So, Ethereum (ETH) is chilling in the mid-$4,000 zone, and guess what? The Chicago Mercantile Exchange (CME) futures open interest (OI) for our beloved crypto is hitting all-time highs. 🚀 Like, who even needs a vacation when you can just watch ETH charts all day, am I right? Anyway, analysts are now whispering sweet nothings about a new all-time high (ATH) for ETH by the end of the year. *cue dramatic music*

According to a CryptoQuant Quicktake post by the ever-so-insightful PelinayPA, Ethereum’s CME futures OI is on a steady climb towards new highs. It’s like watching a snail race, but hey, progress is progress! 🐌

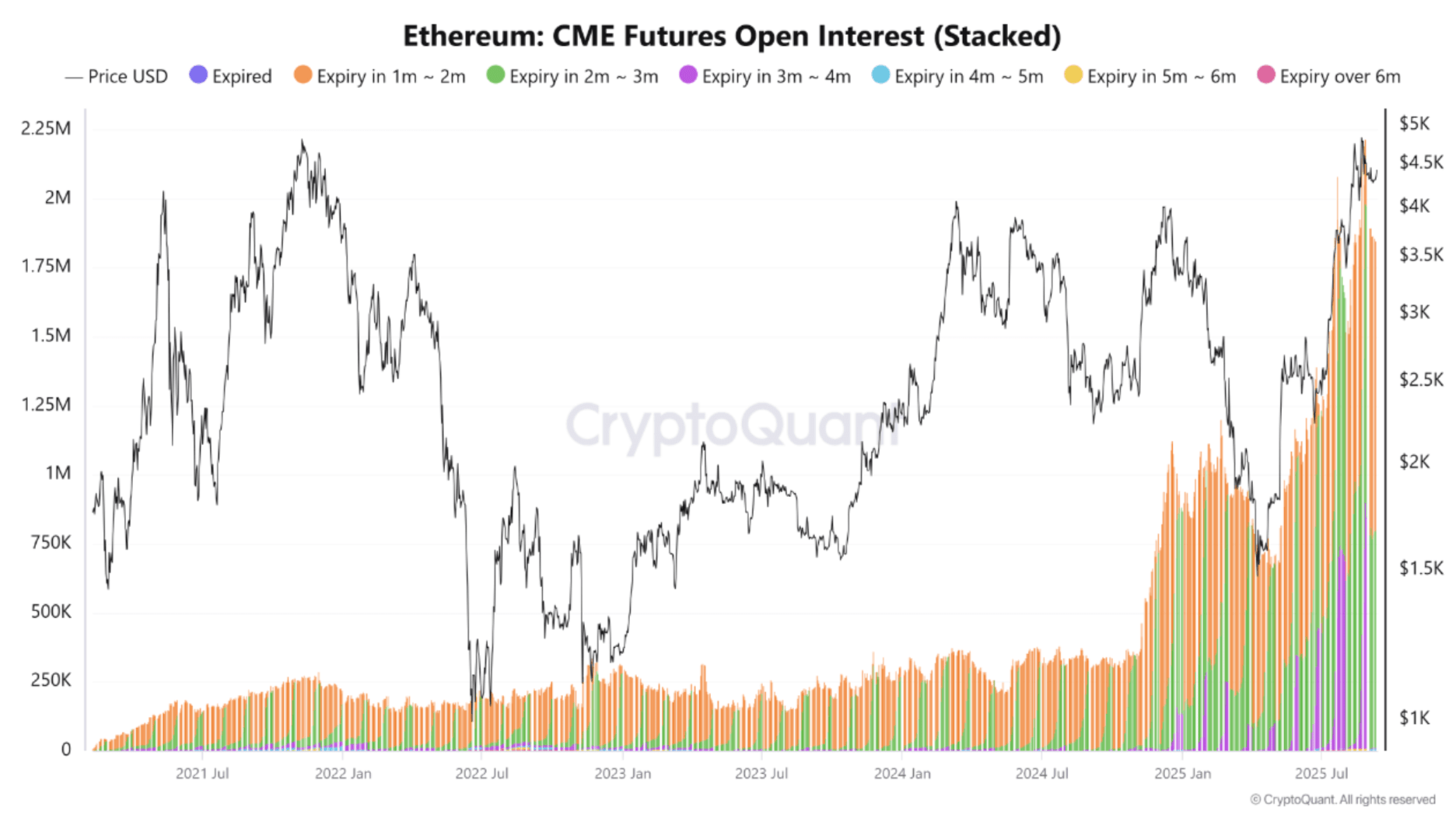

Back in 2021-2022, Ethereum futures OI was pretty chill, mostly dominated by 1-2 month contracts. ETH was feeling the love, but the big players were still playing it safe, like, “Yeah, sure, I’ll date you, but let’s not get too serious.”

Then came the 2022 bear market, and it was like someone turned off the lights at a party. ETH prices dropped, and so did the OI. Short-term contracts were still the life of the party, but the long-term ones were MIA, indicating that institutions weren’t exactly feeling confident. 🙄

But then, in 2023-2024, things started to pick up. Ethereum OI began to rise again, especially among 3-6 month contracts. It’s like the institutions finally decided to show up to the party, and they brought the snacks. 🍿

Fast forward to 2025, and Ethereum OI has hit new highs. As ETH rallied to the $4,500 to $5,000 range, there was a noticeable uptick in short-term contracts. This means the big boys are back, and they’re ready to play. 💪

The CryptoQuant analyst broke down the implications of two potential scenarios. High OI with a bunch of short-term contracts can lead to some wild rides, aka increased volatility. Think of it as a rollercoaster with no seatbelts. 🎢 On the flip side, if we see rising long-term OI in 3-6 month contracts, it could mean that institutions are getting cozy with ETH, which is great news for the long-term price. Just remember, crowded leveraged positions can turn a smooth ride into a bumpy one. PelinayPA summed it up nicely:

ETH is trading around $5K (near ATH) with record OI on CME, clear evidence of institutional FOMO. While this supports the ongoing bull trend, liquidation risk is high. Short term volatility and corrections are likely, but the medium to long term outlook remains bullish. 📈🔥

So, where does this leave us? The analyst thinks ETH could hit the $6,800 resistance level by the end of 2025. But, let’s be real, if the global economy decides to throw a tantrum, ETH’s momentum might take a little break. 😴

Case For A New ETH ATH

Beyond the institutional FOMO, there’s more good news on the horizon. Positive exchange data, like recent ETH outflows from Binance, have driven the supply ratio to a new low. It’s like ETH is becoming the exclusive club everyone wants to join. 🏦

And let’s not forget, more and more ETH is being staked on the Ethereum network, making the smart contract platform stronger and more robust. At press time, ETH is trading at $4,409, down 0.7% in the past 24 hours. But hey, every good story has a few twists, right? 📊

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-09-12 07:19