As a seasoned crypto investor with a knack for deciphering market trends from the whale’s perspective, this recent surge in large holder activity on Dogecoin (DOGE) has piqued my interest. With over a decade of experience under my belt, I’ve learned to read between the lines of on-chain data and interpret its implications.

As Monday saw a 6% drop in the price of Dogecoin (DOGE), a new wave of bullish activity emerged on the chain of the popular meme cryptocurrency. According to data from IntoTheBlock, the net flow of DOGE into the wallets of large holders increased by more than 118% over the past day – from 67.85 million to 148.36 million tokens, which is equivalent to $14.84 million.

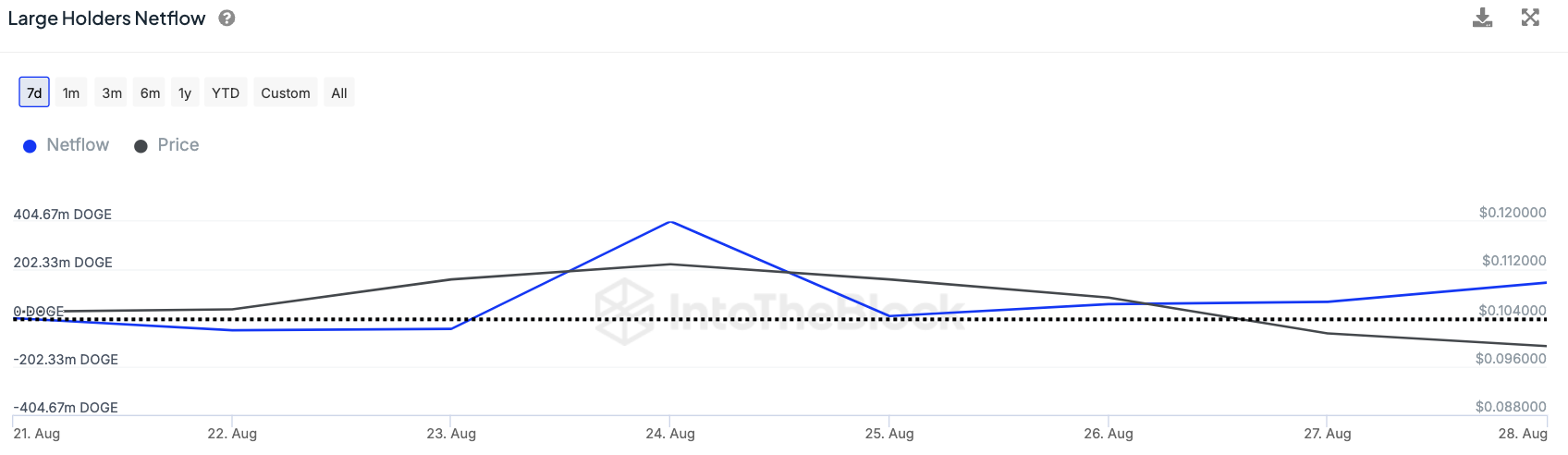

The graph illustrates the shifting positions of whales (investors holding over 0.1% of Dogecoin supply) relative to each other. Essentially, increases in netflow suggest that large investors are accumulating more Dogecoin, while decreases indicate they’re either reducing their holdings or selling some off.

In the past day, an increase of more than 1.5% has been observed in the quotes for Dogecoin, with its current value being around $0.1 per DOGE. Notably, this rise followed a trend where an expansion in the number of large Dogecoin holders occurred before a surge in the cryptocurrency’s price.

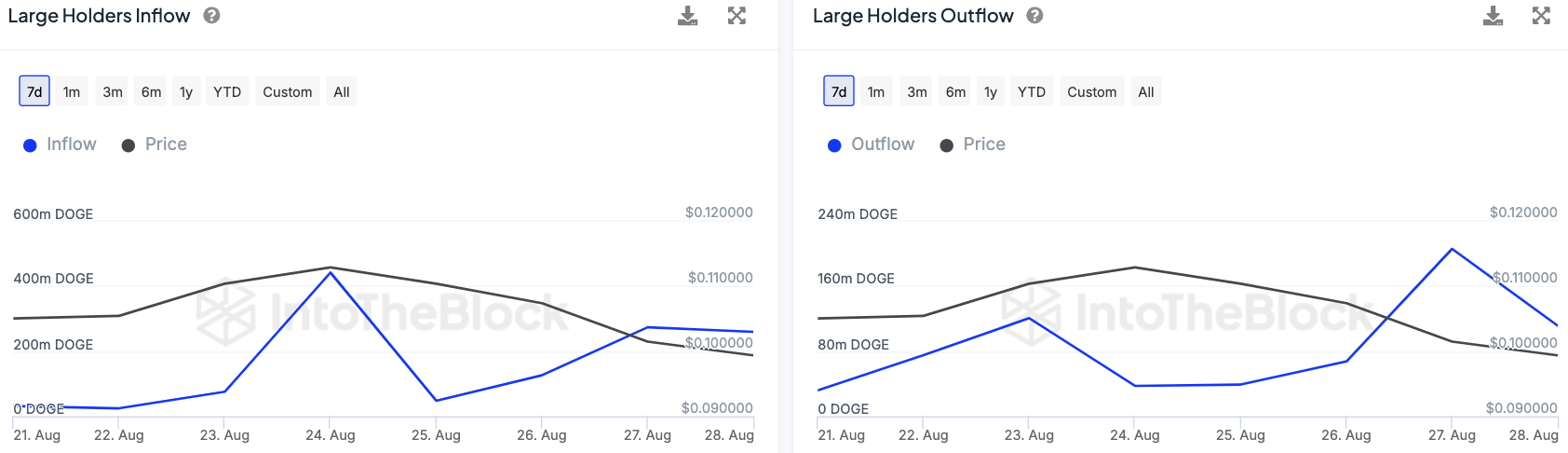

Looking more closely, it appears that the primary cause for the surge isn’t an upsurge in incoming funds, but rather a significant drop in outgoing transactions. Over the reviewed period, large holder wallets saw a reduction of approximately 45.9% in DOGE outflows, totalling around 111.41 million tokens.

It’s worth noting that despite a decrease, the inflows only dipped by 5.13%. They still stood firm at approximately 259.77 million Dogecoins.

It’s unclear yet if this could mark a significant rise for Dogecoin, but it’s worth keeping an eye on.

Nevertheless, it’s worth keeping an eye out for some turbulence in the market of the largest and most widely used meme cryptocurrency. This is because an uptick in on-chain activity can frequently signal potential issues reflected on the price graph.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- TARA/USD

- FLOKI PREDICTION. FLOKI cryptocurrency

2024-08-29 14:29