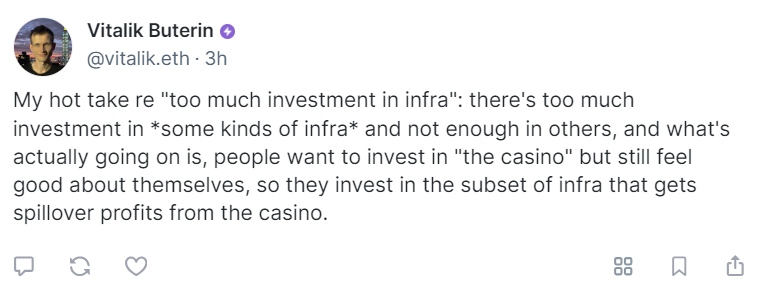

As a seasoned analyst with extensive experience in the technology sector and a particular focus on the blockchain industry, I have closely followed Vitalik Buterin’s latest criticism of overextended investment practices, specifically investments in infrastructure not directly tied to speculative markets. While his perspective is valid and has merit, I believe it may be too narrowly focused.

Vitalik Buterin has surprisingly expressed criticism towards excessive investment practices, specifically in areas where infrastructure isn’t truly necessitated. Yet, his perspective carries potential risks as well as benefits.

From Buterin’s perspective, many investors are drawn to risky, high-reward investments (similar to gambling in a casino), yet they try to justify their decisions by investing in infrastructure that ultimately benefits from these speculative ventures.

While it holds true for certain market sectors, it’s crucial to consider the broader ramifications of this viewpoint. Vitalik’s standpoint could be seen as having some limitations. Infrastructure investments often lead to major technological advancements and inventions, irrespective of their connection to speculative markets.

In addition to the initial potential uses of blockchain technology in speculative investments, numerous advancements can expand its applications across various sectors. These may encompass enhancements in logistics for supply chains, innovations in public administration systems, and the emergence of decentralized financial solutions. Moreover, significant investment and curiosity are often attracted to the market through “casino investments,” providing crucial financing for new projects and businesses.

An influx of capital could lead to advances that would have been impossible with more conservative investment. The fine line between risk-taking and innovation should not be disregarded, as dismissing high-risk investments might suppress the daring ideas and inventiveness driving the sector forward. Buterin raises valid concerns, however.

Observed repeatedly on the cryptocurrency scene, unchecked speculation leading to volatile bubbles can bring about devastating repercussions once they burst. Such instability poses a risk of undermining investor trust in the technology and potentially causing substantial losses. For the long-term viability of the ecosystem, it is essential that investments are made wisely and with a focus on sustainability.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- HEC/USD

2024-07-16 13:40