Well, strap in, folks, because the crypto world is at it again! Bitcoin decided to have a little party, soaring above $90,000 like it was nothing, and naturally, Ethereum, the trusty sidekick, tagged along, hitting a high of $3,148. But, as is the way with these fickle digital darlings, the price slipped back below $3,100 faster than you can say “blockchain.” So, the big question now is: has the bull run run out of steam? 🏃💨 Fear not, dear readers, for the technicals and on-chain data suggest that ETH is gearing up to defend the $3,000 fortress like a knight in shining armor. 🛡️

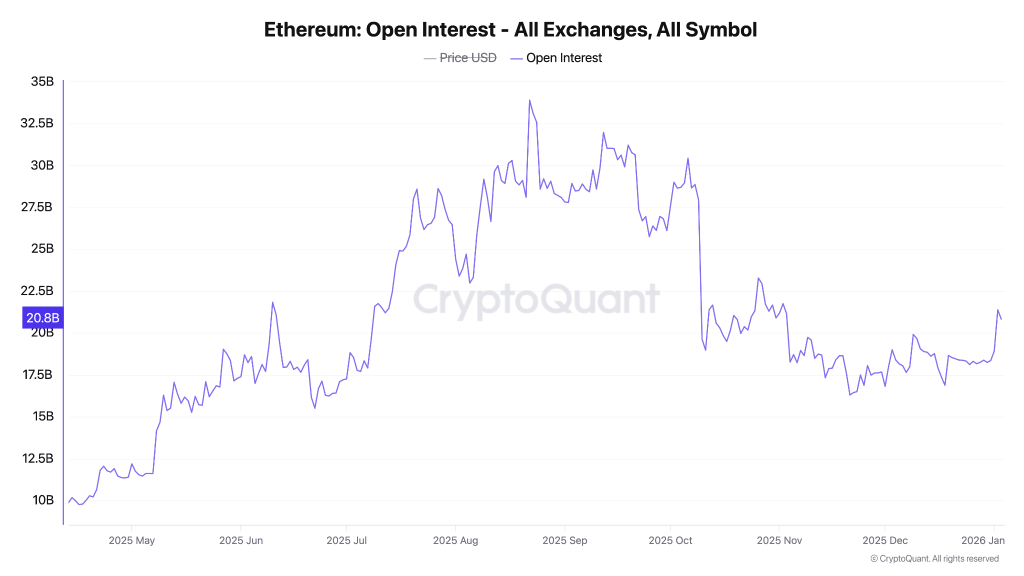

Open Interest: Not Too Hot, Not Too Cold 🌡️

Open interest, the number of open positions (both long and short), has had a bit of a workout lately, spiking like a teenager’s enthusiasm for TikTok. This indicates more liquidity, volatility, and, let’s be honest, drama in the derivative market. But here’s the kicker: ETH’s open interest is lounging around $20 to $21 billion, well below its previous peak of $30 billion. So, while it’s not exactly a snooze fest, it’s also not a forced-liquidation apocalypse waiting to happen near $3,000. Phew! 😌

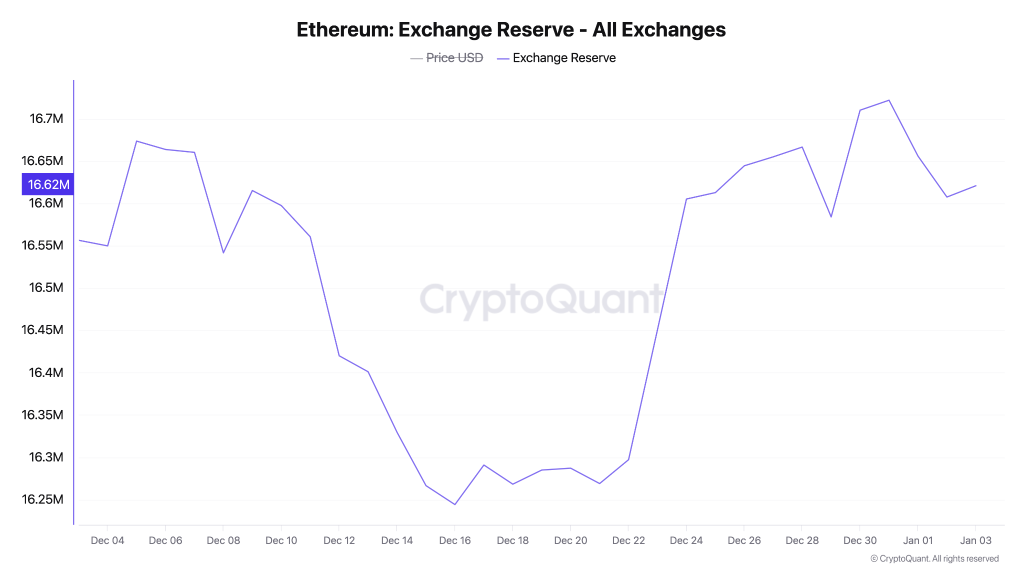

Exchange Reserves: Steady as She Goes ⚓

Exchange reserves, the total coins chilling on exchanges, are sitting pretty at around 16.6 to 16.7 million. Sure, some tokens took a little field trip back to the exchanges, but this isn’t a panic sell-off-more like a casual stroll. The stability here suggests consolidation, not a nosedive below $3,000. So, no need to cancel your Netflix subscription just yet. 📉✋

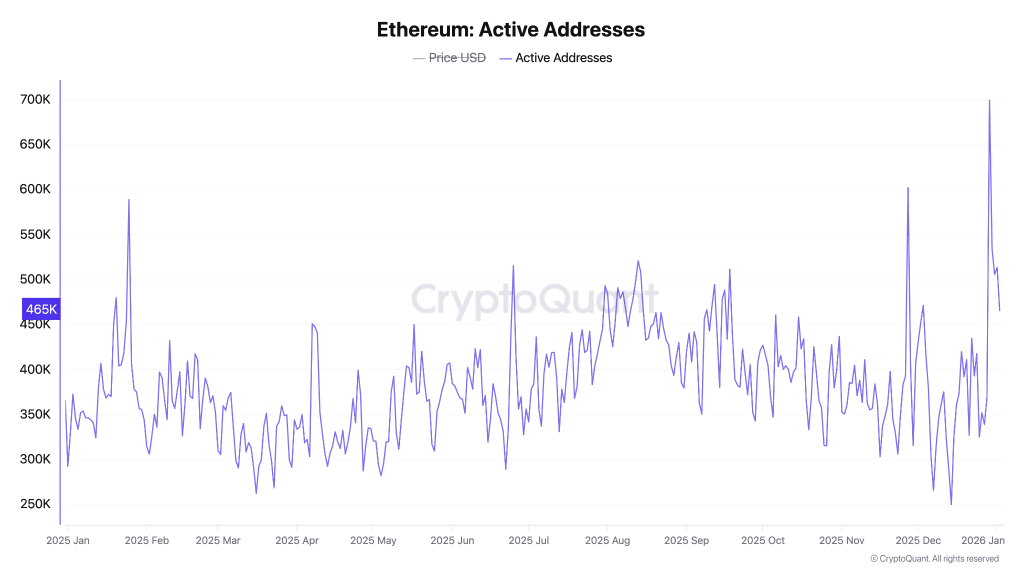

Active Addresses: The Party’s Still Going 🎉

Active addresses, the lifeblood of the Ethereum network, have been on a bit of a rollercoaster, spiking to 700K before settling around 456K. But hey, that’s still a lot of folks swapping, buying, and selling. This uptick in activity is like a shot of espresso for the bulls, giving them the energy to defend that $3,000 psychological barrier. ☕💪

Ethereum Price Analysis: What’s Next for Our Digital Hero? 🦸♂️

Since December, Ethereum has been trading in a bullish pattern, and its recent upswing has pushed it above a pivotal range. Volume? Meh, it’s been average, but the bulls seem to be calling the shots. So, ETH looks primed for a bullish continuation, with $3,200 in its sights. But let’s not get ahead of ourselves-crypto is as predictable as a cat on catnip. 🐱

ETH has finally surged above the 50-day MA for the first time since the October drama, and the RSI is climbing like a squirrel up a tree. The rally’s strength is growing, so an upswing seems likely. But, as always, crypto loves to keep us on our toes. If ETH can handle the current upward pressure, the next move could be massive. Or not. Who knows? 🤷♂️

Can ETH Hit $3,500? The Plot Thickens… 🕵️♂️

Here’s the deal: Ethereum is more likely to consolidate before making any grand moves toward $3,500. The data supports defending the $3,000 zone, but an immediate breakout? Not so fast. For ETH to hit $3,500, two things need to happen: exchange reserves need to start trending downward, and the price must reclaim the $3,200-$3,300 range with some serious volume. So, $3,500 is possible, but it’s not going to happen just because we wish it would. 🌈✨

If Ethereum holds above $3,000 and network activity stays lively, a gradual move toward $3,500 later this month isn’t out of the question. But without fresh demand or a market catalyst, expect some sideways action first. In short, $3,500 is achievable-but only after confirmation, not by assumption. So, grab your popcorn and enjoy the ride! 🍿🎢

Read More

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- Sega Declares $200 Million Write-Off

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- How to Unlock the Mines in Cookie Run: Kingdom

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2026-01-03 16:42