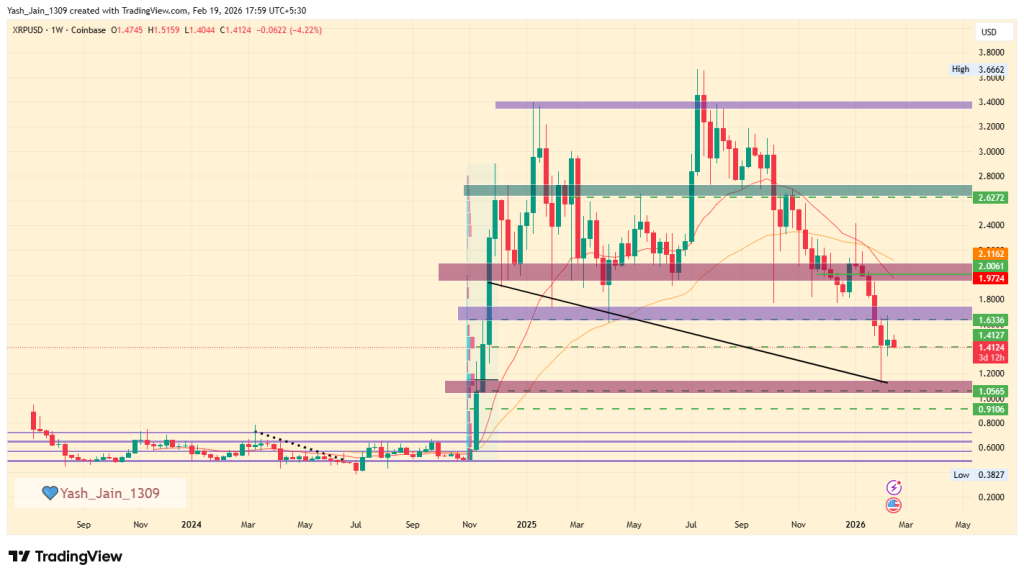

Ah, the price of XRP-a veritable high-wire act without a safety net. On one side, a staggering 3.8 billion coins have cascaded from the gilded wallets of whales into Binance since the dawn of 2026. On the other, the supply on exchanges is whimsically dwindling, while bullish sentiment-a rare bird-has soared to a five-week zenith.

Feeling befuddled? You ought to be! Let us untangle this delightful mess.

Whales Gallivanting to Binance

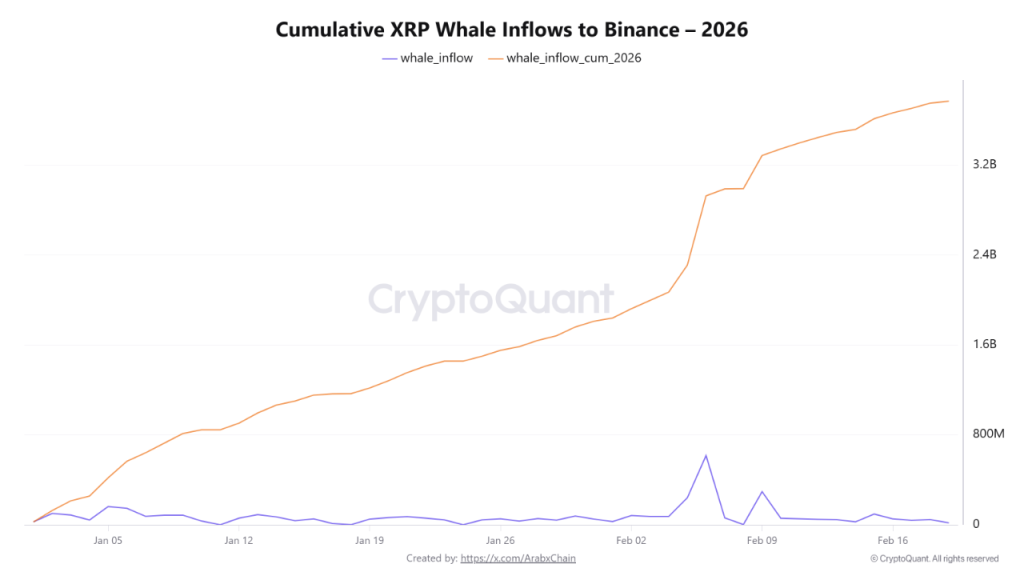

Behold the cumulative flow chart, a graphic marvel displaying a steady ascent in XRP deposits from the affluent few into Binance, totaling approximately 3.8 billion XRP since January. Not erratic spikes, mind you. No, these are calculated maneuvers, akin to a well-rehearsed ballet.

Then February strutted in.

The curve became positively mountainous. Inflows surged considerably during the first half of the month, indicating that our whale friends weren’t merely dabbling their toes but were instead diving headfirst into the dips.

Historically, as noted by the sage CryptoQuant analyst Arab Chain, it is evident that heavy whale inflows to exchanges have often preceded short-term corrections or strategic realignments ahead of a fresh trend. How thrilling!

This implies liquidity could be lounging about, waiting to be scooped up.

Now, let us not leap to conclusions. Some of these inflows may support trading pairs or internal exchange operations. But let’s not play coy-billions in potential sell-side liquidity are hardly a trifle when it comes to the delicate dance of the XRP price chart.

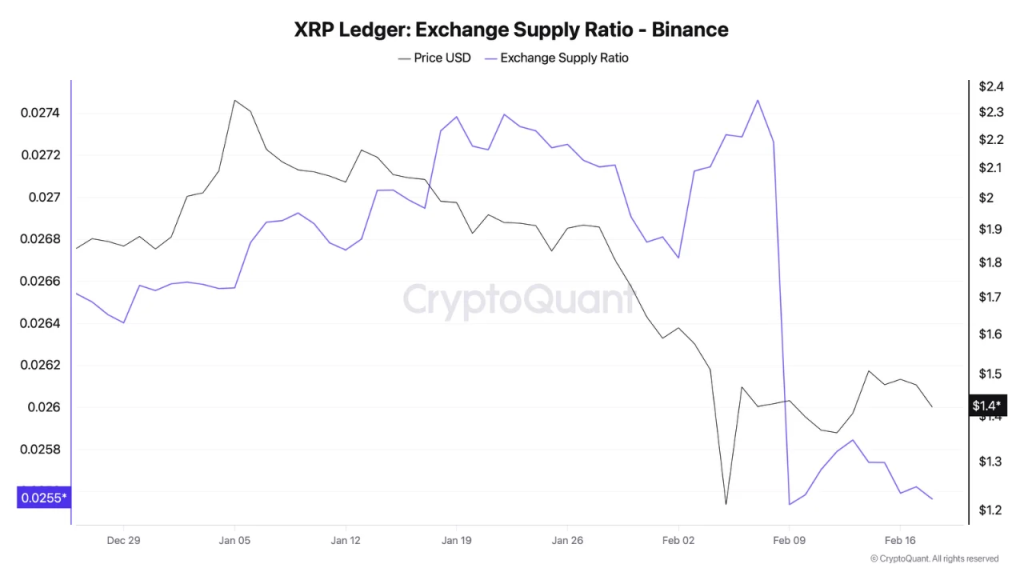

A Curious Decline in Supply Ratio

Ah, here lies the twist worthy of any theatrical production.

While our gallant whales are sending coins forth, the XRP supply ratio on Binance has taken a nosedive from 0.027 to 0.025 over the past ten days. An astonishing 200 million XRP has waltzed away from the exchange in that span.

This curious dynamic hints at accumulation by another class of investors-those with a penchant for the long game. Historically, a dwindling exchange reserve reflects unwavering conviction, as tokens are whisked away into private wallets rather than being left in the chaotic whirlpool of trading.

And context, dear reader, is everything.

According to the astute analyst Darkfost, the XRP price has experienced a rather dramatic correction of around 40% since the year’s outset. For some investors, such a retreat does not scream “sell”; it gently whispers “opportunity.”

So, what portent does this hold for any predictions regarding the XRP price? It presents a rather mixed tableau for today. However, the whales appear poised for action. Retail investors and long-term holders seem to be in accumulation mode, and even if the price dips further, the buying may persist.

That tension, my friends, is the heart of the matter.

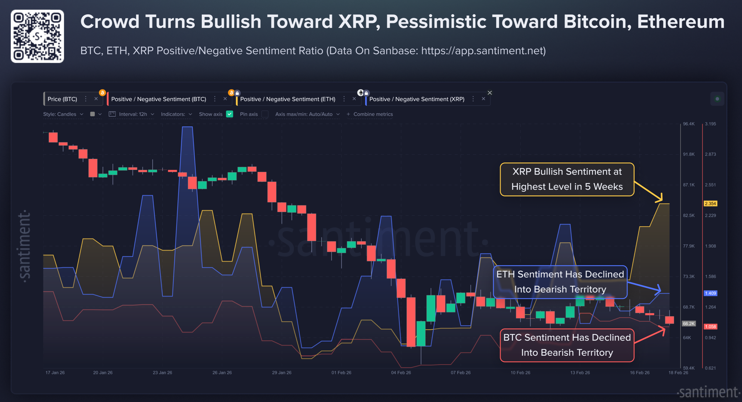

The Resurgence of Bullish Sentiment

Meanwhile, the insights from Santiment reveal that social data is experiencing a delightful renaissance in bullish sentiment toward XRP, now reaching a five-week high-even as the broader crypto commentary on Bitcoin and Ethereum has cooled like yesterday’s tea.

Part of this newfound optimism can be traced back to news of a partnership expansion between Ripple and GOSH Charity on February 17th. This collaboration aims to unlock the wonders of crypto philanthropy, allowing global supporters to donate digital assets with the alarming ease of flicking a switch.

This isn’t mere fluff-it suggests increased utility, which translates to greater transaction flow potential. In theory, such real-world applications add a narrative tailwind to XRP/USD beyond just wild speculation.

So, where does this leave the ever-elusive XRP price?

Billions in whale inflows. A declining exchange supply ratio. A rising tide of bullish sentiment. A 40% correction year-to-date.

The stage is set, dear audience. Whether this story concludes with wild volatility or a graceful trend shift is a question only the market can answer next.

Read More

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- God Of War: Sons Of Sparta – Interactive Map

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- Who Is the Information Broker in The Sims 4?

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2026-02-19 16:37