Ah, the sweet smell of ambition in the air-Ethereum bulls are stampeding toward $12,000 like it’s the last hay bale on a frostbitten steppe. Analysts, those modern-day soothsayers, are now debating whether this rally is the dawn of a new era or just another mirage in the desert of speculation.

Market Overview: ETH Breaks Key Resistance (and Maybe Some Hearts)

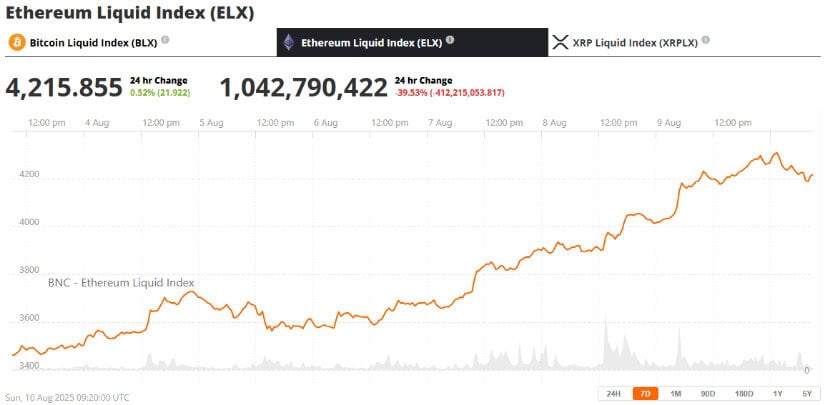

Ethereum (ETH) has surged over 19% in the past week, leaving a trail of liquidated short positions worth $200 million. In the last 24 hours, ETH gained 7.5%, briefly flirting with $4,300 before settling near $4,250. Meanwhile, Bitcoin, the old guard of crypto, limps along with a modest 3% weekly increase. Ethereum’s dominance grows, pushing the total crypto market cap closer to $4 trillion. On-chain analyst Tracer boldly proclaimed on X that Ethereum is “about to break 4-year resistance,” adding, “$12,000 is not just a dream anymore.” Oh, how dreams can inflate like balloons at a child’s birthday party! 🎈

But let us not forget, dear reader, that every ascent is shadowed by the specter of gravity. Will Ethereum soar like Icarus or plummet like a lead balloon? Only time-and perhaps a few more tweets from analysts-will tell.

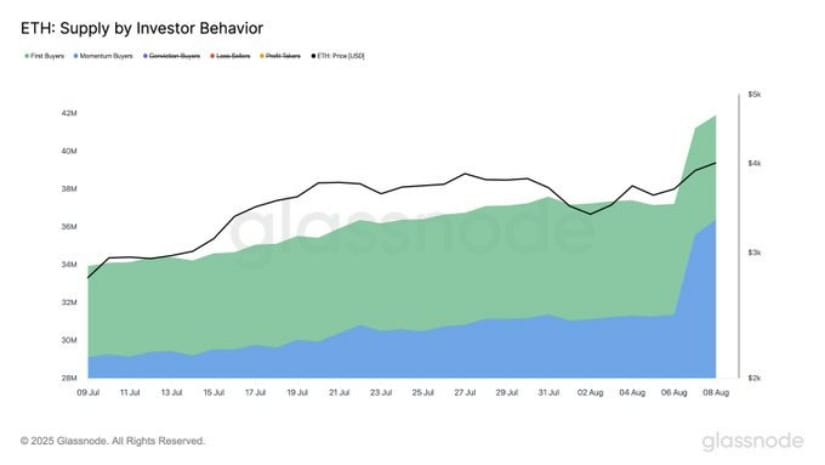

Institutional Demand and Whale Accumulation: The Big Fish Feast

This rally isn’t fueled by retail traders sipping lattes and dreaming of Lamborghinis; oh no, it’s the whales and institutions gorging themselves on ETH. According to data from The Boss, SharpLink Gaming splurged on ETH, amassing a staggering $2.12 billion after a major purchase on August 8. One can almost hear the cash registers ringing in the background. 💰

And the whales aren’t stopping there. A recent $40.5 million over-the-counter acquisition of 10,400 ETH has sent ripples through the market. Standard Chartered’s Geoffrey Kendrick predicts that corporate treasuries might eventually hold 10% of Ethereum’s total supply-a move that could make spot ETFs look like small potatoes. Speaking of ETFs, they’re enjoying their own renaissance, with twelve consecutive weeks of inflows totaling over $5 billion in July. Truly, the age of institutional crypto is upon us.

Technical Analysis: Room for Growth (or Hubris?)

From a technical perspective, Ethereum has cleared multiple resistance levels like a hurdler on steroids. After rebounding from support at $3,470, ETH broke above the $4,193 Fibonacci 1.618 extension-a level often associated with price explosions. The Relative Strength Index (RSI) sits at 68.8, tantalizingly close to overbought territory but still leaving room for further gains. The “three white soldiers” candlestick pattern since August 5 signals relentless buying pressure, while the MACD remains as positive as a motivational poster. 📈

Key short-term price levels to watch:

- Immediate resistance: $4,391 and $4,532

- Extended upside targets: $4,712 and $4,868 (ATH)

- Support zones: $4,193-$4,150, then $3,470

Fundamental Catalysts: ETF and Layer 2 Growth

The winds of regulatory change are blowing in Ethereum’s favor. The SEC recently clarified that liquid staking doesn’t violate securities laws, paving the way for staking-inclusive ETH ETFs from giants like BlackRock, Fidelity, and Bitwise. Imagine the bureaucratic gears grinding slower than molasses, only to suddenly align perfectly. 🧾

Meanwhile, Ethereum Layer 2 solutions are flourishing like weeds in an untended garden. Arbitrum, Optimism, and zkSync are attracting DeFi projects and NFT marketplaces faster than moths to a flame. These scalability solutions are adding fresh demand for ETH, proving that sometimes, growth is less about brute force and more about finesse.

Outlook: Can Ethereum Reach $12K?

While skeptics warn of potential retracement after such a rapid climb, the overall sentiment remains bullish. On-chain trends, ETF momentum, and macro breakout patterns all point toward continued gains. Analyst Rekt Capital estimates Ethereum is only “50-60% through its macro uptrend,” suggesting there’s still plenty of room for upside. If current momentum holds, ETH could challenge its all-time high of $4,868 in the coming weeks and potentially target $5,000-with the ambitious $12,000 forecast no longer seeming like a pipe dream. 🚀

So, dear reader, as Ethereum charges toward $12,000, one must ask: Are we witnessing the dawn of a new financial utopia, or is this just another chapter in the great speculative novel of our times? Either way, buckle up-it’s going to be a wild ride. 🎢

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-10 20:55