Based on the information recorded on the Ethereum blockchain, the cost of processing transactions has reached its cheapest point since the beginning of the year, potentially indicating that a price floor is near.

Ethereum Transfer Fees Has Plunged As Network Has Gone Cold

Based on information from Santiment’s on-chain analysis, Ethereum network users have seen a significant decrease in transaction fees recently. “Transaction fees” in this context refer to the typical fees (expressed in USD) that Ethereum senders are currently adding to their transactions.

The value of this metric typically indicates the level of congestion on the blockchain, with increased usage leading to higher average transaction fees.

During times of heavy transaction volume on the blockchain, its ability to handle a large number of requests is surpassed, resulting in network congestion and delayed processing of transactions.

For users unwilling to endure long waits, attaching higher fees to transactions is an option. This fee structure enables validators to process their transfers prioritically, leading to increased competition among senders. Consequently, the average fee amount can surge rapidly, making blockspace a valuable commodity.

During times of low usage on the Ethereum blockchain, transaction fees can stay affordable since users have less reason to pay higher fees for their transactions.

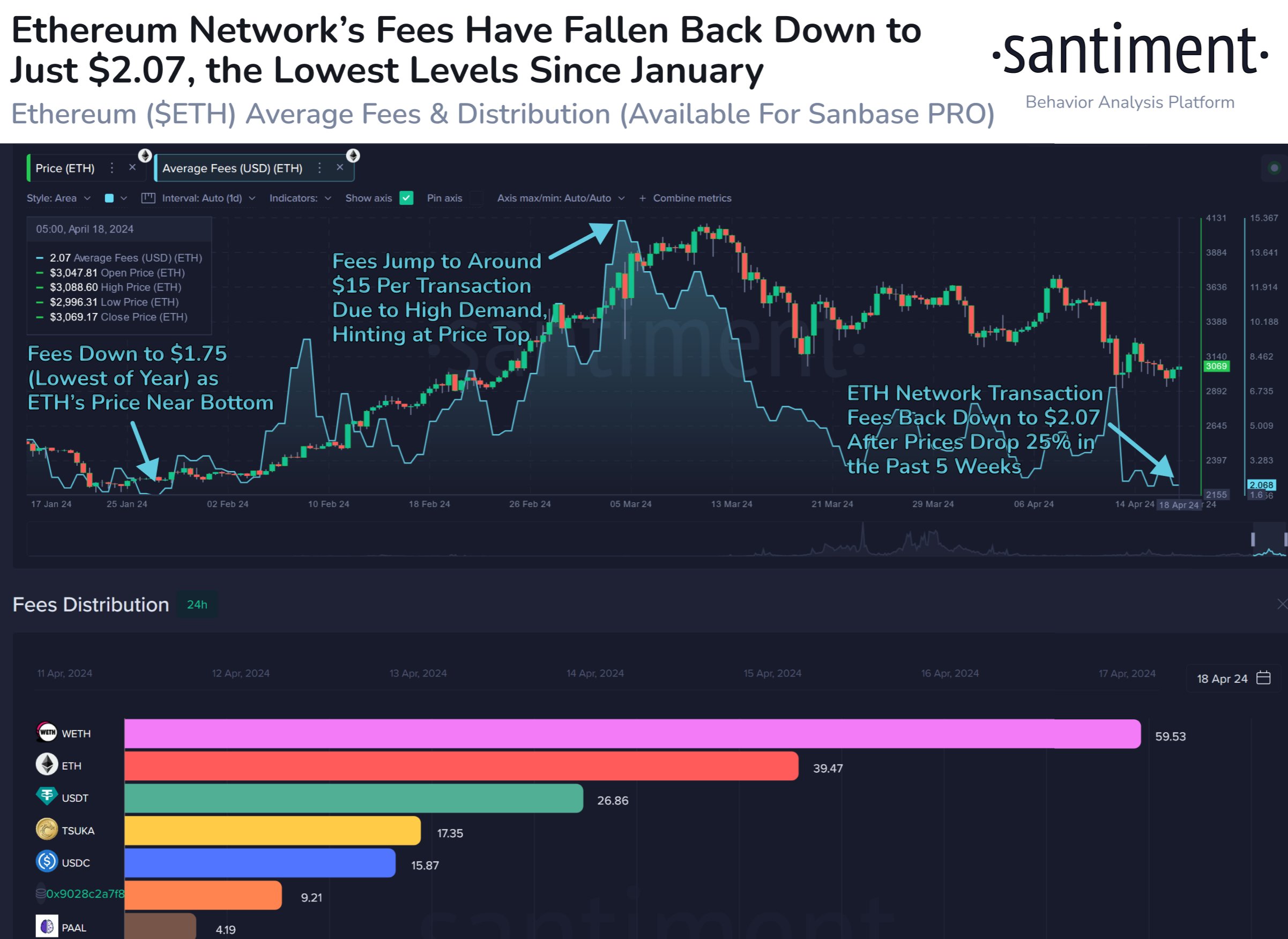

Now, here is a chart that shows the trend in the Ethereum average fees over the last few months:

The graph above shows that Ethereum transaction fees have dropped significantly and reached a minimum of $2.07 recently. This is the least expensive fee for a transaction on Ethereum network since the beginning of this year.

A decrease in fees for this cooldown period suggests that cryptocurrency network activity has lessened. According to Santiment, traffic levels often mirror the sentiment surrounding the asset.

Historically, the crypto market experiences shifting sentiment, swinging between the belief that cryptocurrencies are about to soar to new heights (“To the Moon”) and the conviction that they have reached their end (“Crypto is Dead”). This emotional pendulum often manifests through changes in transaction fees.

The network showing minimal activity from investors could indicate their current disinterest towards the coin. Yet, this situation might not negatively impact the asset’s price.

Based on data from the analytics company, it seems that Ethereum’s lower-than-average fees often signal market bottoms. On the other hand, high fees might indicate market peaks.

The graph indicates that ETH‘s price came close to its lowest point in January when transaction fees reached their minimum at $1.75. Correspondingly, the indicator peaked at $15 prior to the price reaching its highest point in the previous month.

In other words, it is yet to be determined if Ethereum’s price behavior will follow the same trend as before and reach a low point.

ETH Price

Earlier today, Ethereum dipped below $2,900, but it has since bounced back and is now trading at around $3,100.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LBT PREDICTION. LBT cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

2024-04-19 23:26