As a seasoned crypto investor with several years of experience under my belt, I’ve learned to pay close attention to market indicators when evaluating potential investment opportunities in digital assets. The recent surge in Ethereum’s Taker Buy Sell Ratio, as indicated by the data from CryptoQuant, has piqued my interest.

Based on the available information concerning the Ethereum futures market, the following insights can be gleaned about the prevailing attitude towards ETH – is it more bearish or bullish?

Ethereum Taker Buy Sell Ratio Has Observed A Strong Surge Recently

In a recent analysis piece for CryptoQuant, an expert has discussed Ethereum’s future prospects based on insights from futures market data. The key metric they examined is the “Taker Buy Sell Ratio,” which monitors the volume of ETH trades where buyers are taking (purchasing) and selling (placing orders to sell) on derivatives exchanges.

When the value of this metric exceeds 1, it indicates that more traders are buying or going long than selling or shorting, resulting in a predominantly bullish market attitude.

Meanwhile, the fact that the indicator falls below the benchmark suggests a prevailing bearish sentiment amongst potential buyers, leading more sellers to offload their assets at reduced prices.

Based on my extensive experience in analyzing cryptocurrency market trends, I’d like to share with you some insights I’ve gleaned from this chart depicting the 14-day simple moving average (SMA) Ethereum Taker Buy Sell Ratio over the past few months.

Inspecting the given chart, it’s clear that the 14-day Simple Moving Average (SMA) of Ethereum’s Taker Buy Sell Ratio has experienced a significant uptick lately. This observation suggests that the market equilibrium has been tilting recently.

Based on my extensive experience in financial markets analysis, I have observed that when there is a significant increase in a particular indicator for an asset, it often coincides with a surge in the asset’s price. This pattern was evident in the chart I recently analyzed, which showed a similar trend in the metric preceding the robust price rally in the first quarter of the year. My years of experience have taught me that such correlations are worth paying close attention to, as they can provide valuable insights into potential market movements.

Based on the recent trend, the quant comments:

The significant increase in buying activity in the perpetual market signifies robust optimism among investors, implying a bullish outlook. If this positive momentum in the Taker Buy-Sell Ratio persists, it’s a strong indicator of an emerging mid-term bull trend, potentially driving prices upward to reach higher levels.

The 14-day Simple Moving Average (SMA) Taker Buy Sell Ratio’s upward trend in the crypto market is something to watch closely. If it persists in the near future, this could be a sign of an emerging bullish pattern.

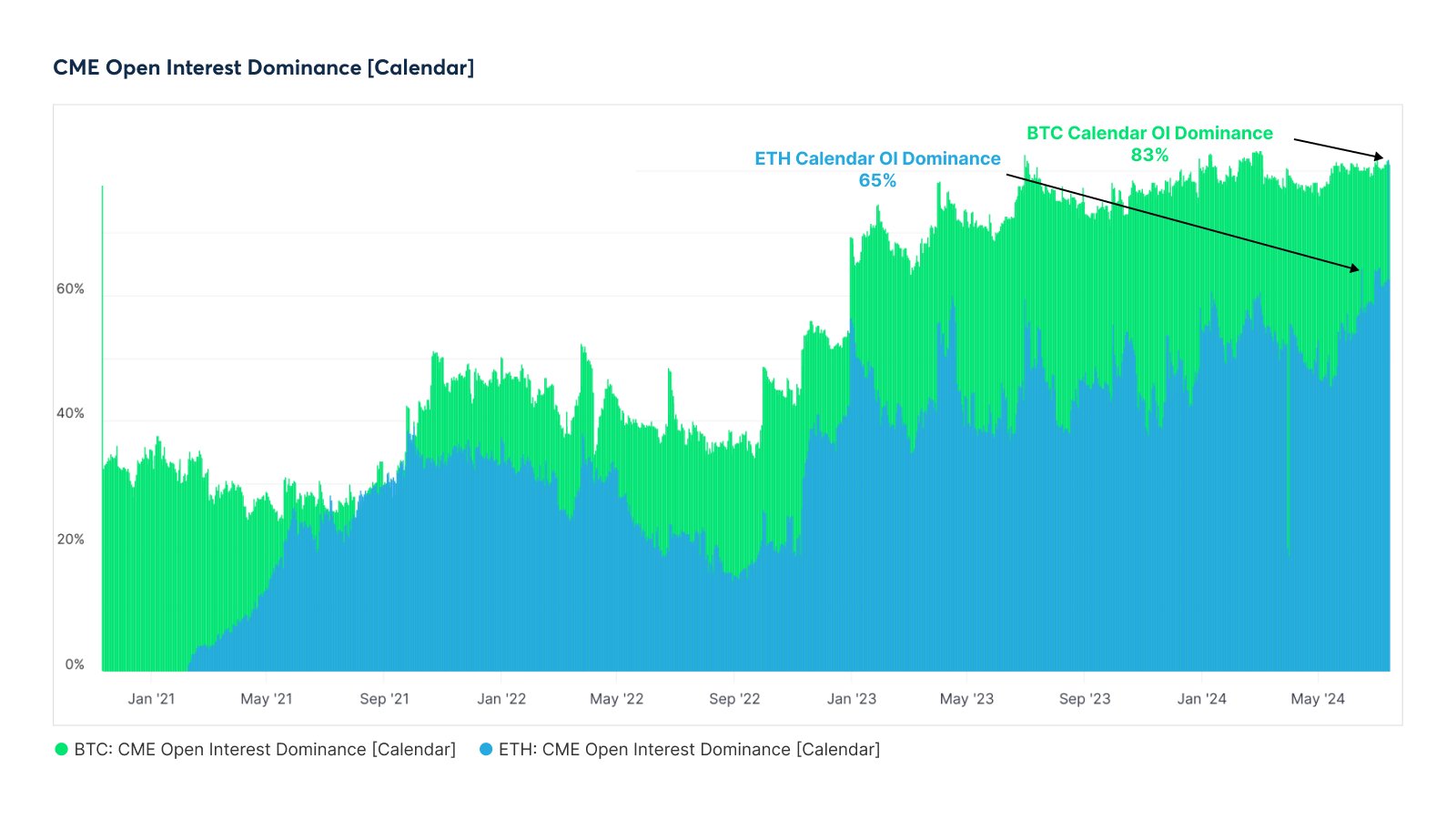

In the realm of futures markets, Glassnode’s recent analysis highlighted that the CME Group has strengthened its position in the calendar futures market for both Ethereum and Bitcoin.

The chart showcases the Open Interest figures held by the CME Group in their calendar futures market. Open Interest represents the quantity of open contracts in existence at any given time.

The CME Group holds approximately 83% of the Bitcoin and around 65% of the Ethereum open interests in the calendar market.

ETH Price

The price of Ethereum has hovered around $3,400 over the past few days, preventing its recovery from continuing.

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- USD COP PREDICTION

- EUR CLP PREDICTION

2024-07-19 15:12