So, the memecoin market, bless its cotton socks 🧦, has seen a bit of a bounce, hasn’t it? According to those folks at CoinMarketCap, we’re talking a nearly 2% increase in market cap. And trading volume? Up a whopping 8.5%! You’d think we’d discovered the cure for boredom or something.

This, apparently, is all thanks to Bitcoin [BTC] managing to stagger its way past the $82.5k resistance on April 11th. One can only imagine the champagne corks popping in the crypto world. 🍾

Now, dogwifhat [WIF], the Solana [SOL]-based meme coin that sounds like something you’d accidentally step in, has rallied a mighty 9% in 24 hours. A 9%! But don’t get too excited, because apparently, the outlook is still “bearish.” Which, as far as I can tell, means “likely to go down.” 📉

The burning question, of course, is: Should WIF traders expect this momentum to keep going like a runaway train? Or is it more like a slightly tipsy unicycle ride? 🤡

Selling WIF: Probably a Better Idea Than Buying, Let’s Be Honest

Despite this recent… burst of enthusiasm, dogwifhat is apparently struggling under a “bearish structure.” Which, in crypto-speak, means it’s not doing so well. The losses have been too “severe to recover,” so traders and investors are better off looking for “selling opportunities.” Because who doesn’t love a good fire sale? 🔥

And where might these “opportunities” be, you ask? Well, technical analysis (which is basically like reading tea leaves for nerds ☕) has narrowed it down.

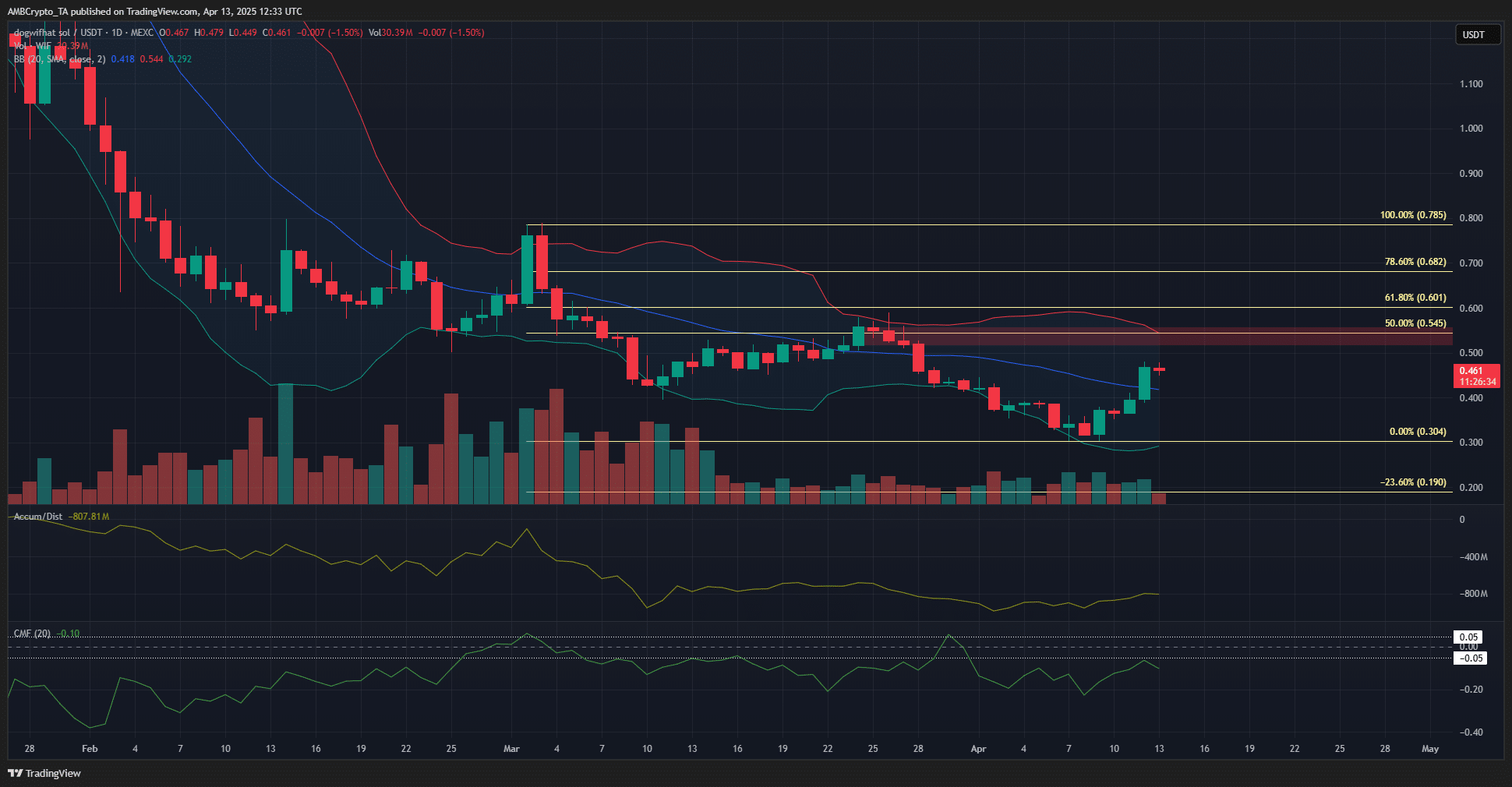

The $0.55 zone, highlighted in angry red, is apparently a “bearish order block” coinciding with the 50% Fibonacci retracement level. Which sounds impressive, even if I have no idea what it means. It also has “confluence” with the upper Bollinger Band. Because why use one confusing term when you can use three? 🤔

The A/D indicator saw a bounce in April, but couldn’t quite make it above the high set in March. This shows “some buying pressure,” but not enough to write home about. ✉️

The CMF, meanwhile, has been below -0.05 for most of the past three months. Ouch. Apparently, this underlines the “steady selling pressure and the lack of bullish strength.” Which, if you ask me, sounds like a polite way of saying “abandon ship!” 🚢

So, traders can use the $0.5-$0.55 region to “sell WIF.” Because, you know, why not? 🤷

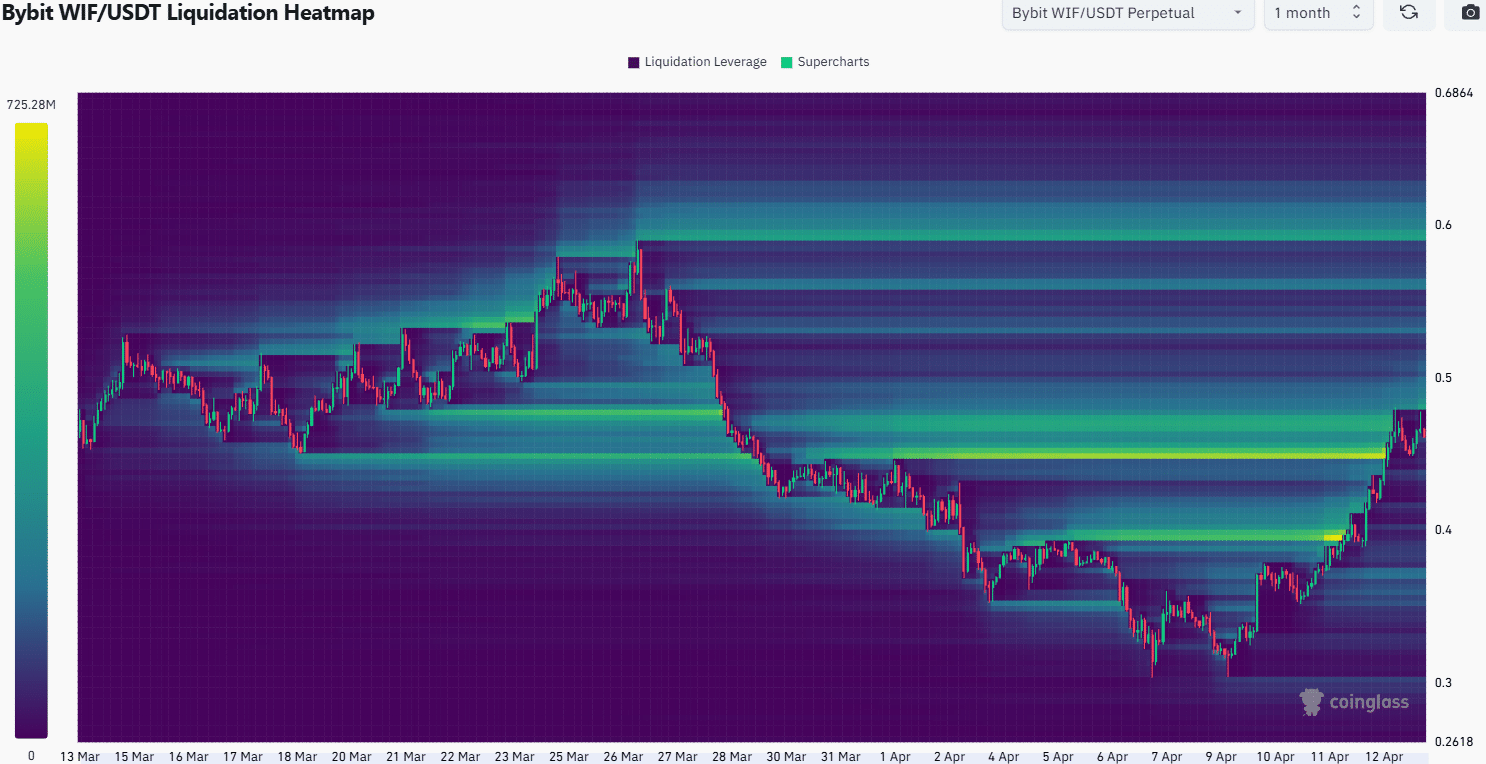

The 1-month liquidation heatmap shows that the $0.45-$0.47 region had been filled with short liquidations. Which, I assume, is a good thing for someone. WIF bulls were able to maintain prices above $0.42, which is nice. The BTC price move higher might have influenced “market sentiment.” Or maybe it was just the weather. ☀️

The build-up of liquidity around $0.48-$0.5 marks it as a short-term target. Further north, the $0.6 level is the next notable liquidity pocket. Given the “confluence of resistances” around $0.55 and “weak demand,” a breakout appears unlikely. But hey, never say never. 🤞

If WIF can “consolidate” around $0.46 over the next 24-48 hours (whatever that means), the liquidity around $0.5 would likely grow thicker. This scenario, followed by a price bounce and a “bearish reversal,” appears the most likely short-term outcome. Buckle up! 🎢

So, traders looking to short the memecoin need to watch the $0.5-$0.55 area, as well as the trend of BTC, to determine if selling would be a “feasible option” or not. In other words, good luck! You’ll need it. 🍀

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-14 11:06