As a seasoned researcher with over two decades of experience observing the cryptocurrency market, I have seen more than my fair share of roller coaster rides, and Dogecoin’s recent performance is no exception. Having closely followed its price action for years, I can confidently say that this meme coin has a knack for surprising us all.

Over the past 24 hours, the price fluctuations of Dogecoin (DOGE) have been as thrilling as a roller coaster ride for crypto market enthusiasts. In fact, its value dropped by over 11%, resulting in approximately $35.1 million worth of liquidations. This places DOGE among the top cryptocurrencies when it comes to this “unfortunate” measure, with long positions being liquidated more than others.

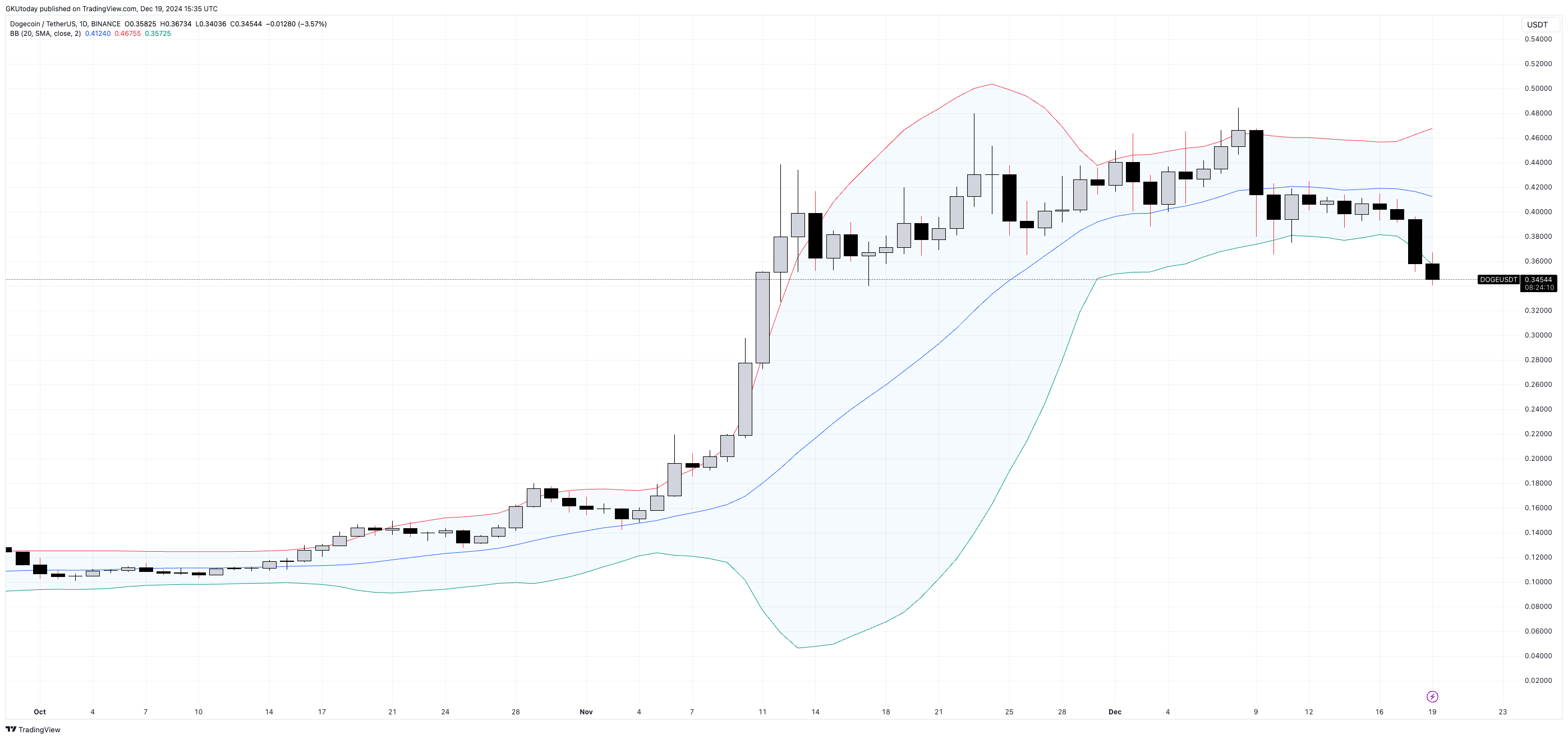

However, despite all the ugliness that Dogecoin may now present from an investment standpoint, one popular indicator is actually signaling that the main meme crypto coin of the market is oversold. This is the Bollinger Bands, developed by expert trader John Bollinger decades ago.

Simplifying things a bit, Bollinger Bands are based on a 20-day moving average and two lines that show how far prices deviate from this average in either direction. Normally, the price tends to stay within these bands. When the price moves outside of them, it might suggest the asset is undervalued (oversold) or overvalued (overbought).

Using Dogecoin, we’ve moved past the lower boundary on all timeframes, and particularly on a daily basis. The price of this meme cryptocurrency now stands at $0.3576 per DOGE, which represents a 3.5% increase compared to its current quotes.

It appears that a rise in the Dogecoin price at this moment is unlikely. But, according to price action statistics, it seems probable that Dogecoin will return to its Bollinger Band range soon. As for the exact timing, that’s still uncertain.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- REPO: All Guns & How To Get Them

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- LUNC PREDICTION. LUNC cryptocurrency

- All Balatro Cheats (Developer Debug Menu)

- REPO: How To Play Online With Friends

2024-12-19 20:42