Ethereum’s derivatives market is practically doing a conga line through a fireworks factory 🎉🔥. Open interest? Sky-high. Trader enthusiasm? Borderline unhinged. And ETH’s flirting with $4K like it’s swiping left on poverty. Let’s unpack this circus 🤹♀️💸.

Ethereum Derivatives Market: The Great Financial Soap Opera

Per Coinglass, ETH futures open interest is $46.27B-basically, a giant “I O U” note between traders betting the farm 🏦.

CME is the Wall Street dad here with $10.47B (22.6% market share), while Binance flexes $8.4B. Bybit ($3.5B) and OKX ($2.5B) are the quirky sidekicks. Gate and Bitget? They’re the hype squad, up +3% in 24 hours. Retail therapy, anyone? 💆♂️

CME’s numbers scream “institutional FOMO,” but Binance/OKX’s perpetual swaps? Pure retail chaos 🚀. OI dipped -0.10% hour-over-hour, but hey-it’s still +0.17% overall. 11.74 million ETH contracts floating around. Basically, everyone’s throwing spaghetti at the wall to see if it turns into a Lambo 🚗.

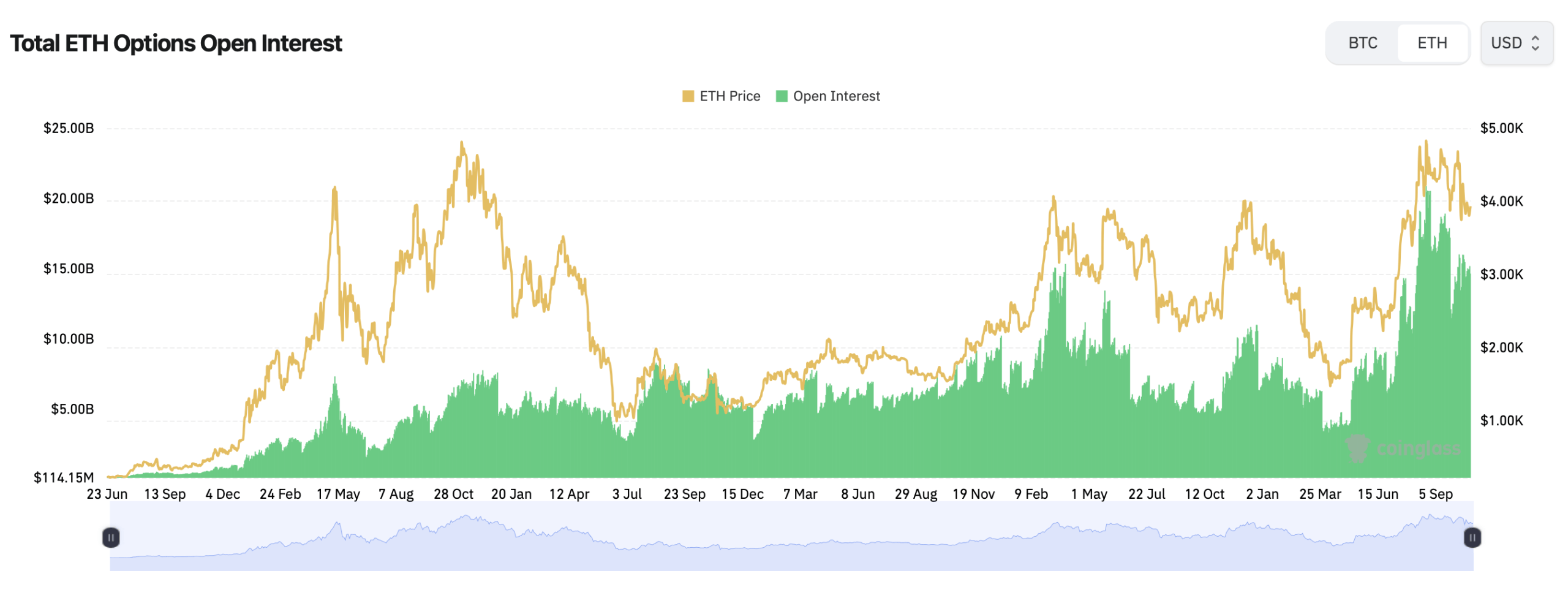

Options market? Pure bullishness with a side of “please don’t dump.” $14.5B-$15B OI, 63.7% calls (bulls) vs. 36.3% puts (bears). 24h volume: 87,153 ETH calls vs. 58,062 puts. Translation: More people betting ETH will moon than crash into the sun ☀️.

Deribit is the options kingpin, hosting $6K, $5K, and $7K strike contracts expiring Dec 26, 2025. Near-term action? $4,200-$4,250 strikes. Traders think ETH’s staying above $3,900 “no cap” 🧢.

Max pain point at $3,900-where 67% of options expire worthless. Coincidence? ETH’s spot range last week was $3,749-$4,080. So, traders are hedging like it’s a rainy picnic 🧺. November’s looking spicy-either a breakout or a “hold my beer” correction 💨.

Bottom line: Derivatives market’s a dumpster fire of bullish bets 🗑️🔥, but $4K is the emotional speed bump. Will ETH cruise past or faceplant into a meme? Place your bets, folks. 🎰

FAQ ⚡ (Because You’re Definitely Panicking)

- What’s ETH’s futures OI?

A staggering $46.27B. CME and Binance are basically the prom queens here 👑. - Calls vs. puts in ETH options?

Calls own 63.7%-traders are more bullish than a Wall Street bro at a strip club 🐂. - Max pain level?

$3,900. Where dreams go to die (or not). 💀 - Top exchange for ETH derivatives?

CME for futures, Deribit for options. They’re the Beyoncé and Jay-Z of crypto 💍🎤.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-10-25 17:43