Darling, it seems the economic soothsayers are in a tizzy, predicting a U.S. recession in 2025 with all the drama of a West End flop. The dollar’s fate? Trump’s tariffs? It’s all very Downton Abbey meets Wall Street—minus the charm and with more panic.

Recession Roulette: A Game No One Wants to Play

Oh, the economists are at it again, darlings, squabbling like cats in a sack over whether 2025 will bring a recession or just another round of “let’s pretend everything’s fine.” The U.S. dollar, that darling of global finance, is apparently on shaky ground, and Trump’s tariffs? Well, let’s just say they’re about as popular as a wet weekend in Brighton. Cue the melodrama.

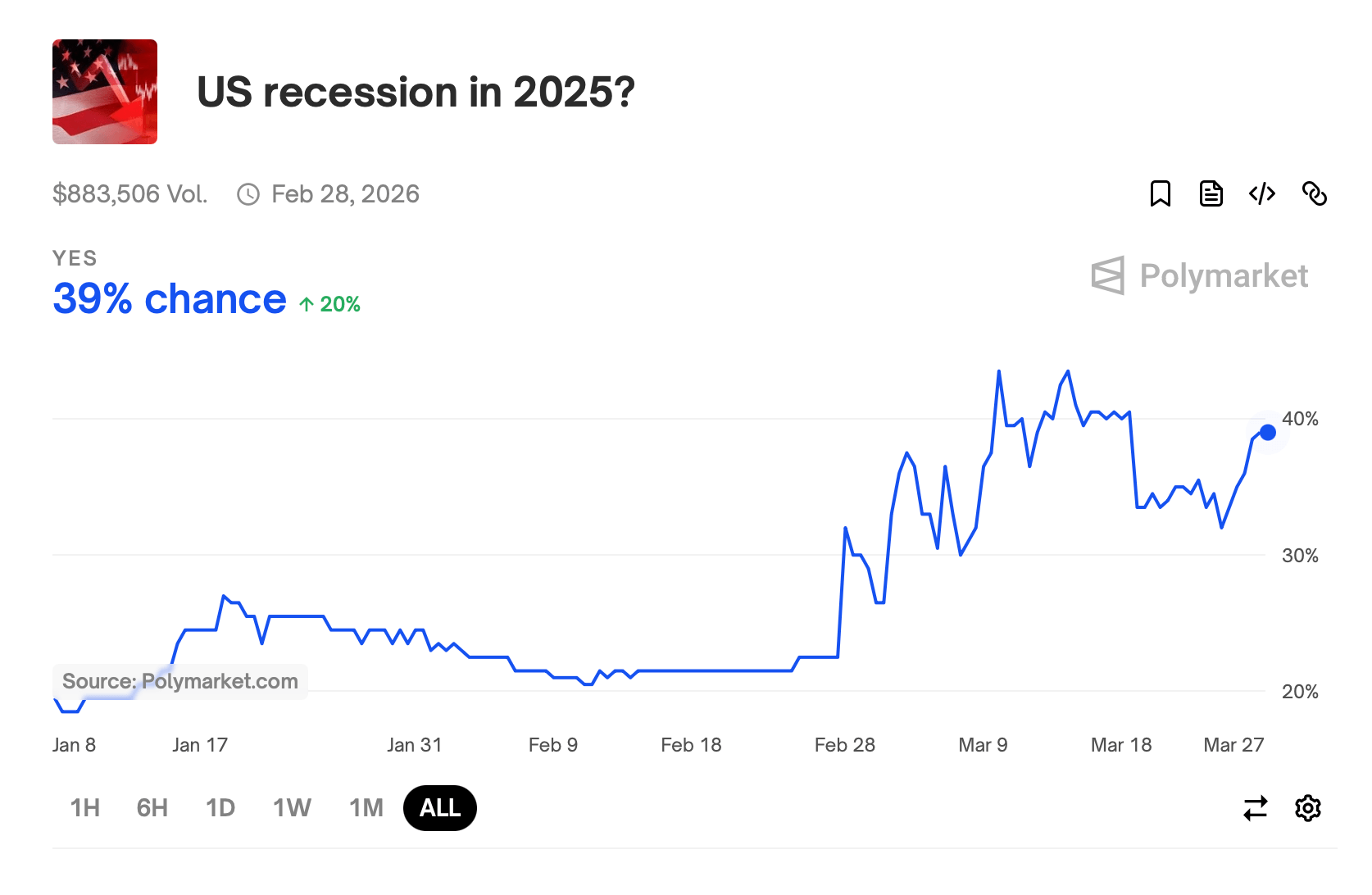

A recession, for those who’ve been living under a rock (or perhaps just avoiding the news), is defined as two consecutive quarters of negative GDP growth. But the National Bureau of Economic Research, bless their hearts, likes to throw in a few extra factors like employment and industrial production to keep things spicy. As of March 2025, the economy is about as stable as a Jenga tower in a hurricane. Trump’s tariffs, consumer confidence wobbling like a drunk at a wedding, and market volatility have everyone clutching their pearls.

Enter Peter Schiff, the Cassandra of capitalism, who’s been warning of a 2025 recession with the fervor of a street preacher. The CEO of Euro Pacific Capital has been banging on about a U.S. dollar crisis that could send the economy into a tailspin, complete with soaring prices and interest rates. His prediction? The dollar is overvalued and due for a correction. Unlike his peers, who hedge their bets like a nervous gambler, Schiff is absolutely certain a recession is coming. Cheers, Peter. 🥂

Other experts, bless their cautious hearts, are a bit more measured. Bruce Kasman of JPMorgan gives a 40% chance of a 2025 recession, citing trade policies and the U.S. dollar’s global dominance as risks. Edward Yardeni of Yardeni Research has raised his recession odds to 35%, but he’s not quite ready to call it a done deal. Both agree that economic forecasting is about as reliable as a weather app. 🌧️

Meanwhile, the Federal Reserve is playing the optimist, forecasting 1.9% GDP growth for 2025. But even they’ve had to admit that their GDP Now model flagged a potential Q1 contraction of 1.5%. Officials are quick to point out that one bad quarter doesn’t make a recession, but it’s hardly a confidence booster. Cue the nervous laughter.

The UCLA Anderson Forecast has linked recession risks directly to Trump’s policies. Economist Clement Bohr warned that fully implementing Trump’s tariffs and federal job cuts could trigger sector-wide contractions. Analytics firm Expana has predicted a global recession starting in spring 2025, driven by synchronized slowdowns in major economies. Goldman Sachs and Morgan Stanley have also downgraded U.S. growth forecasts, though their recession probabilities remain lower. 🎢

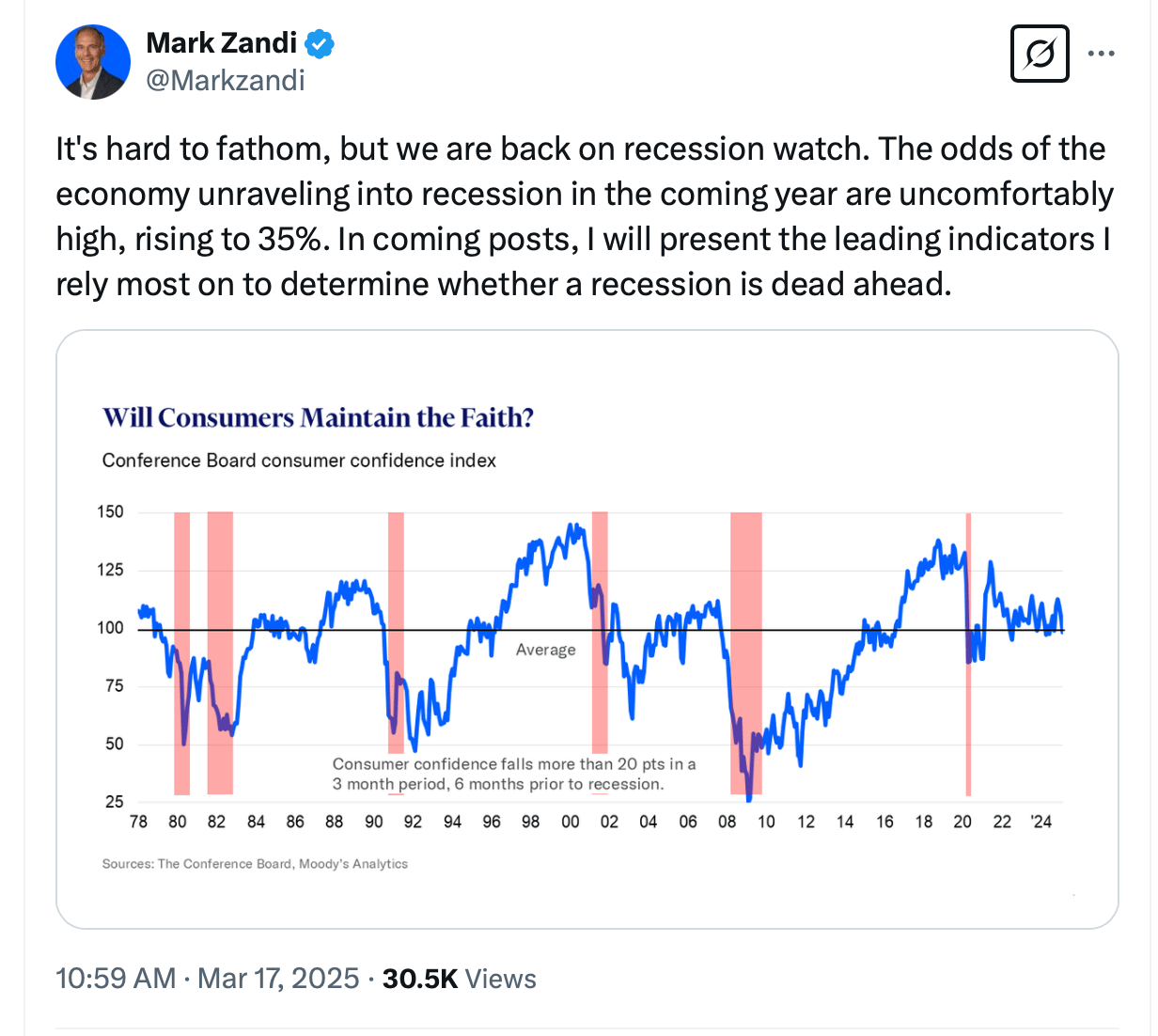

Moody’s Analytics chief economist Mark Zandi has highlighted rising mortgage delinquencies as a potential red flag. The Conference Board’s Consumer Confidence Index has fallen sharply, reflecting dwindling short-term expectations for incomes, business conditions, and employment. Financial institutions like HSBC, Citi, and Barclays have downgraded U.S. equity outlooks, citing tariff-related uncertainties. 🚨

Trump’s policies are, of course, the elephant in the room. His tariffs and federal job cuts have drawn criticism from economists who argue they could stifle trade, inflate consumer prices, and erode business investment. The CNBC CFO Council reported that 60% of surveyed chief financial officers view policy uncertainty under Trump as a key recession driver. 🐘

A Deutsche Bank survey pegged the 12-month U.S. recession probability at 43%, while Harvard economist Kenneth Rogoff estimates 30-35% odds. Jeffrey Gundlach of DoubleLine Capital offered a starker view, placing the likelihood at 50-60%. It’s all very Apocalypse Now, isn’t it? 🎬

Though the U.S. central bank remains cautiously optimistic, figures like Schiff, Yardeni, and Expana, alongside major financial institutions, are sounding the alarm. Their collective vigilance mirrors an economy walking a tightrope between adaptability and structural stress. As authorities like Gundlach, Rogoff, and Moody’s intensify recession warnings, 2025’s economic trajectory increasingly hinges on nimble policymaking. 🎪

Tariffs, fiscal contraction, and worldwide deceleration compose a hazardous trifecta that even upbeat projections cannot easily discount. With organizations revising growth estimates downward and families preparing for uncertainty, discussions now pivot not on whether crises will emerge, but on the magnitude with which geopolitical tremors and legislative decisions might precipitate contraction. 🎭

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nine Sols: 6 Best Jin Farming Methods

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Invincible’s Strongest Female Characters

2025-03-27 19:00