As an experienced analyst, I believe that the current low Ethereum transaction fees could be a sign of decreased demand for the network. Historically, high transaction fees have been indicative of market euphoria and FOMO (Fear of Missing Out), which can lead to price tops. Conversely, low fees may suggest a lack of demand and even bearish sentiment, potentially leading to price bottoms.

On-chain data shows the Ethereum transaction fees is now at its lowest since October 2023. Here’s what it could mean for the cryptocurrency.

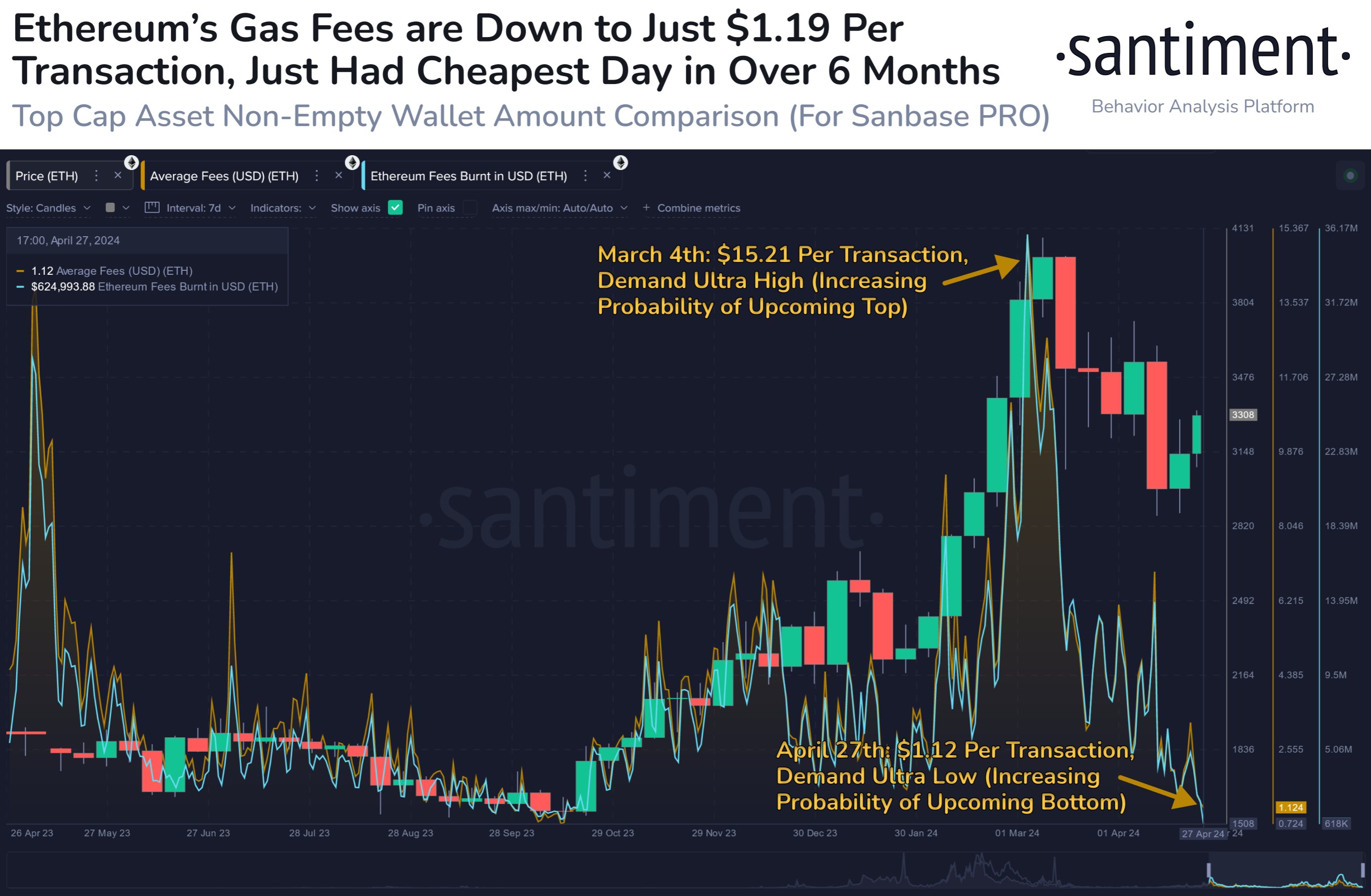

Ethereum Transfer Fees Has Recently Plunged To A Low Of $1.12

Based on information from the on-chain analysis company Santiment, the Ethereum network’s average transaction fee has fallen to relatively low figures in recent times. The term “fee” signifies the quantity that each sender is required to add to their transactions as remuneration for the blockchain to handle their transfer.

The fee an investor needs to pay for a transaction to be processed promptly depends on the current network conditions. In periods of heavy usage, competition to process transactions quickly can be intense, causing investors in a hurry to pay higher fees as a means of cutting through the congestion.

During times of network congestion, the typical transaction fee is usually high. Conversely, when the network activity is low, users can pay relatively low fees. This inverse relationship implies that the average fees serve as an indicator of current demand for using the Ethereum network.

As a researcher studying transaction costs on the Ethereum blockchain, I’ve compiled the following data representing the average fees over the past year. (Pointing to or sharing a chart)

The graph shows that Ethereum’s average transaction fees have significantly increased during this year’s price rally, reaching a peak of $15.21 in the previous month. Notably, this fee peak aligned closely with the highest point in Ethereum’s price.

“According to the analytics firm’s observation, historical trends among traders have shown fluctuating sentiment towards cryptocurrencies, ranging from beliefs of unprecedented growth (“To the Moon”) to feelings of despair (“It Is Dead”). These shifts can be identified through transaction fees.”

Based on historical trends, it’s common for the market to go against the consensus, particularly during times of fear or excitement when many investors are jumping on the bandwagon. High fee periods, fueled by the fear of missing out (FOMO), have often marked market peaks. Therefore, the price behavior we witnessed last month is consistent with this pattern.

As a crypto investor observing the Ethereum market, I can see from the chart that both the Ethereum prices and fees experienced a pullback following the recent peak. More specifically, the Ethereum transaction fees have cooled down significantly, reaching a new low of $1.12.

The price of the network’s services is currently at its lowest point since last October. Similarly, exorbitant fees can cause market peaks, while insufficient demand can lead to troughs in the cryptocurrency market.

As a researcher, I’ve observed that markets have primarily trended downward over the past six weeks. The decreased demand and resulting pressure on the network could potentially lead to a reversal for Ethereum (ETH) and associated altcoins sooner than some may anticipate.

ETH Price

Yesterday, Ethereum reached a peak of $3,350 in my portfolio, but it appears that this upward trend has already reversed course. Now, the value of my Ethereum holdings is sitting at $3,170.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- OSMO PREDICTION. OSMO cryptocurrency

2024-04-30 00:11