So, here we are, teetering on the edge of 2026, and the Ethereum price prediction narrative is as bullish as a marauding herd of intergalactic space cows. 🌌🐄 Why, you ask? Well, it seems the big money suits are finally waking up to the fact that Ethereum isn’t just Bitcoin’s quirky little sibling-it’s the life of the party, complete with staking yields and on-chain innovation. 🎉

Institutional Rotation: The Great ETF Shuffle 🕺

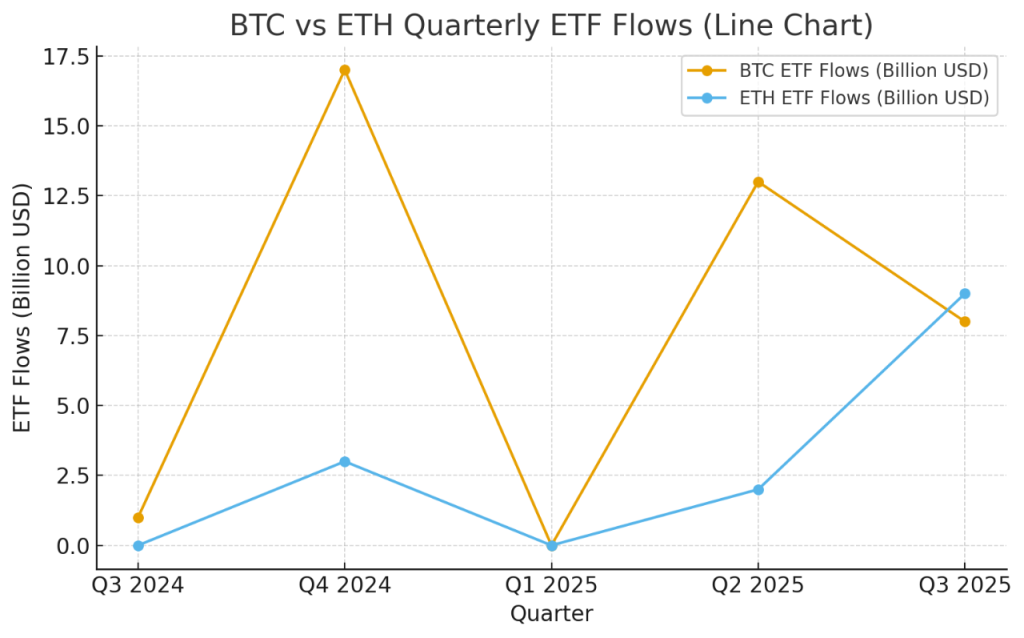

In the vast, $3.76 trillion cryptocurrency universe (yes, it’s bigger than your imagination), Bitcoin and Ethereum are the dynamic duo, hogging over 70% of the spotlight. But hold onto your hats, because the ETF landscape is doing the cha-cha! 💃 Bitcoin ETFs, once the belle of the ball with $30 billion in inflows, have stumbled to a mere $8 billion in Q3 2025. Ouch. Meanwhile, Ethereum ETFs are sashaying in with $9 billion, proving that ETH isn’t just a pretty face-it’s got the moves. 🕺

Is this the beginning of a new era? Too early to tell, but Ethereum’s evolution is as undeniable as the fact that 42 is the answer to life, the universe, and everything. 🌌

XWIN Research Japan (yes, the same folks who probably predicted sushi would be a global phenomenon) chimed in, noting that Ethereum fund holdings have doubled in 2025, hitting 6.8 million ETH by October. That’s not just accumulation-that’s a hoard worthy of a dragon’s lair. 🐉

Even during market pullbacks, fund volumes have grown, proving that institutional investors are in it for the long haul, not just a quick fling. 💍

Ethereum Gains Ground While Bitcoin Takes a Nap 😴

Bitcoin ETFs may have dominated the early 2025 dance floor, but their moves have gotten as unpredictable as a Vogon’s poetry reading. 📜 Meanwhile, Ethereum’s ETF momentum is as smooth as a Pan Galactic Gargle Blaster. Investors are now eyeing assets that offer more than just a store of value-they want yield, innovation, and maybe a side of fries. 🍟

If this trend keeps up into Q4, Ethereum could redefine portfolio allocations faster than you can say “Don’t Panic.” 📈

Whales Return: The On-Chain Confidence Boost 🐳

Beyond the ETF hoopla, Ethereum’s on-chain data shows whales and sharks are back in the game. After dumping 1.36 million ETH (probably to buy a few planets or something), wallets holding 100 to 10,000 ETH have started rebuying, scooping up 218,470 ETH in the past week. That’s confidence, or perhaps just FOMO in a fancy suit. 🕴️

Historically, such patterns have preceded rallies so epic they’d make the Hitchhiker’s Guide blush. So, buckle up, because the ride to $5,600 might just be starting. 🚀

Ethereum Price Prediction 2025: $5,600 or Bust? 💰

Technically speaking (and who doesn’t love a bit of technobabble?), Ethereum’s chart is as bullish as a two-headed space llama. 🦙 Currently trading near $3,950, ETH is holding strong above the $3,670 to $3,870 support range-a zone that’s gone from resistance to fortress in Q4. This aligns perfectly with the midline of a long-term ascending channel, which has been guiding ETH’s uptrend since 2023.

If this support holds (and why wouldn’t it?), Ethereum could soar to $5,600 by year-end, a nearly 40% upside. That’s enough to make even Zaphod Beeblebrox raise an eyebrow. 👽

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

2025-10-25 18:05