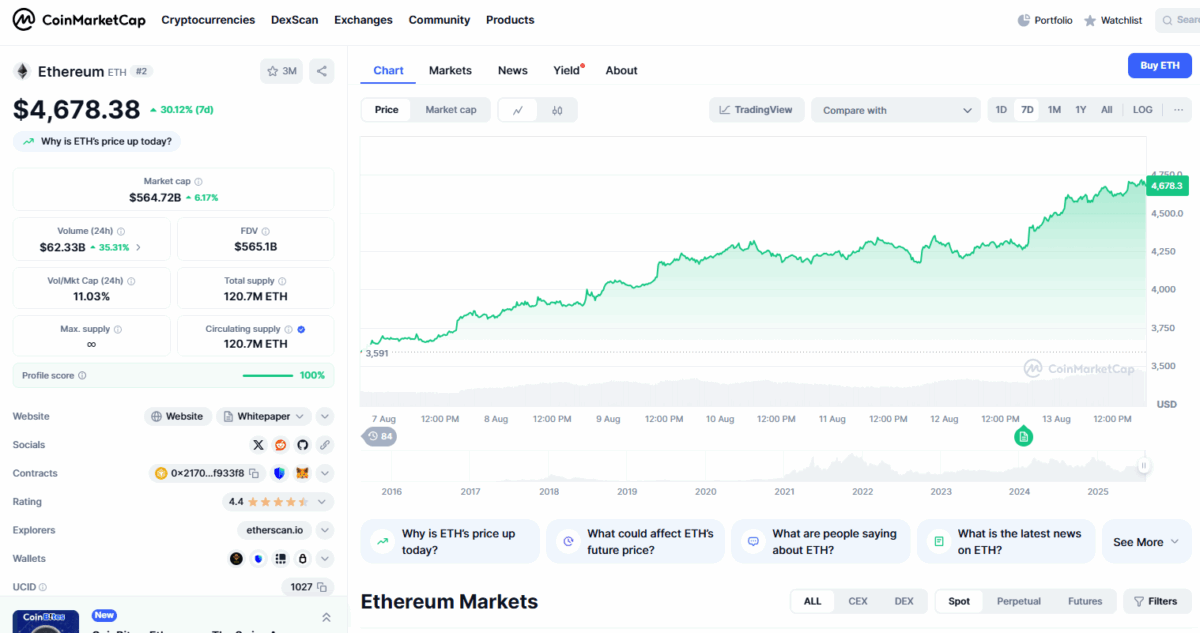

Imagine a digital beast awakening from its slumber, stretching its virtual muscles, and inching majestically toward a new all-time high. That’s Ethereum, or ETH if you’re feeling casual. It’s like that overenthusiastic friend who suddenly gets a boost of confidence – only in this case, the boost comes from big-money investors and a flurry of exchange-traded funds clamoring to get a piece of the action. Currently, ETH is lounging above $4675, just shy of its record-breaking $4891 – only about a whimper away, or as traders like to say, “less than 6%.” In the past 24 hours alone, it’s managed an energetic 6.62% climb, which is roughly the equivalent of a cricket leaping onto your dinner plate and claiming it’s King of the Garden.

When the Asian trading session kicks off, ETH already hit a lofty $4734.45, as if it’s been shot out of a rocket. Trading volumes are surging – up 25%, no less – with a tantalizing $61.58 billion exchanging hands. And since we’re talking bullish frenzy, consider this: we’re only about $200 away from that shiny, historic high, making it feel almost as easy as flipping a pancake.

Ethereum’s rising star isn’t just a flash in the pan; it’s solidifying its reputation as the darling of big institutional players. More firms are jumping on board, deploying its blockchain tech like it’s the latest must-have accessory. And leading the charge, SharpLink Gaming has raised almost $400 million for additional ETH purchases – talk about a collective shopping spree that could make even the most die-hard shopaholic blush.

The ETF Party Is Just Getting Started

Meanwhile, Ethereum spot ETFs are causing quite a stir, pulling in record-breaking sums faster than you can say “cryptocurrency millionaire.” Data from SoSoValue reveals a staggering $1.02 billion rolled into these funds just two days ago, with BlackRock’s ETHA fund alone scooping up around $640 million. Fidelity’s FETH isn’t far behind, with $277 million. Over a week, total inflows have surpassed $2.3 billion, which, let’s be honest, sounds like a lot of digital gold pouring into digital safes. Today, funds hold about $27.6 billion worth of ETH – roughly 4.77% of the entire Ethereum market cap – indicating investors are not just dipping toes but cannonballing into the pool.

Nate Geraci, the president of The ETF Store (yes, that’s a real job), notes that “spot ETH ETFs have brought in about $2.3 billion over five days, including one of their top five single-day inflows since they launched.” Since July, they’ve captured nearly $1.5 billion more than the equivalent Bitcoin ETFs – a shift so dramatic it makes mustard look fancy.

Another half bil into spot eth ETFs…

That’s the 5th best day since launch.

A total of $2.3 billion over the past 5 days.

Since July, spot eth ETFs have outdone spot btc ETFs by nearly $1.5 billion.

What a rollercoaster.

– Nate Geraci (@NateGeraci) August 13, 2025

And just to keep things spicy, ETH’s price is up over 40% this month – a kind of bullish renaissance after a sluggish start to the year. This upturn has partly been fueled by America’s GENIUS Act, which offers a clearer set of rules for stablecoins. Several popular stablecoins operate on Ethereum, so the law could give a nudge to its network’s popularity, much like lending a ladder to a climbing cat.

Crypto wizard Michael van de Poppe chimed in on X, suggesting Ethereum is flexing some serious muscle, reminiscent of the rally that followed Bitcoin ETF approvals earlier this year. If the buying trend keeps its mojo, ETH might just give the record a tango – who needs a red carpet when you have blockchains?

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-08-13 18:13