The meme coin now trades around $0.52, reflecting a 3.22% daily decline and a staggering 75% drop from its yearly peak, according to BraveNewCoin data. The market’s confidence has taken a nap, leaving it in a deep slumber, while the coin’s value wobbles like a drunk seagull on a tightrope. 🦉

Analyst Warns of 75% Decline Following Trendline Breakdown

In a recent post on X, market analyst Greeny highlighted Dogwifhat as one of several assets that experienced deep corrections following the loss of major support levels. The analyst emphasized that once a coin “loses its support trend, it’s often a great time to take profits,” as the downside risk can expand up to 90%-a number so large, it could fit a whole family of squirrels in a nut. 🐿️

Greeny compared the coin’s current move to similar declines seen in ABSTER (-72%), SPX (-40%), and FARTCOIN (-71%), noting that the asets t’s 75% slide exemplifies this post-trendline behavior. It’s like watching a parade of sad clowns, all wearing the same hat. 🎪

The analyst added that traders looking to reenter should “wait for lower prices to actually confirm a bottom,” ideally through a market structure shift featuring higher highs and higher lows or renewed support near lower Fibonacci retracement levels. Because nothing says “excitement” like waiting for a coin to hit rock bottom… and then maybe not. 🧠

Market Cap Below $520M as Bearish Momentum Grows

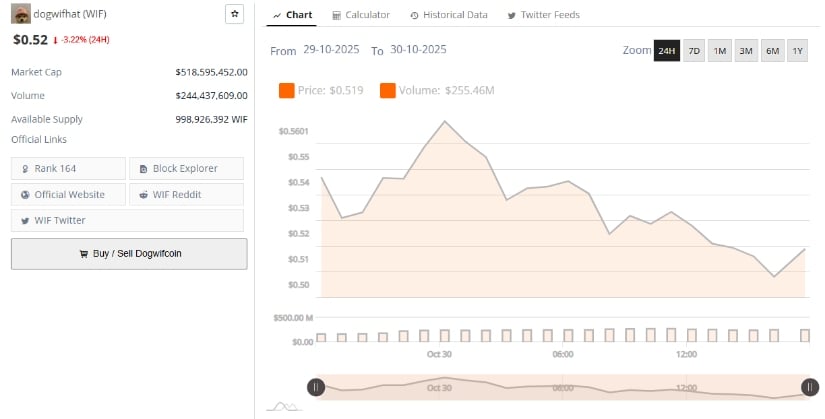

Data from BraveNewCoin shows Dogwifhat trading at $0.52 with a market cap of $518.59 million and 24-hour trading volume of $244.43 million. The token currently ranks #164 by market capitalization, with an available supply of 998.9 million tokens. The steady contraction in valuation highlights cooling speculative activity and fading liquidity since the Q1 2025 highs-like a dying fire, flickering but still managing to burn your fingers. 🔥

While short-term sentiment remains bearish, the token still maintains moderate retail participation on major Solana-based DEXs such as Raydium, suggesting that some traders are accumulating during the extended consolidation phase. But let’s be honest, they’re probably just hoping for a miracle. 🧙♂️

Data Confirms Downtrend Continuation and Weak Open Interest Recovery

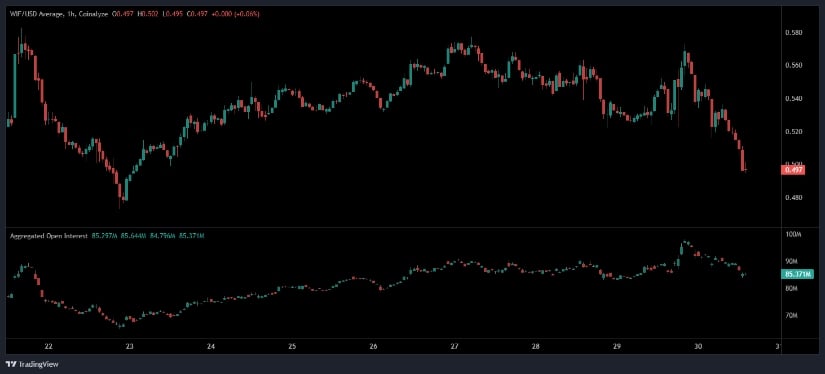

According to open interest, the coin has failed to reclaim upward momentum following its major breakdown in early 2025. The WIF/SOL weekly chart depicts a sharp decline from over $2.00 to the current $0.52 zone – a drawdown of more than 75% – after a confirmed trendline break. It’s like a rollercoaster that went off the rails and landed in a swamp of despair. 🚂💨

In the hourly the asset chart, price action reveals consistent lower highs accompanied by a gradual decline in aggregated open interest, which now hovers around $85.37 million. This contraction indicates reduced speculative activity and fading confidence among leveraged traders. Unless the coin reclaims the $0.60-$0.65 range and forms higher timeframe support, the token risks further downside toward the $0.40-$0.45 zone before any meaningful recovery attempt. But who’s counting? 🕵️♂️

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-10-31 01:00