As a seasoned researcher with years of experience in the cryptocurrency market, I find myself increasingly concerned about Ethereum’s current state based on recent on-chain data. The persistent distribution among large investors, or “whales,” as we commonly refer to them, has been a recurring theme for the past six months, according to the Accumulation Trend Score.

Over the past six months, on-chain data indicates that large Ethereum holders (often referred to as “whales”) have consistently sold their Ether, which is a pattern that might suggest unfavorable conditions for Ethereum.

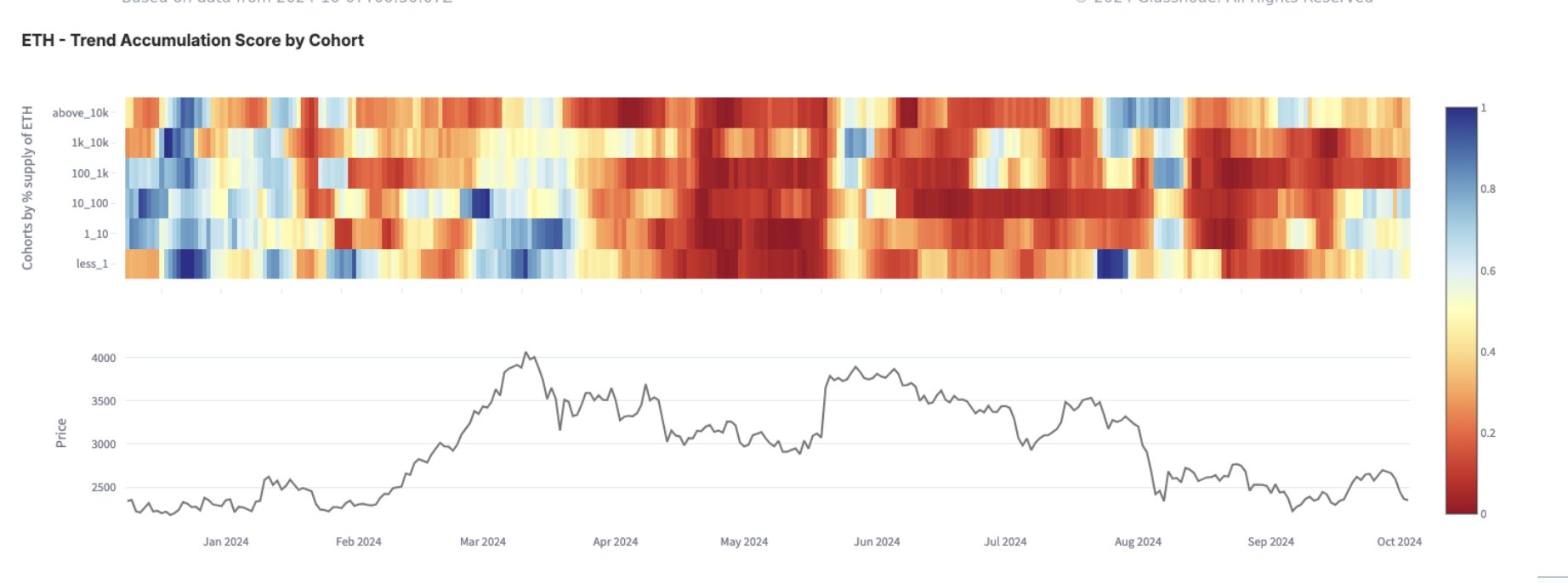

Ethereum Accumulation Trend Score Has Been Red For Cohorts As A Whole

According to analyst James Van Straten’s latest post on X, the Accumulation Trend Score, which is a tool provided by Glassnode indicating whether investors are buying or hoarding a specific asset, has been painting a concerning image for Ethereum in recent times.

This measurement considers not just the fluctuations in investor wallets, but also the scale of the involved entities. Essentially, larger entities carry more significance in this indicator. A score value near 1 suggests either large investors are actively accumulating or a high number of smaller investors are purchasing. Conversely, a score close to 0 may indicate a network-wide distribution trend or simply a lack of accumulation activity.

In our ongoing discussion, it’s the specific form of the Accumulation Trend Score for individual groups (cohorts) that we’re focusing on. These groups have been created based on their account balances.

Over the past year, I’ve been tracking the Ethereum Accumulation Trend Score across various groups. Here’s a visual representation of how this score has evolved within each cohort: [Insert chart]

According to the graph, the Ethereum Trend Accumulation Score was predominantly blue among the groups at the start of the year, suggesting that overall investors were engaging in some level of accumulation.

Following Bitcoin‘s record peak in March, investors began heavily selling off their holdings, causing the indicator’s value to plummet close to zero. While selling has slowed over the past few months, the overall trend remains negative. It’s worth mentioning that large groups of investors holding 100 to 1,000 BTC, 1,000 to 10,000 BTC, and more than 10,000 BTC continue to sell off their Bitcoin.

These groups are often known as sharks, whales, and colossal whales. These investors, given their scale, hold sway in the market, so their recurring selling activity over the past six months or so is concerningly suggestive of unfavorable trends for Ethereum.

Until all groups have resumed saving their funds again, Ethereum may not experience a substantial rebound.

ETH Price

As I pen this analysis, Ethereum hovers slightly above the $2,400 mark, representing a decline of over 7% in value compared to its position a week ago.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- EUR CAD PREDICTION

- APU PREDICTION. APU cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- POL PREDICTION. POL cryptocurrency

- EUR INR PREDICTION

- USD GEL PREDICTION

- JST PREDICTION. JST cryptocurrency

2024-10-09 10:11