As a researcher with a background in finance and experience following the cryptocurrency industry, I believe that France’s regulatory crackdown on unauthorized crypto exchanges like Bybit is a positive development for the industry as a whole. The move by the French Financial Market Authority (AMF) to enforce DASP registration for all crypto exchanges operating within its jurisdiction will help protect investors and maintain financial order in the volatile and often unregulated crypto market.

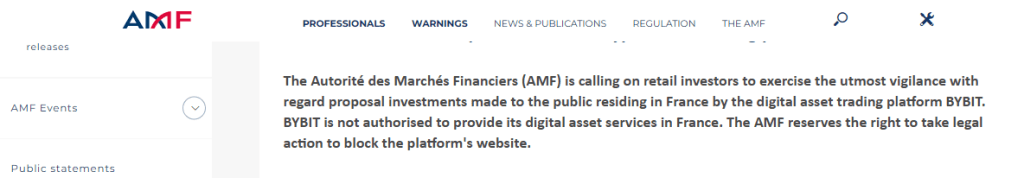

French authorities are making it clear that cryptocurrency businesses must comply with their regulations. The most recent enforcement action was taken against Bybit, a prominent crypto exchange, by the Autorité des Marchés Financiers (AMF), who have barred the platform from operating within France due to lack of proper authorization.

In line with a previous caution issued against Bitget in November, this action underscores the French Financial Markets Authority’s determination to curb the unregulated cryptocurrency market within its jurisdiction.

DASP Registration: The Gatekeeper To French Crypto

As a crypto investor, if you want to play by the rules in France’s digital asset market, then securing a Digital Asset Service Provider (DASP) registration is the way to go. This registration serves as a crucial regulatory passage, enabling exchanges to meet certain requirements that safeguard consumers and preserve financial order.

As a financial analyst, I would explain that in accordance with theAMF’s regulations, it is mandatory for exchanges to register under the DASP (Dispute Resolution Mechanisms for Clients’ Securities) program. By adhering to these criteria, exchanges are able to safeguard consumers and preserve financial stability within the market.

Protecting Investors In A Volatile Market

The attention of the Autorité des Marchés Financiers (AMF) towards investor protection is commendable. Newcomers to the cryptocurrency market may find themselves navigating risky waters due to its volatile nature and vulnerability to fraudulent activities. Registration under the Digital Asset Service Provider (DASP) scheme serves as a protective barrier, mandating that exchanges implement measures to safeguard retail investors from hazardous trading practices.

Not Just Bybit: A Trend Of Regulatory Scrutiny

As a researcher studying the regulatory landscape of cryptocurrency exchanges, I’ve observed that France’s crackdown on non-compliant platforms isn’t limited to Bybit. In the past, Binance, a prominent player in the crypto exchange market, faced investigations from the Autorité des Marchés Financiers (AMF). Despite securing a license, this incident underscores an essential truth: the AMF is unyielding in its pursuit of enforcing regulations on both small and large-scale platforms.

The trend towards increased regulatory oversight is expected to persist as the international crypto market evolves. With maturity comes the challenge for governments worldwide to strike a balance between fostering innovation, safeguarding consumers, and ensuring financial stability. France’s unyielding approach sets an example for other nations striving to create a robust and regulated cryptocurrency infrastructure.

The Road Ahead For Bybit: Compliance Or Exclusion

French regulatory authorities have made it unmistakable that unlicensed cryptocurrency exchanges are not tolerated: the prohibition of Bybit is a strong cautionary tale for similar platforms functioning beyond the purview of the Autorité des Marchés Financiers (AMF) and the Prudential Supervision and Resolution Authority (ACPR).

As an analyst, I’ve observed that for transactions that adhere to regulations, France offers a significant business opportunity. Binance’s recent achievement in acquiring a license serves as proof that it’s feasible to maneuver through the intricacies of French regulatory framework. The main insight? Compliance is no longer a choice; it’s essential for gaining access to France’s crypto events.

Is This A Positive Development For The Crypto Industry?

Some people believe that the AMF’s interventions could hinder creativity, but others consider them essential for gaining recognition. Stricter oversight may bolster confidence and entice hesitant institutional investors, who have been cautious due to the cryptocurrency market’s notorious wild west image.

In the end, France’s regulatory efforts could lead to a more developed and eco-friendly cryptocurrency scene, not only domestically but possibly on a worldwide level as well.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-05-17 12:41