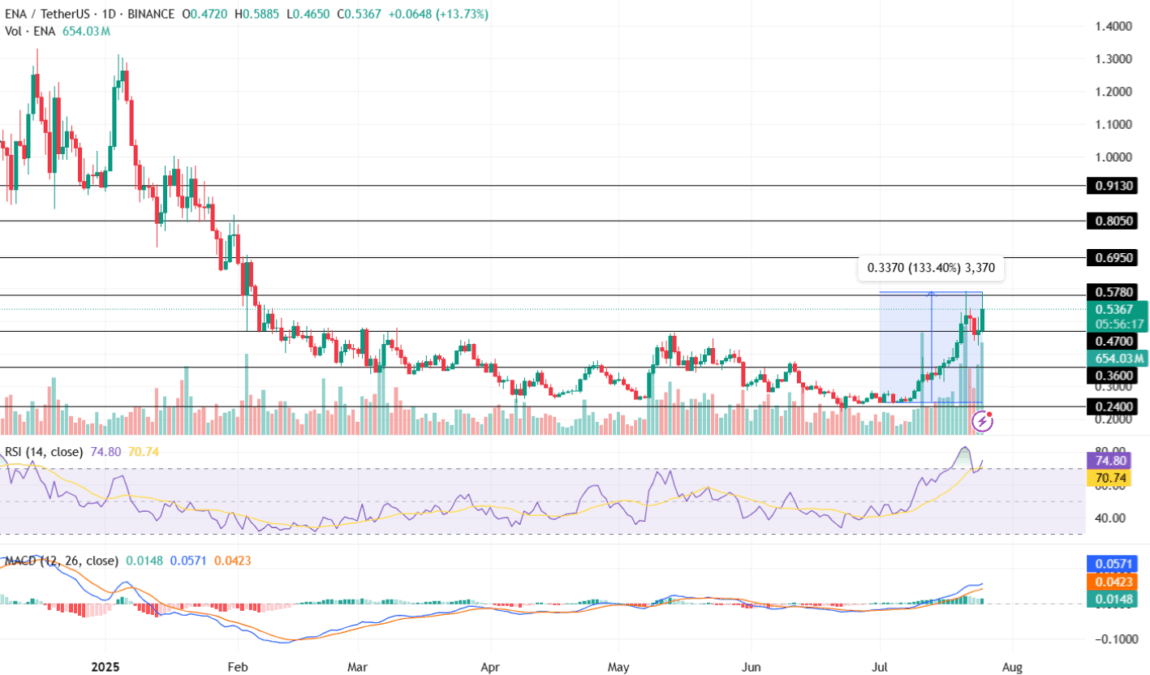

In a world where digital currencies are more unpredictable than the weather in Moscow, Ethena (ENA) has managed to stand out, much like a bright star in the night sky. Over the past 25 days, this altcoin has surged by a staggering 133%, touching a local high of $0.5367. The token has been basking in the glow of increased trading activity and technical momentum, posting an 11.65% daily gain with a 24-hour trading volume of $1.68 billion. This meteoric rise has propelled its market capitalization to a respectable $3.39 billion.

ENA’s journey has been nothing short of a thrilling rollercoaster ride. According to data from TradingView, the token broke through previous resistance levels at $0.36 and $0.47, a feat that would make any investor’s heart race. Prior to this upward breakout, ENA had been contentedly consolidating between $0.24 and $0.36, much like a cat napping in a sunbeam.

The significant increase in trading volume during the rally is a clear indication that the big players have taken notice, suggesting that this isn’t just another retail-driven frenzy. The volume surge is akin to a symphony orchestra tuning up—sure signs of a grand performance to come.

The Relative Strength Index (RSI), a tool as essential to traders as a wand is to a wizard, currently reads 74.80, indicating overbought conditions. This is usually a sign that a short-term consolidation might be in order, much like a sprinter catching their breath after a race. The MACD indicator, always the optimist, shows the MACD line at 0.0571 above the signal line at 0.0423, suggesting that the bullish momentum might continue despite the overbought readings.

Technical analysis, the art of reading the tea leaves of the market, suggests potential resistance levels at $0.695, with further upside possible toward $0.805 based on current chart patterns. However, should the rally lose steam, support levels at $0.47 and $0.360 will be there to catch it, much like a safety net for acrobats.

While the current technical indicators point to continued momentum, the overbought conditions hint at potential volatility in the near term. Market participants, always the brave souls, should consider the speculative nature of altcoin trading when evaluating position sizing and risk management strategies. After all, in the world of cryptocurrencies, the only constant is change, and the only certainty is uncertainty. 🤷♂️💸

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-07-26 23:04