As a seasoned crypto investor with a knack for recognizing opportunities, I find the recent revelation by Matthew Siegel, head of digital asset research at VanEck, highly intriguing. The resurgence of Ethereum (ETH) in terms of market share of fees among fee-based layer-1 blockchains is a sign that could potentially signal a bullish trend for ETH.

The head of digital asset research at $101.9 billion U.S. hedge fund VanEck, Matthew Siegel, has discovered and revealed what could be key information for those bullish on Ethereum (ETH).

As per Siegel’s analysis, Ethereum has made a strong comeback in terms of fee market share among the transaction fee-based layer-1 blockchains. It climbed back up from a mere 9% share in late August to its current 40% share.

bucking the prevailing opinion, Ethereum has significantly increased its market share in transaction fees among the first-layer blockchains that earn fees. This recovery started after it held just 9% of the market share in late August and has now reached a remarkable 40% today.

— matthew sigel, recovering CFA (@matthew_sigel) September 23, 2024

In August, Ethereum’s layer-1 fees made up 20% of what they had been since the end of 2019, marking a significant low point. This period, towards the end of 2019, was seen as quite favorable for buying ETH by Siegel. It’s worth noting that this perspective contrasts with the current general outlook on Ethereum as a leading altcoin. The analyst offered his detailed analysis as an alternative view to the prevailing sentiment in the market.

Is “blood in the streets” mode on for Ethereum?

Certainly, when weighed down by Ethereum’s persistent drop in value relative not only to Bitcoin, but also its primary rival currently, Ethereum enthusiasts have prompted Vitalik Buterin to share optimistic updates. It’s not solely about the price of ETH, but also about Solana’s success this year in capturing market share among blockchains.

At present, it’s worth noting that some standalone apps, such as pump.fun on Solana, are generating weekly earnings that surpass the total amount earned by the entire Ethereum network in the same time frame.

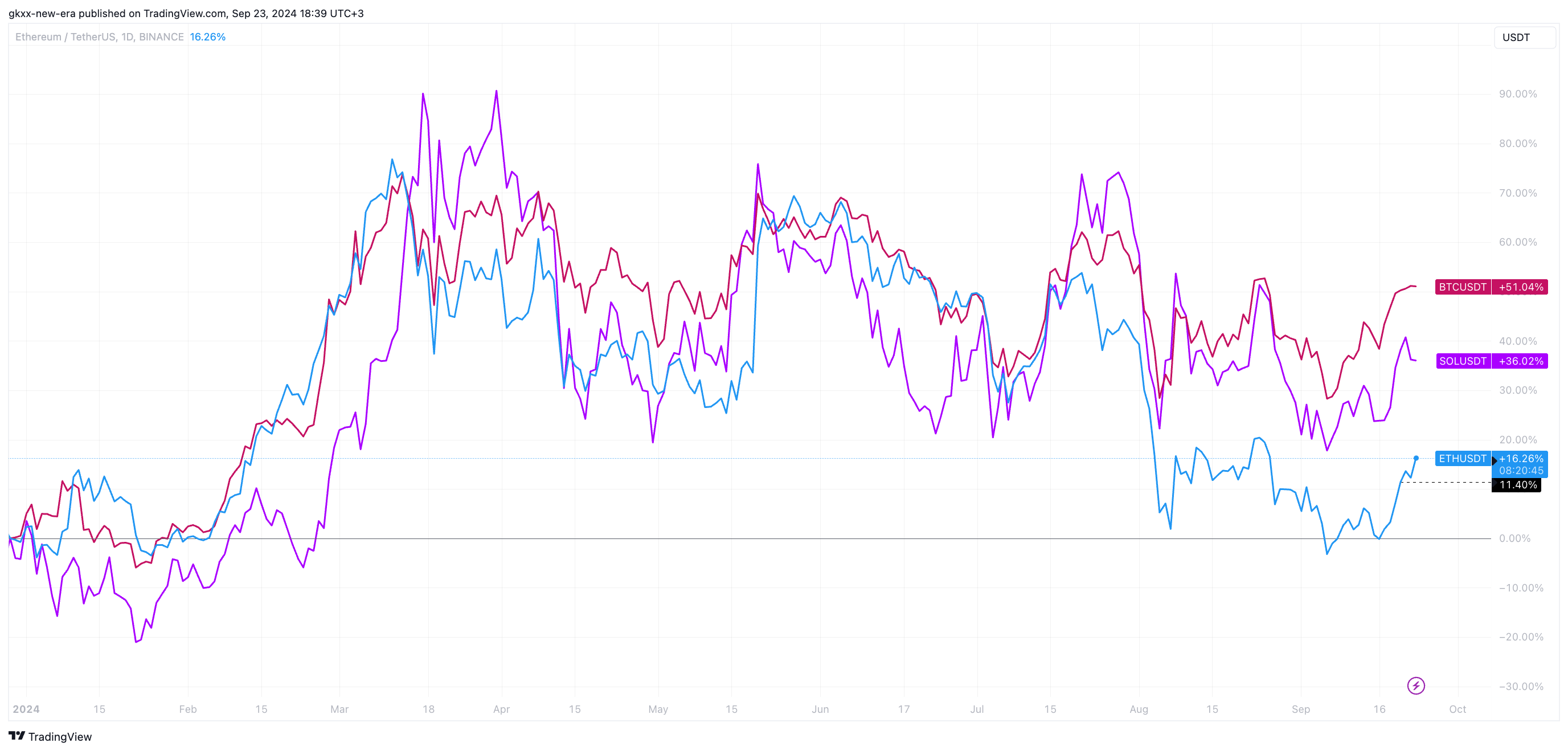

Significantly, Siegel pointed out the striking resemblance between the market conditions in 2019 and the bottom point for ETH‘s price. In contrast to Bitcoin and Solana, which have seen their native token prices surge by over 50% and 40% respectively since the start of 2024, Ethereum, the primary altcoin, has only experienced a growth of 16.86%, with this increase being achieved during the first three months of the year.

It’s possible that history could follow a similar pattern and Ethereum might experience a remarkable resurgence.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR INR PREDICTION

2024-09-23 20:32