Imagine this: US-listed Ethereum exchange-traded funds (ETFs) just had their first week of outflows in 15 weeks. It’s like someone decided to take a break from a really good TV show after 15 straight episodes. 📊

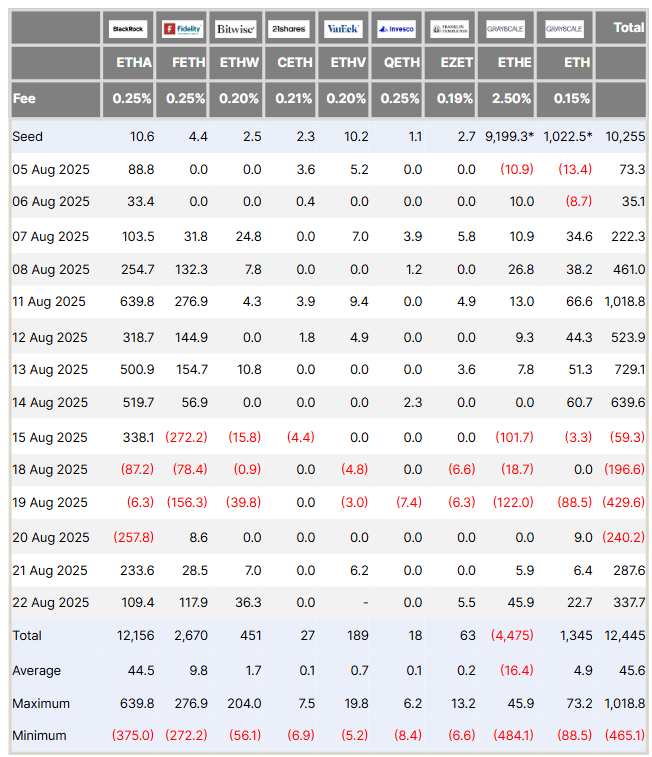

Data from Farside Investors reveals that investors yanked a whopping $241 million from these products during the week of August 22. But hey, it wasn’t all bad news-there was a bit of a late-week rebound, which is like finding a $20 bill in your pocket right before you pay the rent. 💸

Ethereum ETFs Suffer Rare Setback of $241 Million Outflow

The week started with a bang-or more accurately, a crash. Heavy selling pressure saw the nine funds losing a combined $866.4 million between Monday and Wednesday. It’s like they all decided to go on a spending spree at once. 🛍️

And get this: Tuesday alone saw $429 million in redemptions, making it the second-largest daily outflow since these ETFs hit the market. It’s like the financial equivalent of Black Friday, but instead of buying TVs, people were selling off their crypto. 🤦♂️

But then, something interesting happened. By Thursday, the mood shifted, and the funds started seeing inflows again. Two consecutive days brought in a total of $625.3 million. It’s like the stock market version of a rollercoaster ride. 🎢

While this late-week surge helped reduce the damage, it wasn’t enough to completely reverse the earlier outflows. The final tally? A net weekly outflow of about $241 million. Ouch. 😖

This wild ride mirrored broader macroeconomic trends and Ethereum’s own market movements. The early-week selloff was fueled by concerns over US inflation data, which made everyone nervous about what the Federal Reserve might do next. 🤔

However, later in the week, Fed Chair Jerome Powell delivered a more dovish message, calming those nerves and sparking a rally in Ethereum. It’s like he said, “Don’t worry, we’re not going to tighten the belt too much,” and everyone breathed a sigh of relief. 🙌

Despite this hiccup, Ethereum ETFs are still outperforming their Bitcoin counterparts. Last week, Bitcoin ETFs saw more than $1.1 billion in outflows, which is like watching your favorite team lose a big game. 😔

Nate Geraci, president of The ETF Store, noted the broader trend. Since the start of August, spot Ethereum ETFs have attracted $2.8 billion in inflows, while spot Bitcoin ETFs have seen $1.2 billion in outflows. If we look back to July, Ethereum has pulled in $8.2 billion, compared to $4.8 billion for Bitcoin. 🚀

This pattern suggests a significant shift in institutional positioning. Investors seem more willing to bet on Ethereum, even as market volatility continues to play a role in weekly flows. It’s like they’re saying, “Ethereum, you’re the new kid on the block, and we like what we see!” 🌟

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-24 12:37