Ethereum, that most mercurial of digital baubles, has lately taken it upon itself to ascend over 40% in a mere fortnight. Yes, the sort of climb that might force one to reexamine the merits of both tea and tranquilizers. It now idles, elegant yet vaguely bored, in the mid-$2,000s—a sum that, in a previous era, would invite a duchess’s attention, or perhaps an audit.

ETH: The New Aristocrat of Organic Uptrends?

After spending months languishing in the shadowy backwaters of the crypto peerage—while gauche upstarts like Bitcoin, Solana, and the eternally on-trial XRP flounced about the ballroom—Ethereum appears to have enrolled in finishing school. According to the ever-serious Mr. ShayanMarkets of the establishment CryptoQuant (no doubt a club with leather armchairs and heavy port), this price froth is generated by spot market demand. Quite unlike those speculative leverage shenanigans that tend to end with someone’s monocle falling into their soup.

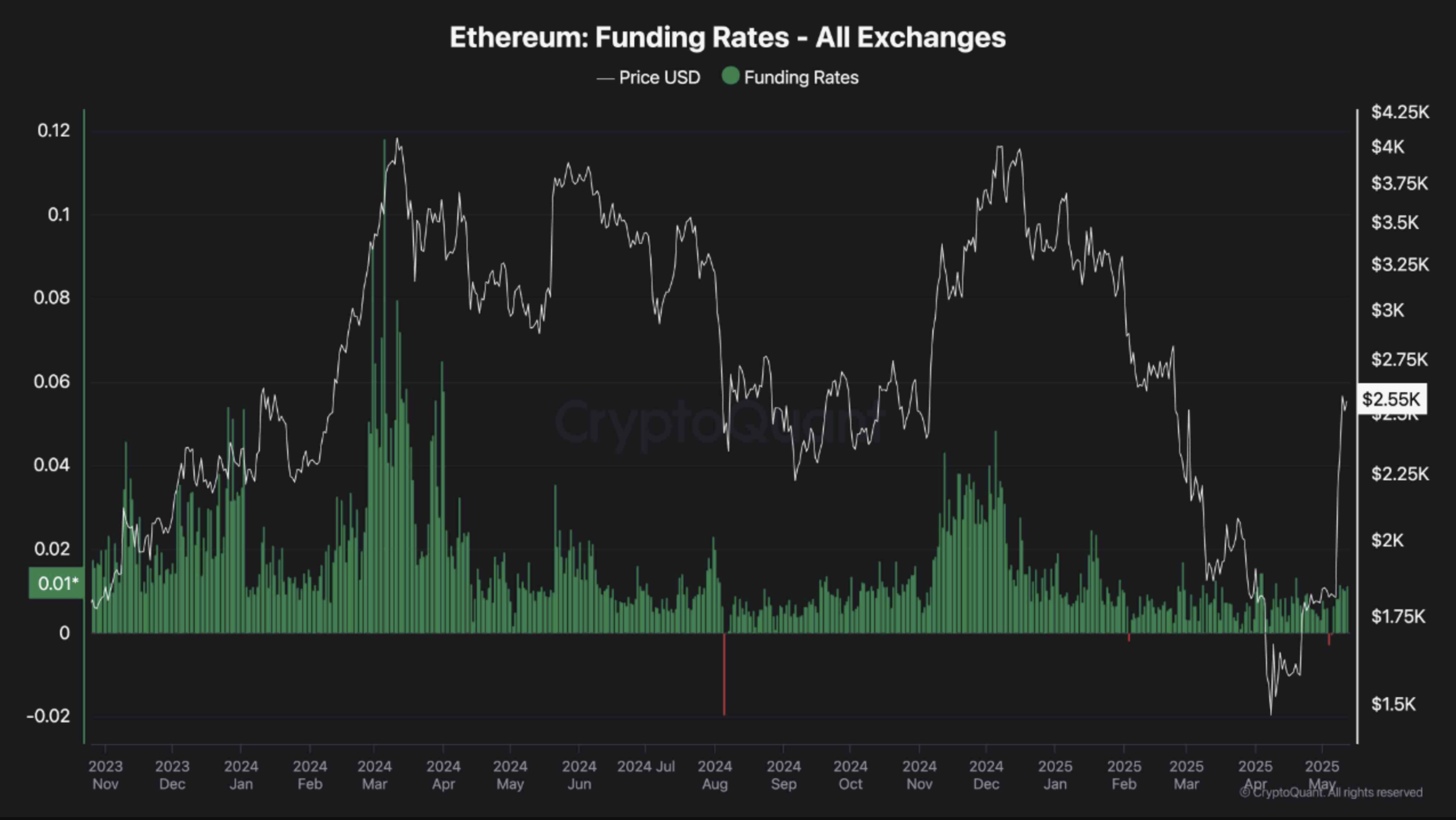

“Funding rates have been ‘relatively flat’,” the analysts proclaim, as if describing the moral fiber of the British upper class. One takes it to mean that no one has been gambling the family estate on ETH perpetuals. The purse strings remain drawn; the servants are not yet rolling dice in the kitchens.

To explain, in language suitable for the less numerate: funding rates are the ghostly machinations by which traders pay each other for the privilege of prophesying the future. If one side grows bullish, they pay the pessimists, and vice versa. When these numbers flatline, it signifies—much like a dinner party in Shropshire—that absolutely nothing dramatic is happening underneath. We are led to believe this is a good thing.

Should this stately progress continue, one is advised by Mr. ShayanMarkets that funding rates will eventually rise—heralding a fever of confidence in the perpetual salons. Until then, the market remains delightfully free from the perils of mass liquidation and the spectacle of grown men crying into their ledgers.

“Still, for the bullish momentum to be sustained and validated, funding rates should begin to rise…”—an analyst, imitating Lady Bracknell explaining the importance of handbags to financial destiny.

Elsewhere, the soothsayer Ali Martinez has opined that smashing through the $2,380 resistance would be tantamount to acquiring a flat in Mayfair—social mobility at last! Some 10 million wallets, we are told, squat upon 69 million ETH between $2,060 and $2,420. (A figure one suspects is designed less to inform and more to provoke envy.)

Will ETH Reach a New All-Time High—and Send Us All to Monte Carlo? 🎩

Though Ethereum still gazes wistfully at its former glories above $4,800 (from the halcyon days of 2021—a year noted mainly for hysteria and questionable haircuts), many a market watcher clings to the hope of a new, loftier ATH. Titan of Crypto—no relation to the Titanic, one trusts—suggests ETH is navigating a V-shaped recovery. He even proffers a chart, which presumably gives solace to those who sleep beside their trading terminals.

Ted Pillows, a man whose name alone promises restful affluence, outlines five “bullish” factors that could, with a fair wind and a sufficiently lenient regulator, propel ETH toward $12,000 in 2025. At this writing, ETH trades at $2,555—a figure both heartening and, for the short seller, the cause of an afternoon gin or three. Buckle up, dearest readers: the drawing room is open, and the roulette wheel waits.

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Invincible’s Strongest Female Characters

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- How to Get 100% Chameleon in Oblivion Remastered

- USD ILS PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- How to Reach 80,000M in Dead Rails

2025-05-13 07:11