So, here we are again—Ethereum shambling back to life as if emerging from the dank Petersburg streets after being mugged by existential dread and unspeakable volatility. Prices climb, the markets tremble: $2,739, a distant but familiar number, not seen since the innocent days of late February, when men dreamed and daredevils hodled without regret. Once pressed beneath the heavy boot of fate (and, admittedly, some bad macro news), now ETH rises, steered by unseen hands—bulls in the throes of sudden optimism, their laughter echoing through the candlelit corridors of the crypto bourse.

Analysts—the modern prophets with slightly less charisma and vastly more spreadsheets—whisper of “altseason.” They claim Ethereum’s muscle is flexing against the old patriarch, Bitcoin. As the latter putters along, comfortable atop a pile of gold coins and memes, Ethereum scrapes its way up through resistance with the grim determination of a Dostoevskian antihero—if Raskolnikov ever tried swing trading, this might be his moment.

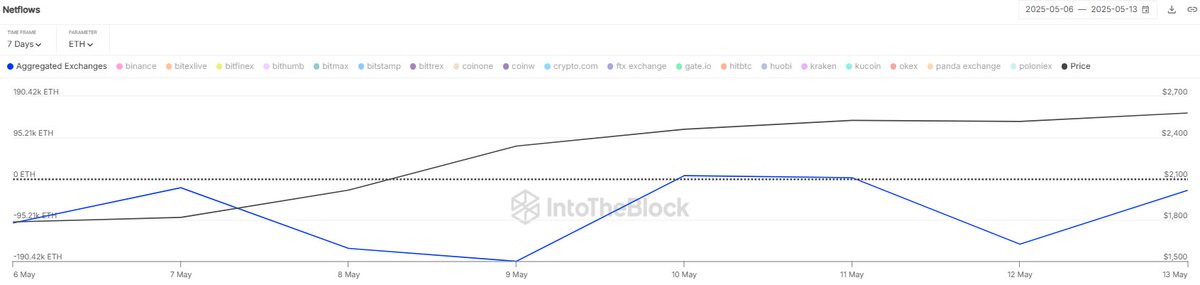

Beneath these philosophical undulations, Sentora—the all-seeing institution, formerly disguised as IntoTheBlock—reveals an exodus: $1.2 billion in Ethereum vanishing from the clammy vaults of centralized exchanges, slinking into cold wallets or perhaps just under some digital mattress. What does it mean? The analysts mutter: “Accumulation. Reduced sell-side pressure.” In plain talk: either someone knows something, or the herd has agreed to lose faith simultaneously—always a crowd favorite.

Now the air buzzes with speculation: is this only the overture? Will ETH charge $3,000—nay, $3,100—with the foolhardy confidence of a university student at his first roulette table? Or will the market, with its characteristic malice, remind everyone what pain truly means? Investors stand divided, almost as if they read too much Dostoevsky and not enough order books.

Fortune Favors the Gloomy Philosopher (and Maybe Ethereum Too) 😏

For weeks, Ethereum shuffled miserably, leaking value like hope drains from the soul on a bleak November morning. But suddenly, a reversal! A 50% gain—enough to turn even the crustiest nihilist into a wide-eyed disciple of altseason. Resistance? Smashed. Bitcoin? Ignored. Speculators now eye the $3,100 level as if it’s the gate to some promised land—in reality, it’s just another number, but faith, as we know, is never rational.

Ethereum now lounges above $2,600, self-satisfied, aware that it was once rebuffed by this very threshold. But let us not be too optimistic—momentum against Bitcoin does not a czar make. In that shadowy zone between $2,900 and $3,100, danger waits, sharpening its knives.

Meanwhile, Sentora returns with evidence—$1.2 billion in ETH, spirited away over seven sleepless days. Collectors, hoarders, true believers: they all conspire to choke supply, dreaming that this will birth price ascension. Or maybe they just forgot their exchange passwords. Who’s to say?

Every eye now turns to ETH. Will it drag the other altcoins kicking and screaming into a market rally, or leave them face-down in the Neva, pockets emptied, regrets fully intact?

The Grim Poetry of the Weekly Chart 📈🪦

Stare long enough at Ethereum’s chart and you’ll start to see ghosts—perhaps of old bagholders, perhaps just of technical indicators. $2,599.14 as of this moment—a splendid number, so close yet so far from the meaning of life. The weekly candle? A towering green obelisk, easily the most compelling object since Sonia’s stare.

ETH has smashed through the 200-week EMA and SMA, those twin sentinels of trend that have mocked hopeful traders for months. Momentum surges, volume swells—hope, that most dangerous of emotions, stirs in the breast once more. $2,739.05, a local high; $2,800–$2,900, bitter resistance; $3,100, the forbidden fruit. If the bulls do not collapse under the weight of their own euphoria, another test will surely come.

Yet caution, inevitable as the Russian winter: $2,450 marks the support, the last line before descent into melancholy. Should this bulwark fail, $2,250 awaits below, arms open—not out of kindness, but of cold necessity. Today, bravado reigns, but next week—who can say? In crypto, even God takes profits too early.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-05-14 21:49