As a seasoned crypto investor with a few years under my belt, I’ve learned that the market is not always predictable, and each asset has its unique characteristics. The recent approval of Ethereum ETFs has left me intrigued but also cautious. While Bitcoin experienced a massive bull run after its ETF approval in 2021, Ethereum has yet to show similar growth.

As a researcher studying the cryptocurrency market, I’ve observed that following the SEC’s approval of Ethereum ETFs on March 23, Ether has yet to exhibit noticeable price growth. In contrast, Bitcoin experienced a significant price surge about a month after its own ETF approval in October 2021, reaching an all-time-high of $73,738.00 on March 14.

In September 2022, Ethereum transitioned to proof of stake (PoS), a series of interconnected upgrades that enhanced Ethereum’s security and sustainability. Proof of stake differs from the previous proof of work system by relying on staked cryptocurrency holdings instead of computational power, making it less energy-consuming. In place of miners, validators are now responsible for creating new blocks, requiring them to stake their Ethereum holdings as a prerequisite.

As a crypto investor, I’ve noticed the surging interest in Ethereum-based decentralized applications (dApps), leading me to consider diversifying my portfolio beyond Bitcoin. An intriguing observation is the correlation between Bitcoin and Ethereum prices. A deeper analysis of this relationship might signal an imminent acceleration in Ethereum’s price growth.

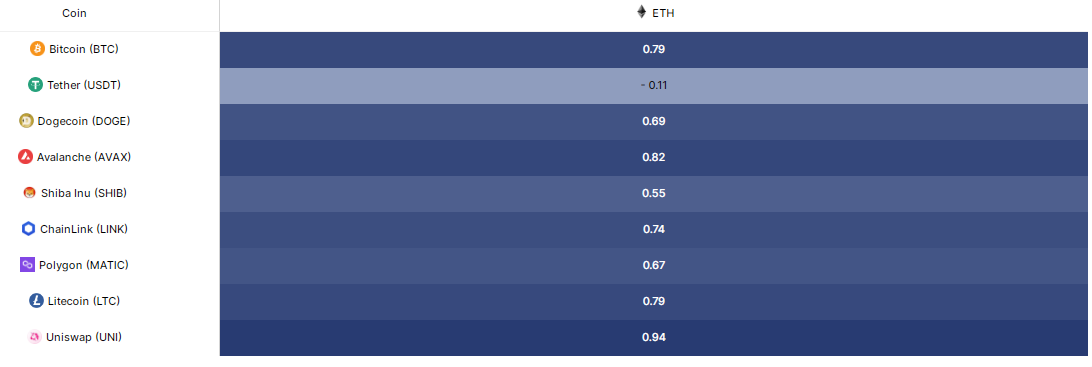

BTC/ETH correlation coefficient

The correlation between Bitcoin (BTC) and Ethereum (ETH) prices is represented by their ratio, which is usually expressed in terms of how many Bitcoins are required to purchase one Ethereum. For instance, if a Bitcoin costs $60,000 and an Ethereum costs $3,000, the ratio would be 0.05, meaning it takes 0.05 BTC to buy one ETH. If Ethereum’s price rises faster than Bitcoin’s, the ratio will increase, suggesting that more Bitcoins are needed to acquire an Ethereum.

As a researcher studying the relationship between Bitcoin (BTC) and Ethereum (ETH), I can also express this connection through the correlation coefficient. This metric ranges from -1 to 1, with extremes indicating perfect positive or negative alignment, while a value of 0 implies no discernible correlation.

In simpler terms, the correlation between Bitcoin (BTC) and Ethereum (ETH) prices indicates their interconnected movement, whereas the correlation coefficient quantifies the degree of this relationship. These measurements are essential tools for effectively managing trades based on the BTC/ETH correlation.

Historic correlation

Based on historical information, Ethereum’s value typically rises in bull markets, with ETH exceeding 0.05 Bitcoin during these market upswings in 2018 and 2021. After 2021, this price point has emerged as a robust support level. On the other hand, Ethereum has encountered resistance at the 0.08 Bitcoin mark on three distinct occasions.

As a crypto investor during the BTC bull market, I’ve noticed a strong correlation between certain factors and Bitcoin’s price growth. This connection intensified, reaching its peak on March 14, when Bitcoin hit an all-time high (ATH) and I witnessed a significant increase in its value.

In the context of market trends, the chart reveals that Ethereum tends to surpass Bitcoin during bull runs, but lags behind during bear markets. Although historical data doesn’t ensure future outcomes, it offers invaluable perspectives for making wiser investment choices.

A report published by Coinbase reveals that the connection between Bitcoin (BTC) and Ethereum (ETH) has been weakening since the beginning of 2023, with a noticeable decrease following Ethereum’s Shanghai (Shapella) hard fork on April 12. This event facilitated staked ether withdrawals, causing their 40-day rolling correlation to drop from 0.95 to 0.82.

Historically, Bitcoin (BTC) and Ethereum (ETH) have shown strong correlation in their price movements. However, several key factors are currently pushing these two cryptocurrencies apart. Firstly, the increasing adoption of decentralized applications (dApps) built on the Ethereum network is drawing more attention and investment towards ETH. Second, the surge in popularity of non-fungible tokens (NFTs), which are primarily based on Ethereum, is further boosting its demand and value. Lastly, Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism represents a significant technological advancement, making ETH more attractive to investors and developers alike. These factors are contributing to the growing divergence between BTC and ETH prices.

Ethereum ETFs expectations

Based on IntoTheBlock’s findings, a staggering 95% of Ethereum positions are currently in the green, with the cryptocurrency experiencing a 30% surge over the last week. Such a high level of profitability was last seen back in November 2021 when ETH reached its all-time peak price.

As an analyst, I’ve observed a noteworthy trend in Ethereum (ETH) purchasing behavior. The resistance to buying ETH at current prices or higher is relatively low. In fact, approximately 3.57 million ETH were transacted between the price ranges of $3,800 and $4,800. This figure pales in comparison to the massive volume of 53.54 million ETH bought when the price ranged from $2,160 to $2,650.

Large Ethereum investors, or “whales,” have been active recently due to heightened prospects for an ETF approval. On Tuesday, 21st October, Ethereum saw its highest on-chain trading volume in over five months, with a total of $15.98 billion transacted.

As a researcher studying the trading activity on a particular market, I found that out of the $15.98 billion in recorded trading volume, approximately $14.33 billion (around 90%) came from transactions valued over $100,000. These large-scale trades are commonly executed by significant investors or “whales.” Given the recent approval of ETFs, it’s reasonable to assume that this trend will intensify in the near future.

As a crypto investor, I’m thrilled about the approval of Ethereum ETFs, which represents a major step forward in cryptocurrency adoption. This development is expected to attract more institutional investors and whales to Ethereum, as evidenced by recent large-volume transactions. The expanding landscape, marked by substantial on-chain trading activity, underscores the growing confidence in Ethereum among both institutions and individual investors.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- PYTH PREDICTION. PYTH cryptocurrency

2024-05-26 11:24