As a seasoned researcher who has been closely observing and analyzing the crypto market for well over a decade now, I must admit that Ethereum’s current state has left me scratching my beard (metaphorically speaking, of course). The ultra-sound money narrative once held such promise, but it seems that August 2024 might just be the month we bid adieu to this tagline.

The cryptocurrency known as Ethereum (ETH), often referred to as “ultra-sound money” because of its deflationary supply approach, is currently encountering fresh obstacles, leading certain financial experts to doubt if this label remains valid.

In a recent comprehensive article, well-known cryptocurrency expert Thor Hartvigsen brought attention to an important topic regarding Ethereum’s fee production and market flow. He elaborated on these aspects in his post.

Is ETH No longer Ultra-Sound money?

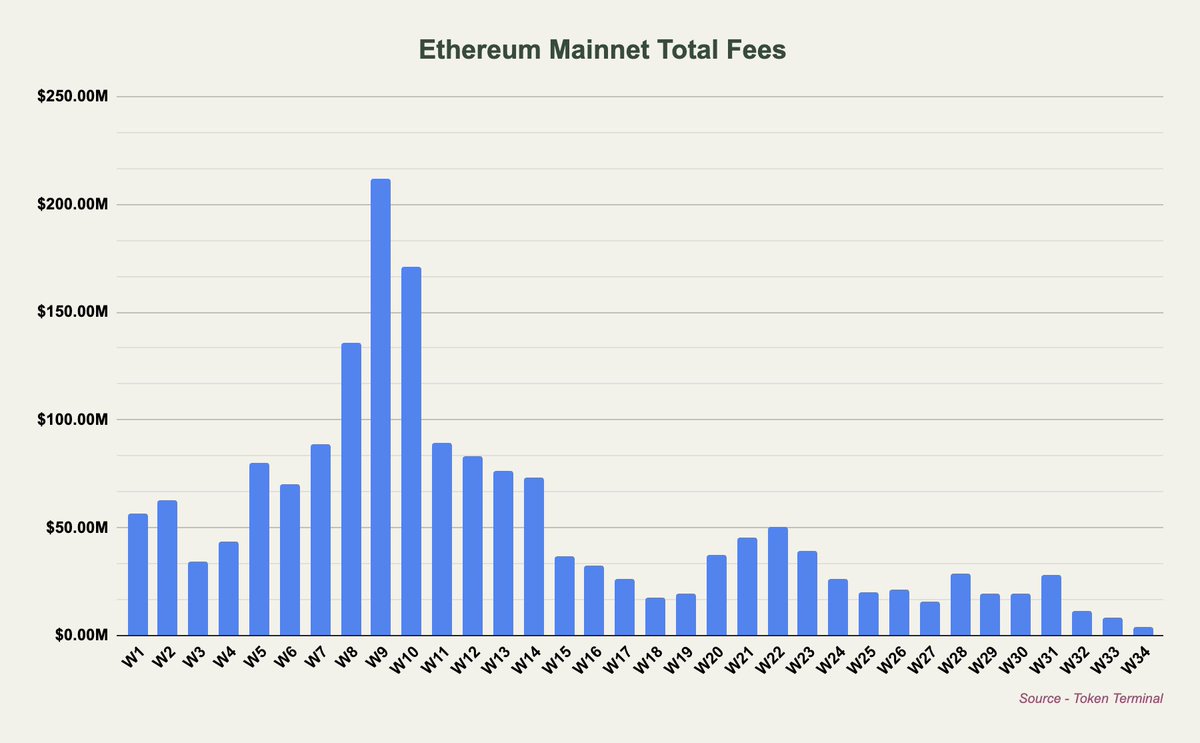

As a researcher, I’ve noticed that August 2024 could potentially be one of the months with the highest fee reductions on the Ethereum mainnet since the beginning of 2020. This trend seems largely due to the integration of blobs in March, which has enabled Layer 2 (L2) solutions to circumvent paying substantial fees to Ethereum and ETH holders.

Consequently, a significant amount of action has moved from the primary network to these layer-two (L2) alternatives. The majority of the worth is now being accumulated at the execution level by the L2 solutions themselves.

Therefore, Ethereum now operates on a net inflational basis, with an estimated yearly inflation rate of about 0.7%. This implies that more Ether is being produced than is being destroyed through transaction costs at present.

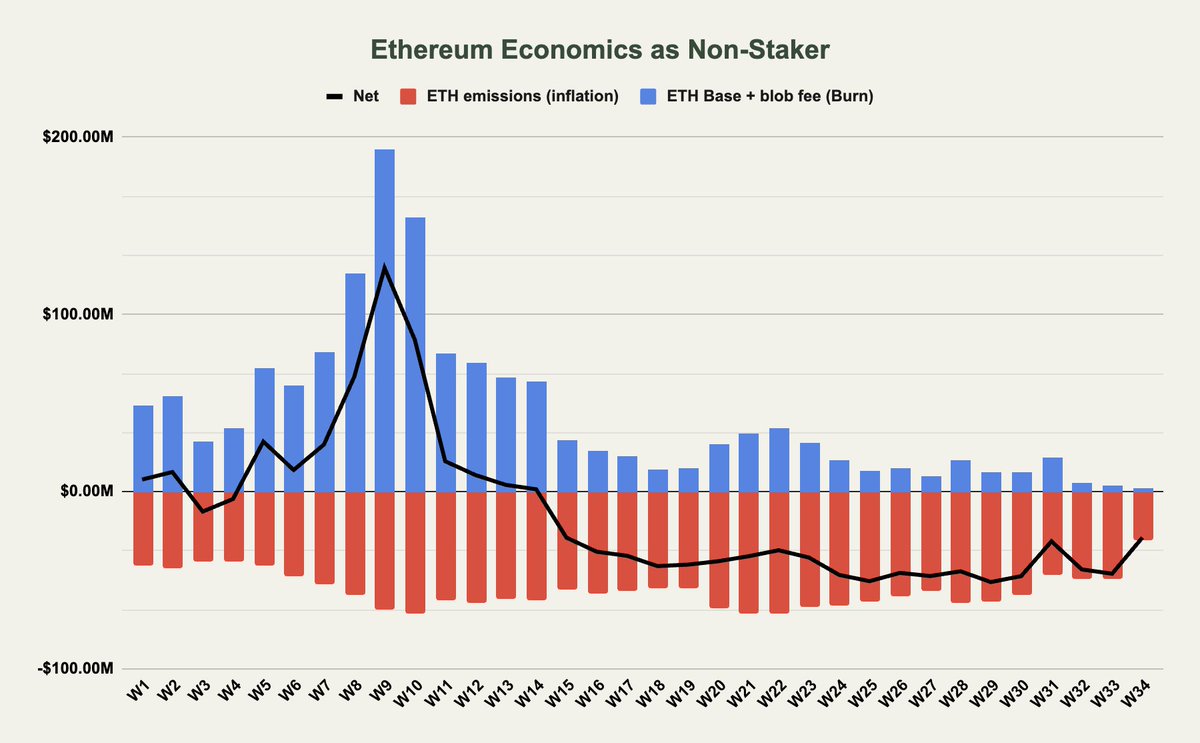

Hartvigsen revealed how this affects both Non-Stakers and Stakers: As per the analyst’s findings, non-stakers mainly reap benefits from Ethereum’s burn mechanism. This mechanism sees base fees and blob fees being destroyed, thereby decreasing the total amount of ETH in circulation.

In essence, since blob fees usually amount to zero and base fee generation is dwindling, those who don’t stake are receiving fewer advantages from these burns. Meanwhile, priority fees and Miner Extractable Value (MEV), which go to validators and stakers instead of being destroyed, do not provide direct benefits to non-stakers.

Moreover, the ethereum emissions directed towards validators and stakers lead to an increase in the overall supply, which can be detrimental to those who do not participate in staking. Consequently, the net effect for non-stakers has become inflationary, particularly following the implementation of blobs.

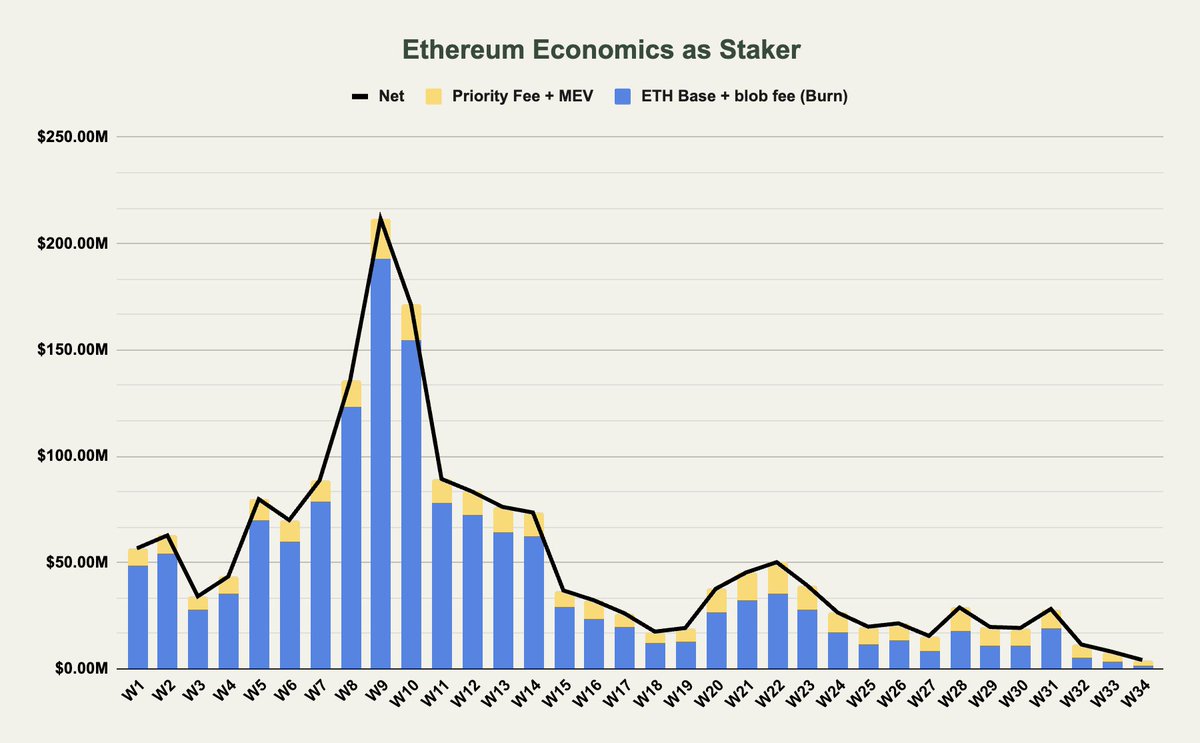

For those who stake Ether (ETH), their circumstances can be seen as distinct. Hartvigsen explained that stakers reap all the transaction fees, whether it’s through burning or by receiving staking rewards. This implies that the overall effect of ETH emission on stakers remains balanced, neutralizing any impact for them.

Yet, while there’s an obvious benefit for stakers, they’ve experienced a substantial decrease – over 90% – in the fees reaching them, compared to the start of this year.

As a seasoned cryptocurrency investor and enthusiast with over a decade of experience in the field, I have witnessed numerous market fluctuations and trends. Recently, the decline in Ethereum has sparked concerns about its sustainability when it comes to the “ultra-sound money” narrative. To address this issue, Hartvigsen’s analysis is insightful.

Ethereum no longer carries the ultra sound money narrative which is probably for the better.

What’s Next For Ethereum?

It seems clear now that Ethereum’s ‘ultra-sound money’ argument might not hold as much appeal as it did in the past, given the present trends.

According to Hartvigsen, as fees drop and inflation marginally surpasses the burn rate, Ethereum is starting to resemble other Layer 1 (L1) blockchains such as Solana and Avalanche, which also experience similar inflationary pressures.

As a researcher delving into the realm of blockchain technology, I’ve taken note of Hartvigsen’s insightful observation. Despite Ethereum’s current annual net inflation rate of 0.7% being significantly lower than other L1s, the potential decline in profitability for infrastructure layers like Ethereum might require a fresh perspective to preserve its value proposition.

One potential solution the analyst discussed is increasing the fees that L2s pay to Ethereum, though this could pose competitive challenges. Concluding the post, Hartvigsen noted:

Stepping back for a broader perspective, it’s important to note that most infrastructure layers, including Celestia which generates approximately $100 in daily revenue, are typically not profitable. When considering inflation as an expense, this becomes even more evident. Just like other infrastructure layers, Ethereum no longer stands out due to its net deflationary supply. As a result, alternative methods of valuation need to be sought for these foundational layers.

Featured image created with DALL-E, Chart from TradingView

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

- USD COP PREDICTION

2024-08-31 04:12