As a researcher with a background in artificial intelligence and venture capital, I find Vitalik Buterin’s perspective on the motivations behind AI development particularly intriguing. His insight into the distinction between the priorities of project founders versus investors is an essential observation that often gets overlooked.

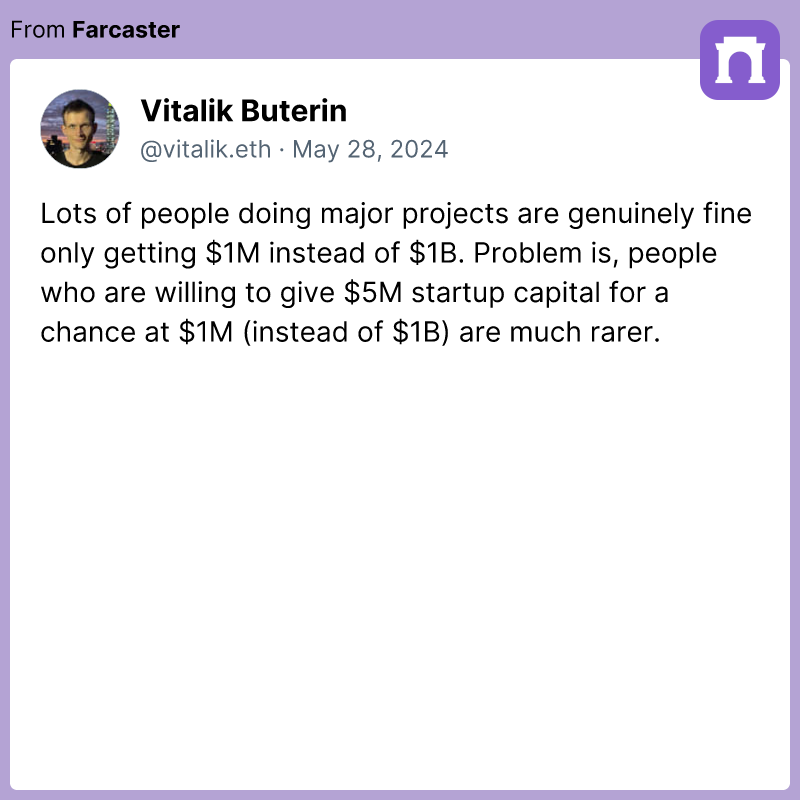

As an analyst studying the crypto industry, I’ve noticed that Vitalik Buterin, one of its influential figures and the founder of Ethereum, has brought attention to a significant obstacle impeding the progress of artificial intelligence (AI) technology. In a post on his Farcaster channel, Buterin raised the issue of whether the drive for supremacy in the AI market is primarily fueled by financial motivations from my perspective.

Recognizing the importance of financial resources in the realm of artificial intelligence, Buterin emphasized a noteworthy disparity: the driving forces behind venture capital investments in AI initiatives can vary greatly from the goals of the project creators themselves.

As a researcher exploring the field of artificial intelligence (AI), I’ve observed that many creators and scientists harbor a deep-rooted passion for its advancement. They are content with reaping moderate, yet significant, rewards from their efforts rather than striving for astronomical gains.

As a researcher studying the Ethereum ecosystem, I’ve discovered that the founder has identified a significant challenge: the limited number of investors ready to accept more modest returns on their investments. Usually, venture capitalists who handle substantial funds for others focus on projects promising exponential growth, with the goal of transforming millions into billions.

A strong emphasis on generating substantial returns may leave a financing shortage for budding AI initiatives, led by founders more concerned with making advancements than amassing extravagant profits.

Current state of AI sector

Artificial intelligence (AI) is currently the center of intense competition among tech giants such as Google and Microsoft. They’re investing massive amounts of resources to advance AI technology, specifically in areas like natural language processing and computer vision, which hold great promise for future innovations.

As an analyst, I would express it this way: In the first quarter of 2024, AI start-up funding experienced a significant revival, with a total investment of $12.2 billion distributed among 1,166 deals. This represents a notable surge in comparison to the previous quarter. Nevertheless, OpenAI’s groundbreaking funding round led by Microsoft, which amounted to over $10 billion in the same quarter last year, remains the largest investment recorded in this sector thus far.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-05-28 18:39