As a researcher with a background in on-chain analysis, I find the recent trend in Ethereum exchange net flows quite intriguing. The data suggests that there have been substantial positive spikes in deposits to exchanges, which can potentially be a bearish sign for the asset’s price.

Recent on-chain data indicates a surge in Ethereum exchange inflows, possibly suggesting that investors are offloading their holdings in the market.

Ethereum Exchange Netflows Have Seen A Spike Recently

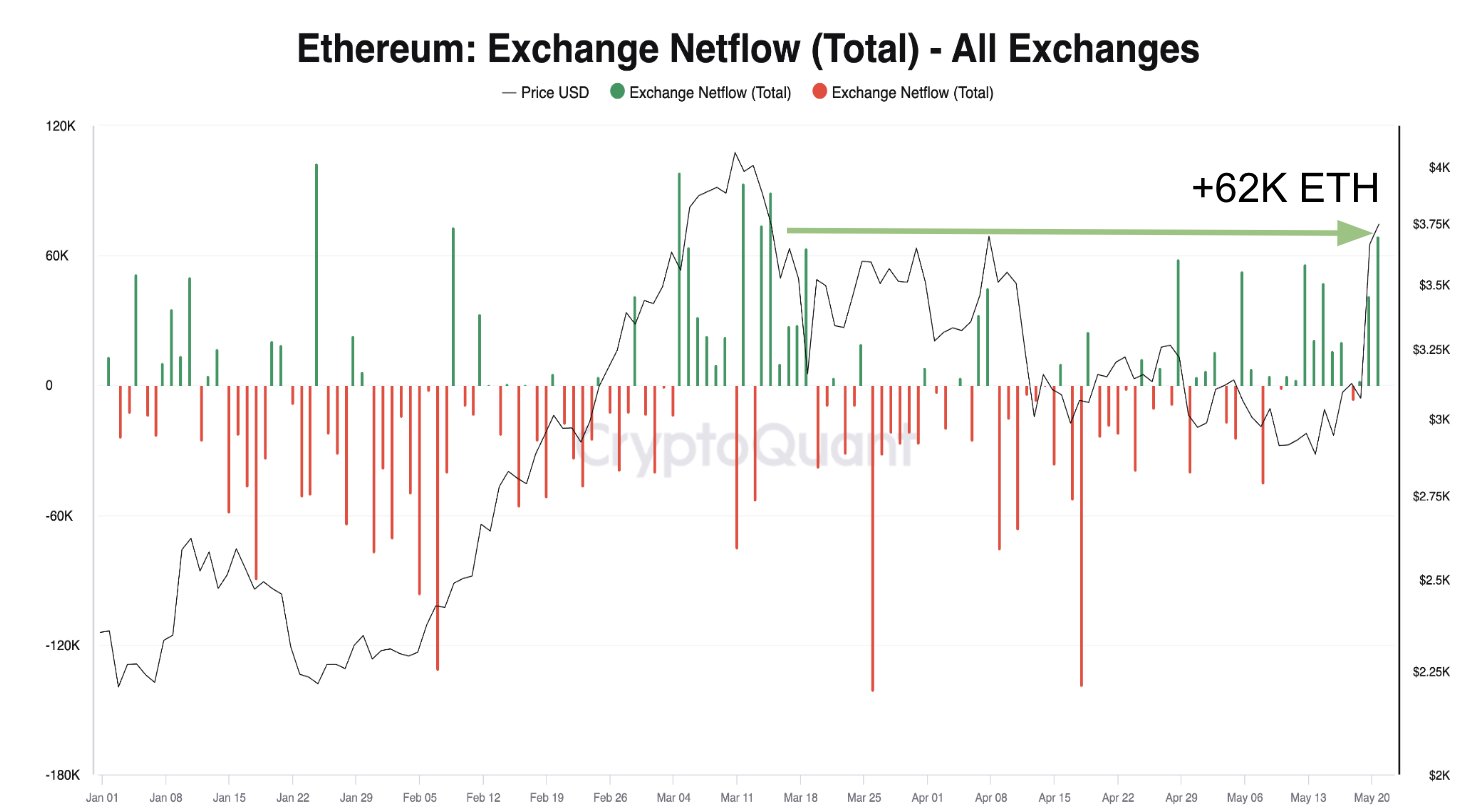

As a data analyst, I’ve recently come across an intriguing observation made by Julio Moreno, head of research at CryptoQuant, in his latest post regarding Ethereum’s exchange netflow trend. This metric signifies the net volume of Ether (ETH) flowing into or out of the wallets connected to centralized exchanges.

When the value of this metric is positive, it signifies that these platforms are currently receiving more coins than they’re sending out. This could be due to various reasons, such as holders transferring coins for selling purposes. Consequently, this trend may have a bearing on the asset’s price and could potentially lead to a decrease in value.

Alternatively, when the indicator shows a negative value, it indicates that more cryptocurrencies are being taken out of exchange-connected wallets than put in at present. This could mean investors are transferring their coins from these entities for safekeeping, which might be a positive sign for the cryptocurrency’s price.

As a crypto investor, I’d like to share some insights based on this Ethereum exchange netflow chart. Over the past few months, you can see a clear trend emerging. The netflow, which represents the total amount of Ethereum moving in and out of exchanges, has been decreasing consistently. This suggests that less Ethereum is being traded on exchanges, potentially indicating reduced selling pressure and a bullish outlook for the cryptocurrency. However, it’s essential to remember that this is just one data point and should be considered in conjunction with other relevant information before making investment decisions.

As a crypto investor, I’ve noticed an intriguing pattern in the Ethereum exchange netflow depicted in the graph. Lately, we’ve witnessed some substantial positive spikes that remind me of the magnitude observed back in March. A significant portion of these deposits has predominantly been directed towards Binance and Bybit.

Previously discussed, an increase in net inflows in the foreign exchange market might suggest selling activity. However, it’s essential to note that this is not always the case. In certain instances, substantial deposits may be utilizing alternative services offered by trading platforms, such as derivatives contracts.

Regardless of the situation, volatility typically increases after significant deposits. The graph illustrates this trend: the indicator reached peak values during the March rally, reflecting investor profit-taking behavior.

Lately, Ethereum has experienced a significant increase in value, driven by encouraging news regarding the approval of ETFs for spot trading. With this price hike, there’s a strong likelihood that investors are looking to cash in on their profits, leading to positive inflows.

To date, ETH has successfully kept at bay a potential sell-off, with its value holding steady. However, it’s unclear for how long the demand will be able to counteract the potential selling pressure should deposits keep pouring into these platforms in the near future.

ETH Price

I analyzed the Ethereum market yesterday and noticed that the price surpassed the $3,950 threshold, signaling a potential upward trend. However, this uptick was short-lived, and the asset subsequently retreated below the $3,800 mark once again.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-05-23 22:11