And let’s not forget regulation-BNY called it the “power-up” for this digital marathon. With laws like the EU’s MiCA leading the charge and the U.S. and Asia-Pacific working overtime, the regulatory scene is shaping up to be quite the adult supervision, ensuring everything stays stable while getting spruced up for the future. 🏛️

“We stand at a powerful inflection point that may fundamentally transform how global capital markets function and how its participants transact,” said Carolyn Weinberg, BNY’s bigwig responsible for all things innovation. She envisions a future where blockchain doesn’t kick out the traditional rails but parties with them, creating a dynamic duo that would make Batman and Robin jealous. “The combination of traditional and digital has the potential to be a powerful unlock for our clients and the world,” she added, probably with a very serious face and a big smile. 😎

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

2025-11-11 02:25