As a seasoned researcher and crypto enthusiast with over two decades of experience in financial markets, I have witnessed numerous market cycles and trends. The current surge in Bitcoin’s price following Trump’s election victory is reminiscent of similar patterns observed during the 2016 US Presidential Election.

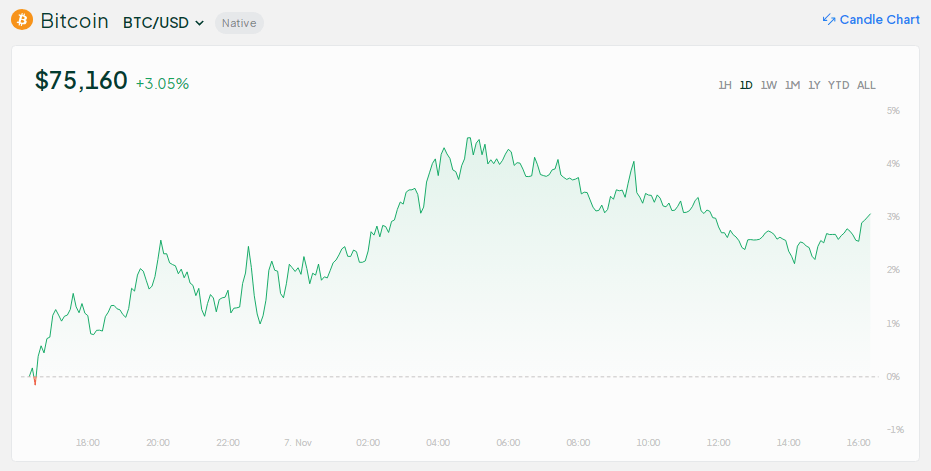

Predictably, the excitement surrounding Bitcoin and cryptocurrencies erupted shortly after Donald Trump’s Republican election victory. Crypto has emerged as a topic in the election discourse, with Trump expressing a more favorable stance compared to his opponent, Kamala Harris, who acknowledged Trump’s win on the previous day. In the early hours of trading, Bitcoin experienced an 8% increase, reaching over $75,000 – surpassing its March high. Many market analysts view this as merely the beginning of a significant upward trend in Bitcoin prices.

Ki Young Ju, CEO of CryptoQuant, predicts that Bitcoin’s price might still grow by up to 40% in the near future. Currently, with today’s pricing, Bitcoin ranks among the top 10 most valuable financial assets in terms of market capitalization. Yet, Young Ju advises Bitcoin holders to adopt a realistic perspective for the short term and suggests a gradual selling approach as the “maximum stress” subsides.

Crypto Market Sees ‘Easing Period,’ Setting Up For A Price Surge

With the election over and done, financial analysts and onlookers have shifted their attention towards Bitcoin and cryptocurrencies, focusing on their periodic patterns or cycles. As per Ki Young Ju’s observations, the behavior of Bitcoin holders tends to follow this cyclical pattern. He noted that new holders typically experience price drops during downturns (known as ‘bear months’), only to find that they have owned these assets for two years after the most difficult period (‘max pain’) has passed.

New investors often hold $BTC through bear markets, enduring losses.

After about two years, it changes hands when pain eases. That time is now.

As I see it, there’s a potential for this asset to increase by around 30-40% from its current position, but let me clarify that such growth doesn’t compare to the extraordinary rise of +368% we witnessed when it was priced at $16K. Given this context, I recommend a cautious approach towards gradual selling rather than an aggressive all-in buying strategy, in my opinion.

— Ki Young Ju (@ki_young_ju) November 6, 2024

In a recent Twitter/X post, CEO Ju indicated that the transfer of assets and relief in market tension is taking place now. Based on this, he predicts a potential increase in price by 30% or more, but warns investors that today’s market conditions are significantly different from when Bitcoin skyrocketed by 368% to $16k. For Ju, the most effective approach is to sell the asset incrementally and avoid taking on too much risk with an all-in buying strategy.

Bitcoin Technicals Tell A Bullish Short-Term Story

Cryptocurrency owners and investors might also analyze Bitcoin’s technical details to gain additional understanding. According to TradingView statistics, Bitcoin’s price is getting close to the upper Bollinger Band, suggesting a positive trend. However, when these bands widen, traders and holders should anticipate increased market volatility.

Moreover, the Relative Strength Index (RSI) for the asset currently stands at 63, implying a positive trend. Bitcoin’s RSI dipped to around 56% three days prior to the US elections, reflecting a balanced market situation. An RSI of 50 indicates market neutrality, suggesting no substantial decrease, increase, or consolidation phase. However, two days post-elections, it has climbed up to 63, signaling a bullish outlook but not yet overbought conditions.

Staking Platforms Benefit From Positive Price Action

As a crypto investor, I’ve noticed that not only holders and investors but also staking platforms like Solv Protocol are reaping the benefits from Bitcoin’s recent market movements. For instance, this leading BTC staking platform has surpassed $2 billion in Total Value Locked (TVL), according to DeFiLlama. This means that approximately 30,000 Bitcoins are now staked on Solv Protocol, which is a significant increase from the 16,340 tokens listed just mid-October. The surge in activities by Solv Protocol across various blockchains seems to align with Bitcoin’s recent price fluctuations.

At Solv Protocol, it’s widely recognized that SolvBTC is the standout product, holding approximately $1.11 billion in assets. The surge in activity at Solv Protocol underscores the rising significance of staking as a strategy to boost returns, particularly during volatile market conditions.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Luma Island: All Mountain Offering Crystal Locations

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- 13 EA Games Are Confirmed to Be Shutting Down in 2025 So Far

- Space Marine 2 Teases 2025 Plans

2024-11-07 19:42