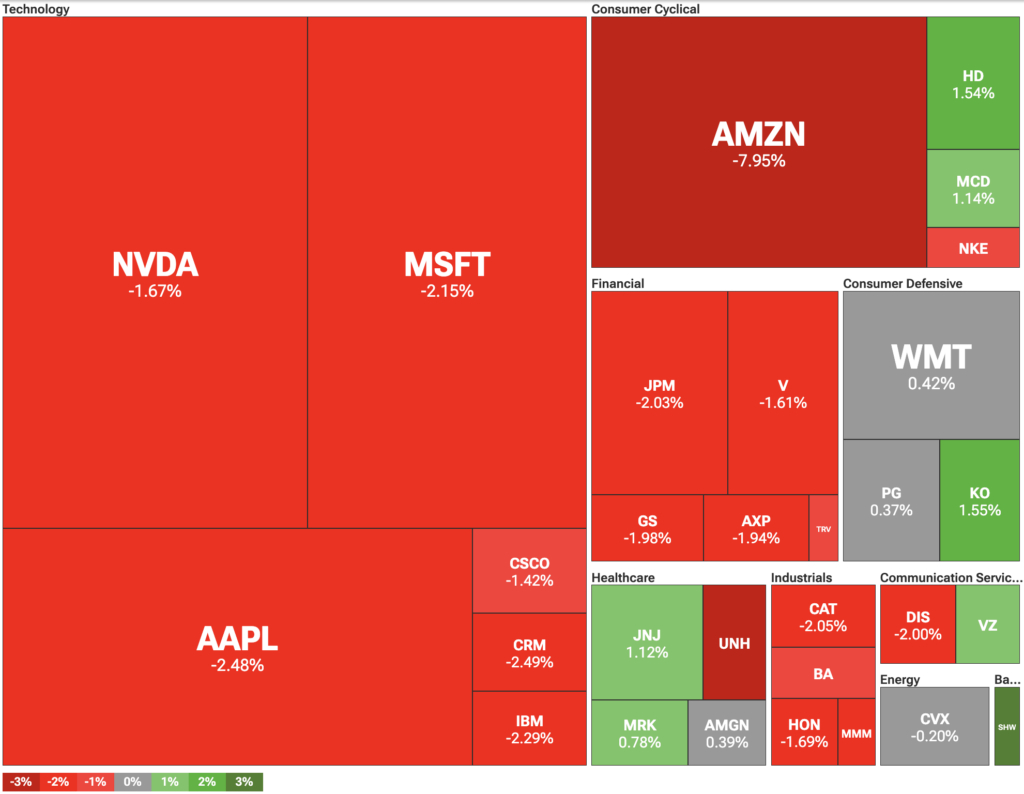

In what can only be described as the universe’s way of saying “Oops,” U.S. stock markets decided to perform a spectacular nosedive, shedding over 600 points in a display of financial acrobatics that would make even the most confident trader gasp. The culprit? Weak jobs data—a.k.a. the universe’s favorite mood killer—sending investors running for cover, despite Apple and Amazon throwing out earnings beats like a caffeinated chicken.

- The Dow Jones took a hyper-accelerated rollercoaster ride down more than 600 points. Buckle up. 🛑

- Apple’s stock decided to take a modest stumble, despite ringing up its highest revenue growth since the tail end of the last ice age (or December 2021, same thing). 🍏

- The Fed, possibly feeling hungry or just overly concerned about the employment situation, is pondering whether to lower interest rates to coax more people into the job market—because that worked so well the last few times, right?

The jobs report—an abnormally dull update on the labor market—showed only 73,000 new jobs, a number likely to induce frowns in economists and dismay in anyone hoping for a healthy economy. This was roughly 30,000 less than the optimistic forecast of 104,000, leaving investors feeling like they’d just been served a plate of economic oatmeal—bland, disappointing, and slightly irritating.

The tech sector, ever the drama queen, bore the brunt. Apple, despite announcing its most impressive revenue surge since the dark ages of December 2021, saw its shares slip by 2.5%. Apparently, “strong earnings” don’t quite cut it when your customers continue spending money in a weird, inflation-laden bubble. Apple’s also teasing AI investments—because when in doubt, just throw some robots at the problem.

Meanwhile, Amazon, with its usual flair for the dramatic, reported earnings of $1.68 per share—beating the estimated $1.33—yet its guidance for the upcoming quarter was about as exciting as a wet sponge. Naturally, investors, always longing for fireworks, responded by knocking 8% off Amazon’s stock, presumably in protest of their modest outlook after a multibillion-dollar AI spending spree.

Oh, the Irony! Could the Fed Turn the Tide?

There’s a tiny glimmer of hope—or at least, a shiny distraction—on the horizon. The same weak jobs report might just convince the Federal Reserve to cut interest rates, which would be perfect if you’re into economic whiplash. Market futures are now suggesting an 83% chance of a rate cut by September, up from a paltry 38% just a day before. Because nothing says “trust me” like changing your mind based on bad employment news.

As the Fed juggles its twin mandates—keep inflation in check and pretend everyone’s employed—it faces pressure from, well, every political corner, even from President Donald Trump, who probably just wants to see the entire economy do a lazy backflip to impress him. The FOMC members are split like a bad team in a tug of war, possibly debating whether to sprinkle interest rate fairy dust or let the economy fend for itself. 🧙♂️

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-08-01 21:54