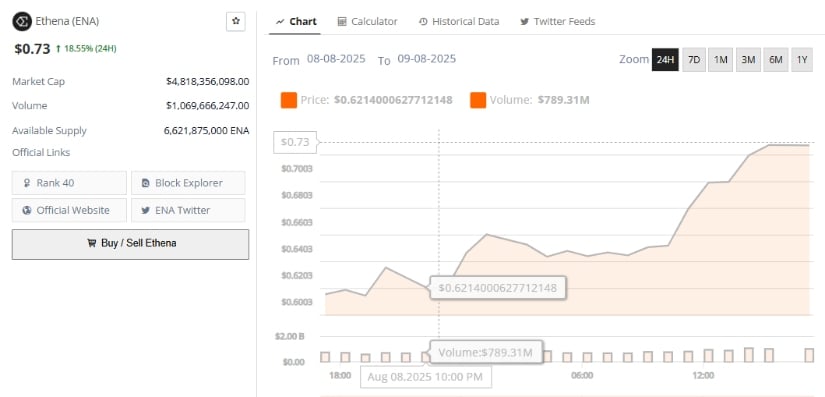

In a world where the whispers of financial markets can sway the fortunes of many, the token ENA, a mere speck in the vast ocean of cryptocurrencies, has embarked on a journey that would make even the most stoic investor raise an eyebrow. 🙄 Starting from a humble position near $0.61, ENA’s value ascended like a phoenix, rising sharply and reflecting the burgeoning faith in the Ethena platform and its ever-expanding ecosystem. The token’s market cap, now flirting with the $4.8 billion mark, stands as a testament to the growing interest among traders, despite the market’s fickle nature. 📈

Amidst the broader cryptocurrency market, which oscillates between hope and despair, Bitcoin and Ethereum struggle to reclaim their former glory, much like old generals longing for the days of yore. Yet, in this climate of uncertainty, ENA’s rise seems almost poetic, a beacon of hope for those who dare to dream of greener pastures. The fear and greed index, hovering around 52, suggests a market in equilibrium, but it is in these moments of balance that true opportunities emerge. 🌱

ENA Price Forecast: Technical Indicators Show Bullish Potential

To the discerning eye, the technical charts of ENA reveal a story of promise and potential. The Moving Average Convergence Divergence (MACD) line, having crossed above the zero line, signals the dawn of a new era of bullish momentum. Meanwhile, the Chaikin Money Flow (CMF) indicator, with a value of 0.24, speaks of a strong buying frenzy, a force that propels the token forward like a ship caught in a favorable wind. 🚢

However, not all is smooth sailing. The Bull Bear Power (BBP) at 0.0698 hints at a moderate bullish tilt, though a full breakout remains elusive. The Relative Strength Index (RSI), resting at 60.5, suggests that while buyers are in control, the token is inching closer to the dangerous waters of overbought territory. The immediate support level, near $0.616, and the resistance just above $0.618, will be crucial in determining the next chapter of ENA’s saga. ⚖️

If the bulls can maintain their momentum, ENA may witness a “golden cross,” a bullish crossover of moving averages that could propel prices even higher. Conversely, a “death cross” could lead to short-term setbacks, testing the lower support levels near $0.615. In the world of cryptocurrencies, fortune favors the bold, but prudence is the wise man’s guide. 🧐

Ethena Crypto Prediction: Market Activity and Token Unlocks

Despite the looming shadow of massive token unlocks, Ethena has defied the odds, maintaining a strong upward trajectory. Over the past 24 hours, ENA’s price surged by over 18%, elevating its market cap to nearly $4.82 billion. Daily trading volumes have swelled by more than 33%, a clear sign of robust investor interest, even in the face of potential sell pressures from unlocked tokens. 📊

Data reveals an influx of approximately 250 million ENA tokens to exchanges over the last two weeks, a harbinger of possible selling activity. Yet, the token’s resilience is a testament to the market’s unwavering confidence, a belief that the best is yet to come. 🌟

ENA Token Price and USDe Stablecoin Growth

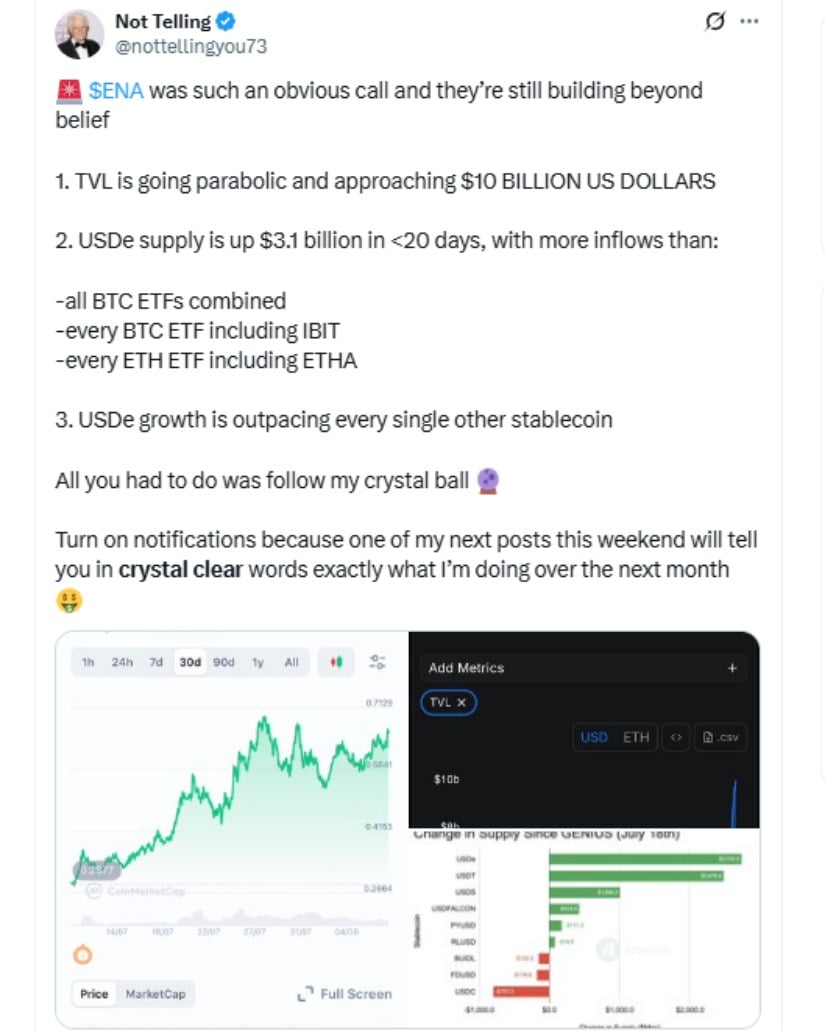

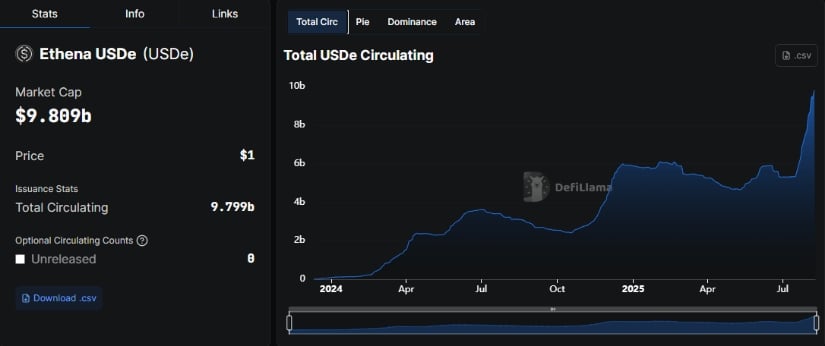

A significant factor driving Ethena’s ascent is the meteoric rise of its synthetic dollar, USDe. In July alone, the supply of USDe expanded by an impressive 75%, catapulting it to the third-largest stablecoin by market capitalization. This surge has seen USDe outpace competitors like Sky Dollar (USDS) and Binance’s FDUSD, a testament to its growing influence within the Ethereum ecosystem and the DeFi space. 💰

With a supply exceeding $9.3 billion, USDe’s presence is felt across major platforms such as Curve Finance and trading venues like Bybit and Uniswap. Bybit alone accounts for over 30% of USDe’s trading volume, a testament to its liquidity and widespread appeal. The Ethena DeFi protocol, now ranking sixth in total value locked (TVL) with over $9.4 billion in assets, offers attractive yields and strategic partnerships that attract both daring and cautious investors alike. 🤝

Ethena Price Analysis: Future Outlook and Partnership Developments

Looking to the horizon, Ethena plans to fortify its ecosystem by developing a USD-compliant stablecoin in collaboration with Anchorage Digital, the first federally chartered crypto bank in the U.S. This strategic move, in tandem with regulatory advancements like the GENIUS Act, positions Ethena as a frontrunner in the realm of compliant decentralized finance. 🏛️

As ETH’s value breaches the $3,800 mark, Ethena’s earnings model is strengthened, allowing the platform to sustain higher USDe supplies and reward stakers with average annual percentage yields (APYs) nearing 8.85%. This represents a significant leap from the 3.51% APY observed in early July, a direct reflection of Ethereum’s upward trajectory. 🚀

Yet, in the complex tapestry of Ethena’s tokenomics and market dynamics, caution is the watchword. The platform must navigate the delicate balance of supply management to prevent liquidity crunches or forced liquidations during potential ETH corrections. Nevertheless, the current trends paint a picture of optimism, suggesting a bright future for ENA’s price forecast as we approach the end of 2025. 🌠

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Sony Shuts Down PlayStation Stars Loyalty Program

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-10 01:25