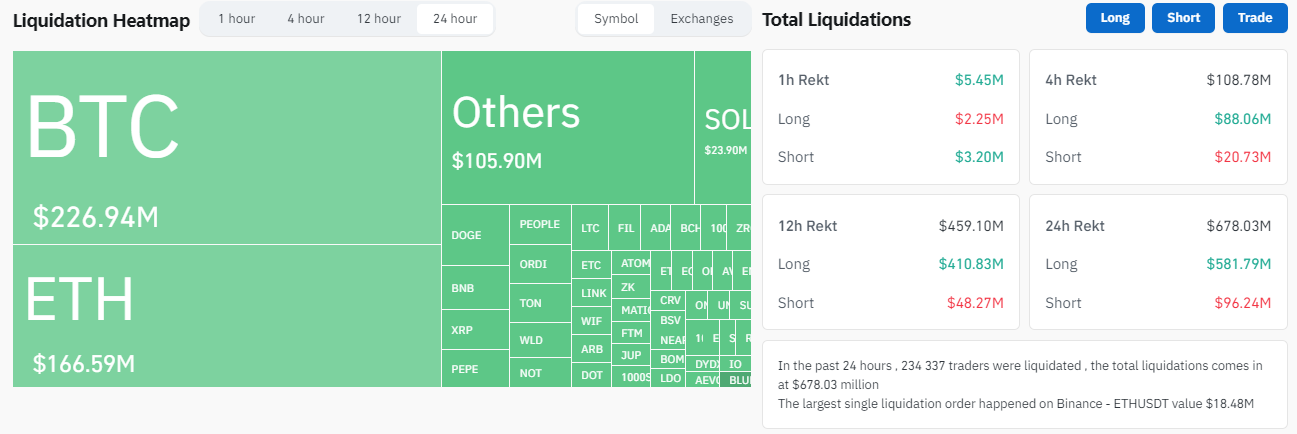

As an experienced analyst, I’ve witnessed numerous ups and downs in the cryptocurrency market over the years. The recent liquidation event, with close to $700 million worth of long orders being destroyed overnight, is undoubtedly one of the most significant downturns we have seen in a while.

As an analyst, I’m observing a significant development in the cryptocurrency market: the second largest liquidation event has occurred, with approximately $700 million in long orders getting wiped out overnight following Bitcoin’s sharp drop below the $55,000 mark. Regrettably, the recovery process may not be as swift this time around.

As a researcher studying the cryptocurrency market, I’ve noticed that when large positions get liquidated, the effect is a snowballing price drop. This isn’t just because the liquidation itself pushes down the price, but also due to the resulting fear among investors, leading them to sell off their own holdings in a panic.

The economic slump could be intensified by these frantic sales, leading to additional bankruptcies and a more drastic drop in prices. This situation also pertains to the present market, bringing about severe repercussions. Significant selling pressure has been inflicted upon the market due to the shifting of funds from the defunct Mt. Gox exchange.

As a researcher studying the Bitcoin market, I’ve observed that the movement and potential sale of certain funds increase the total supply of Bitcoin for purchase. Consequently, this leads to a decrease in prices due to an oversupply in the market. Additionally, ETFs have emerged as a significant contributor to selling pressure. Although they had amassed large quantities of Bitcoin prior to the sell-off, their subsequent sales have put downward pressure on the price.

When large amounts of Bitcoin held by institutional investors such as the US and German governments are sold on the market, the price of Bitcoin tends to decrease significantly. This selling pressure worsens the existing market instability, leading to an increase in supply and a subsequent decrease in price.

As an analyst, I would express it this way: The current high demand for purchases is outpacing the market’s ability to absorb them all. Consequently, even relatively small sale volumes could cause noticeable price fluctuations due to insufficient liquidity in the market.

Recovering from this situation will be a challenging process due to the extensive liquidations, massive selling by institutions and governments, and the prevailing pessimistic market attitude. Considering the current market conditions, bracing for a potentially bearish mid-term trend could be a prudent choice.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- PLI PREDICTION. PLI cryptocurrency

2024-07-05 12:44