Ethereum (ETH) persists in captivating the fickle attentions of the financial elite for a third uninterrupted week, basking in a veritable flood of institutional adoration. Amidst this burgeoning obsession with strategies to secure its ethereal reserves, the preeminent altcoin has audaciously driven crypto inflows to a weekly summit hitherto unmatched. 😉

Meanwhile, the infatuation with Ethereum overflows onto its humbler counterparts, the altcoins, provoking analysts to herald an imminent altseason with all the drama of a scandalous elopement. 😂

Crypto Inflows Attain a Most Astonishing $4.39 Billion in a Single Week

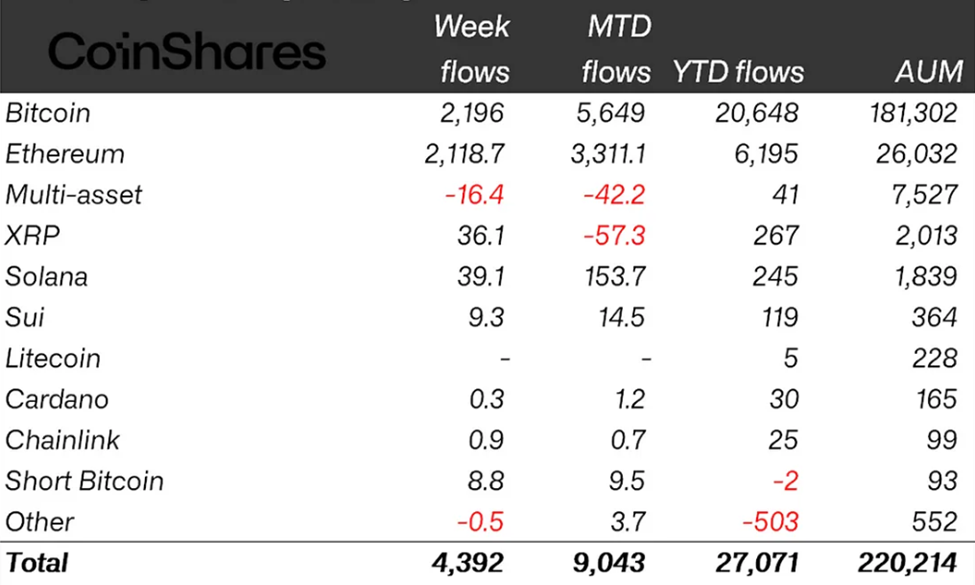

The latest dispatch from CoinShares reveals that crypto inflows have soared to $4.39 billion last week, marking an all-time zenith in weekly accumulations and swelling the year’s positive flows to $27 billion. Concurrently, assets under management have climbed to a record $220 billion, as if the market itself were donning its finest ball gown. 😏

“Investment products in digital assets have achieved their grandest weekly inflows on record, totaling $4.39 billion and eclipsing the prior peak of $4.27 billion established in the wake of the American election frenzy in December 2024,” observed James Butterfill, the head of research at CoinShares, with perhaps a touch too much relish. 🙄

This surge represents a considerable escalation from the $3.7 billion inflows noted the week ending July 12, and it prolongs a streak of favorable flows for the 14th consecutive week, much like an unending country dance that no one dares to sit out. 🌟

As depicted in this chart, Bitcoin (BTC) maintains its lead with inflows reaching $2.196 billion, yet Ethereum emerges as the true diva, more than doubling its own inflows in a mere week. As previously chronicled, Ethereum’s inflows stood at $990.4 million for the week ending July 12, but oh, how it has blossomed to $2.1887 billion, a growth of 2.1 times that might make even the most seasoned speculator blush. 😜 Meanwhile, Bitcoin’s inflows have modestly declined from $2,731 million to $2,196 million, proving that even kings can be upstaged.

“Ethereum has commandeered the stage, drawing in a record $2.12 billion in inflows, nearly twice its former best of $1.2 billion. The inflows over the past 13 weeks now constitute 23% of Ethereum’s assets under management, and already in 2025, they surpass the entire sum for 2024 at $6.2 billion,” Butterfill added, with the air of one announcing a royal betrothal. 🎭

This 2.1-fold increase in Ethereum’s inflows is scarcely surprising, given the accelerating institutional courtship—witness Sharplink Gaming and BitMine, now cradling over $1 billion in Ethereum each, as if it were a dowry of unparalleled allure. 😎

Ethereum is inevitable

— SBET (SharpLink Gaming) (@SharpLinkGaming) July 20, 2025

Furthermore, as reported, Ethereum’s price has ascended dramatically, its market capitalization now dwarfing that of Goldman Sachs and the Bank of China combined, a feat that might elicit envy or alarm, depending on one’s disposition. 😉

JUST IN: $ETH surpasses combined market cap of Goldman Sachs and Bank of China.

— Whale Insider (@WhaleInsider) July 20, 2025

Cetaceans and exchange-traded funds alike are channeling billions into the Ethereum arena, with seers foretelling a possible all-time high, yet one cannot help but recall that pride often precedeth a fall. 😏 Whales and ETFs have also been pouring billions into the Ethereum market, with analysts highlighting a possible ATH soon.

Nevertheless, amidst this euphoria, not all voices join the chorus; some prudent souls urge caution, lest the bubble burst like an overinflated balloon at a child’s fête. 🌤️

“It is high time to contemplate strategies for retreat… Bitcoin and altcoins approach the customary pinnacles of their four-year cycles,” advised Ran Neuner, host of Crypto Banter, to his devoted flock, with the solemnity of a vicar warning of impending doom. 😅

Similarly, Benjamin Cowen, founder of Into the Cryptoverse, observes that many altcoins are lagging behind Ethereum’s meteoric rise, suggesting that such dominance often heralds the later stages of a cycle, where capital flocks to the majors before a general retreat, much like guests abandoning a tedious assembly. 😉

In this vein, trader Daan Crypto Trades counsels investors to redistribute their gains and mitigate risks, a tactic for navigating the capricious seas of volatility with the cunning of a Regency matchmaker. 😂

80% of altcoins in the top 100 have outshone $BTC this month.

This figure diminishes to 41% over the last three months.

Both metrics are ascending as we speak, a rarity in this cycle, save for a few anomalous instances.

The paramount query remains: how enduring will this enchantment prove?

— Daan Crypto Trades (@DaanCrypto) July 20, 2025

At the current juncture, Ethereum trades at $3,786, having advanced by more than 2% in the preceding day, as if to mock those who doubted its charm. 😜

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-07-21 12:37