Ah, Ethereum! The noble steed of the crypto realm, galloping through the valleys of uncertainty! Recently, it seems our brave knight has taken a breather, slowing its momentum as if pondering the meaning of life-or perhaps just deciding whether to have another cup of coffee. After a dramatic tumble into the abyss of the $1,800-$1,850 demand zone, our dear ETH now finds itself in a state of existential reflection, fluctuating like a pendulum caught between the fleeting dreams of bulls and bears.

The Daily Chart: A Tale of Woe

On this grand tapestry known as the daily chart, ETH is stuck in a consolidation phase, reminiscent of an old man staring at his empty wallet after a night of revelry. The candles dance about with minor bullish retracements, but alas, they lack the vigor of a true hero’s charge-merely pitter-pattering like raindrops on a tin roof.

Technically speaking, Ethereum is wedged between the steadfast $1.8K support and the ever-elusive descending channel’s middle boundary, which looms overhead like an ominous cloud, casting shadows around the $2,500-$2,600 region. Until our intrepid ETH breaks free from these constraining walls, it remains in a state of fluctuation, much like a fish flopping about on dry land.

For our hero to regain its strength, a breakout above the channel’s midline is essential, shifting momentum toward the hopeful buyers. Conversely, should the price plummet below the $1,800 support, we may witness a return of the dreaded selling pressure, akin to a swarm of angry bees chasing a hapless fool.

The 4-Hour Chart: A Narrow Escape

Peering into the 4-hour timeframe, we uncover a tightening triangle pattern forming after a less-than-glamorous rebound from the $1,800 low. The trendlines converge like two long-lost friends finally meeting again, reflecting a lull in volatility-a delicate balance between buyers and sellers, neither daring to make the first move.

Ethereum is now perched near the apex of this narrow range, poised for action! A bullish breakout above the triangle’s upper boundary could send prices soaring to the $2,300-$2,400 region, where yet another layer of resistance awaits. Yet, should the price fall victim to a bearish breakdown below the ascending support, it would be time for a sobering revisit to the $1,800 demand zone-an echo of past miseries.

//cryptopotato.com/wp-content/uploads/2026/02/ETH-4H-2-1.jpg”/>

Sentiment Analysis: A Cautious Glimmer

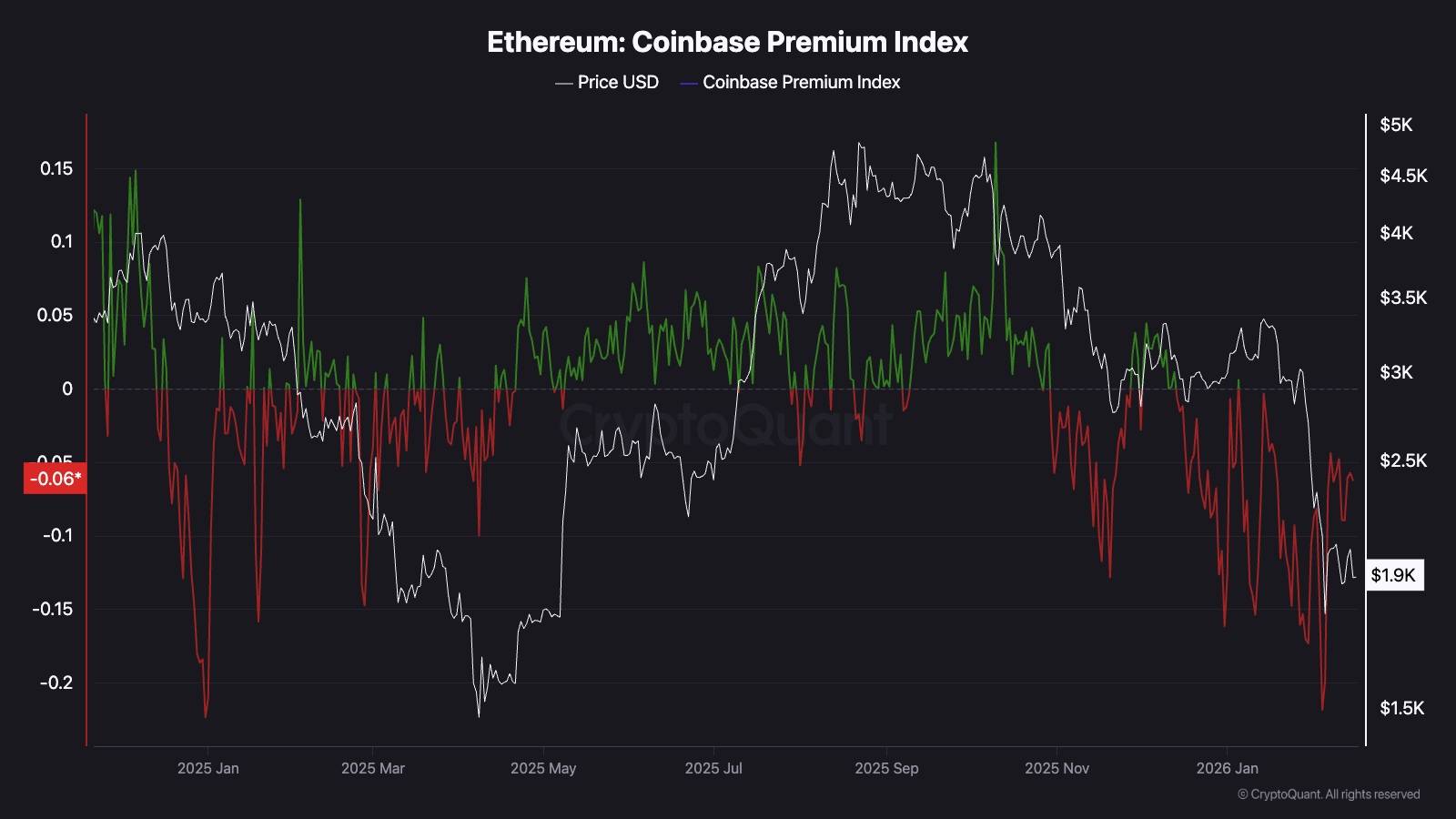

From the dusty annals of on-chain data, we see the Coinbase Premium Index lingering in the negative. This tells us that our US-based investors are not exactly throwing wads of cash at Ethereum; they seem more inclined to sip tea and watch the world go by. However, a flicker of hope emerges! The index has recently surged upwards-though still shy of neutral territory-hinting that perhaps, just perhaps, the selling pressure is easing.

If this upward momentum continues and the index turns green, we might just witness a spark of renewed interest from our weary US investors. Such a shift could serve as the magical catalyst for a bullish resurgence, especially if it aligns with a technical breakout from the current triangle formation. In this optimistic scenario, both technical structure and on-chain demand might unite to usher in a stronger recovery phase. Ah, wouldn’t that be a sight to behold?

Read More

- Enshrouded: Giant Critter Scales Location

- Best Finishers In WWE 2K25

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Best Anime Cyborgs

- All Shrine Climb Locations in Ghost of Yotei

- All Carcadia Burn ECHO Log Locations in Borderlands 4

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Best ARs in BF6

- Keeping Agents in Check: A New Framework for Safe Multi-Agent Systems

2026-02-16 16:31