Ah, the fickle whims of Ethereum! One moment it’s dancing at a high of $2,627.8, and the next, it’s tumbling down to $2,387.6 – a 10% drop in just 48 hours. A charming $310 million worth of liquidation was the result, almost as if the market were playing a cruel joke on its traders. But fear not, for the mighty Ethereum has found its legs again, and by some miracle, it has reclaimed the $2,500 mark today, just in time for the early risers in the U.S. market. Bravo, Ethereum! 👏

Now, what does this all mean for our brave, and often misguided, traders? Well, Ethereum’s daily trading volume surged by nearly 50%, reaching a staggering $27.68 billion, and its market cap now stands tall at $304.24 billion. Naturally, all of this has left investors wondering: What on earth happened? How could such a regal coin fall so low, and more importantly, will it rise again or be doomed to languish in the depths of financial despair? 🧐

With the ominous shadow of a bearish market lingering like a bad smell, will Ethereum retreat to its lower support zones, or will it defy expectations and regain its lost glory? A cliffhanger worthy of a drama series! 🎭

Ethereum On-chain Analysis & ETH Price Prediction

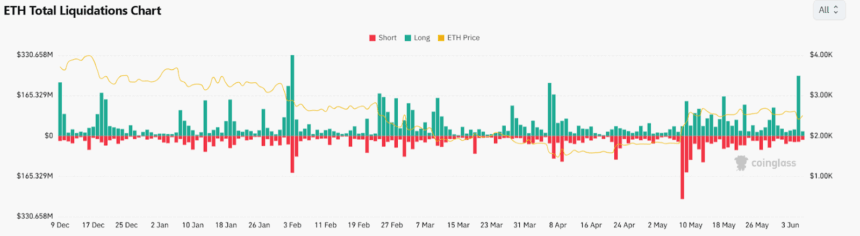

According to Coinglass, Ethereum saw its biggest liquidation in months just yesterday, a monumental event for the record books. A staggering $24.43 million was lost in short positions, and a jaw-dropping $245.685 million disappeared in long positions. Yes, you read that right. If you had invested just yesterday, well, let’s just say you might want to consider switching to a hobby that involves less heartbreak. 💔

But wait, it gets even more exciting (or tragic, depending on how you look at it). As I write, traders are currently facing another $20.58 million in losses from short positions and $20.1 million from long ones. These liquidation spikes, my friends, are not just market movements; they are the cries of traders who ventured too far into the realm of leveraged positions. It’s like watching a group of people walking off a cliff and hoping there’s a trampoline at the bottom. 😬

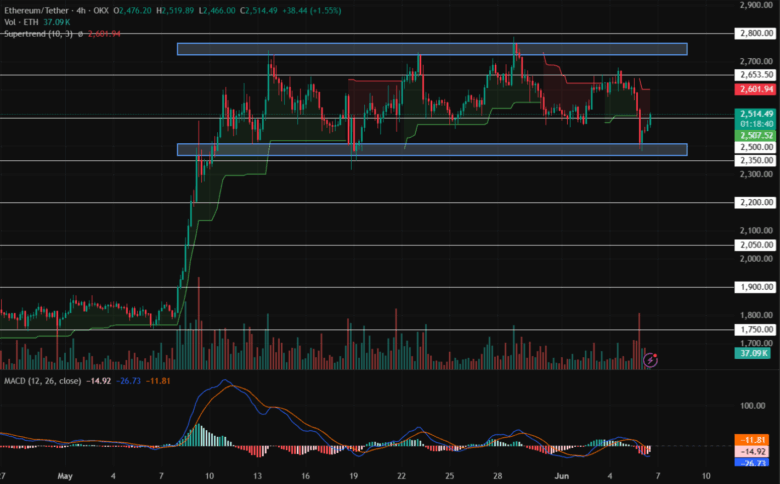

Now, let’s take a glance at the short-term future of Ethereum’s price. The king of altcoins, Ethereum, is showing dominance at 9.3%, but the Altcoin season indicator is flashing a weak signal, a mere 25 – oh, what a season of mediocrity! Still, Ethereum has maintained a narrow trading range between $2,350 and $2,750 since mid-May, like an indecisive guest at a dinner party. Will it break free, or will it continue this dreary dance? 💃

The Moving Average Convergence Divergence (MACD) is flashing red in the 4-hour time frame, and the histogram is slowly fading away, like the hopes of Ethereum bulls after another rough night. But fear not! A bullish reversal could be just around the corner, or perhaps it’s a cruel mirage—who’s to say? 😏

To make matters even more thrilling, the Supertrend indicator is now recording increased volatility. Ethereum is perilously close to testing its green supertrend at $2,500, which might just signal the moment of salvation if the buyers decide to make a grand entrance. Ah, the drama of it all! 🎬

The supertrend, for those not in the know, is like a traffic light for crypto prices, switching between green and red to indicate market sentiment. Think of it as the market’s way of saying, “I’m feeling optimistic… oh wait, maybe not.” 😅

Will Ethereum Price Recover?

If Ethereum manages to stay above $2,500, it might just be on its way to a glorious victory, possibly pushing towards $2,650 by the weekend. And, should the bulls take charge, we could see the price soaring even higher—up to $2,750, maybe even $2,800. Oh, how exciting it must be to be an optimist in this market! 🦄

But, alas, the other side of the coin: a drop below the key $2,500 level could signal the beginning of the end. Lower support zones could be tested, with $2,350 and $2,300 as potential targets. So, will it rise like a phoenix or crumble like a house of cards? Only time will tell. ⏳

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-06-06 20:05