Ethereum, that enigmatic and often capricious force, now stands firm near the lofty heights of $3,428, a rise of more than 7% from the previous day, and has managed to breach a key resistance level with the grace of a seasoned ballerina.

Amidst the swirling mists of on-chain and futures market data, whispers of a continued rally have begun to circulate. A closer examination of exchange reserves, funding rates, and the intricate tapestry of price structure suggests that Ethereum might be poised for a 32% ascent, reaching the dizzying heights of $4,541. 🌟

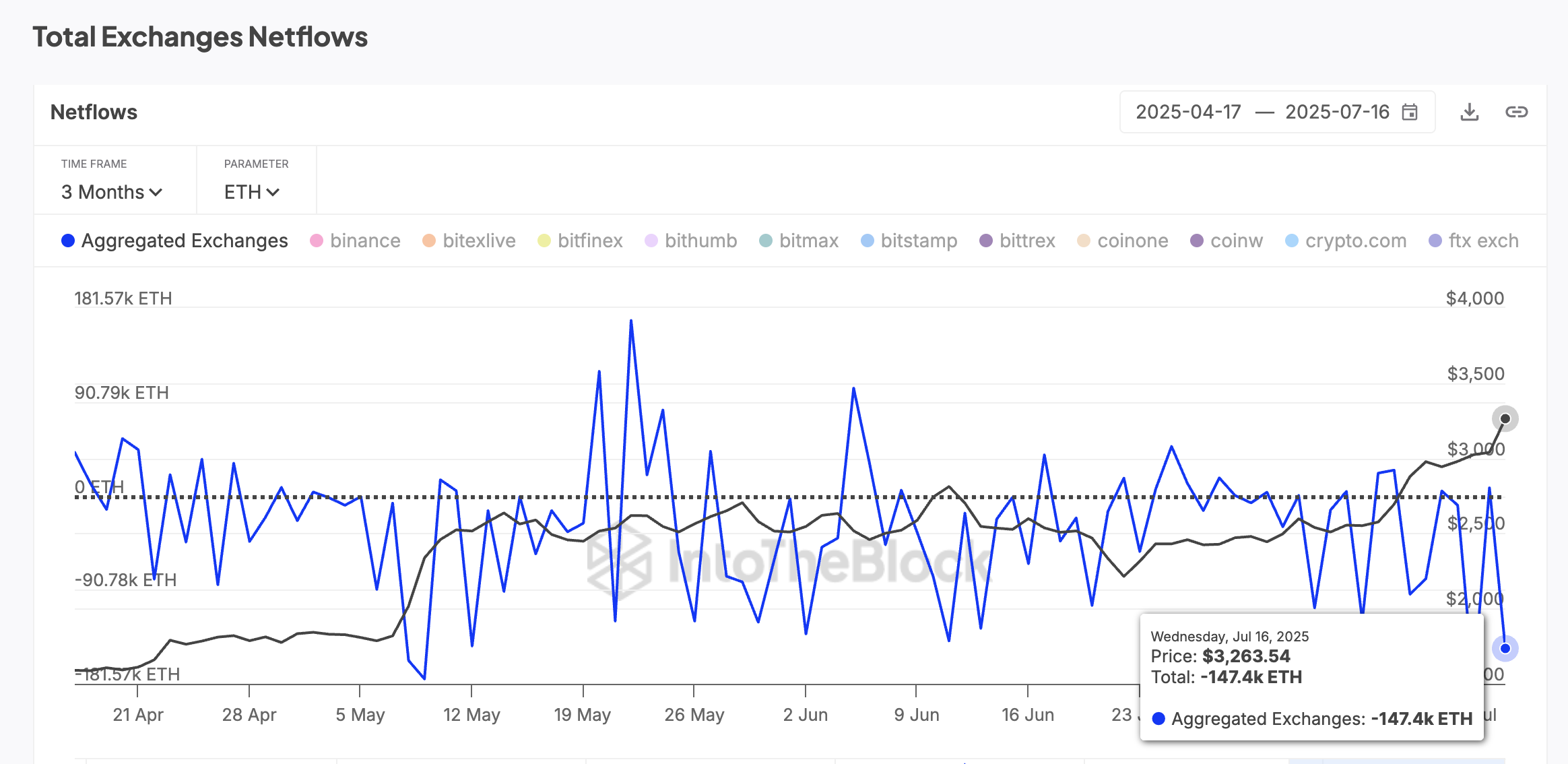

Exchange Reserves and Netflows: Echoes of a Past Symphony

On the fateful day of July 16, Ethereum’s total exchange reserves stood at 19.7 million ETH, a figure that eerily mirrors the reserves seen on October 9, 2024, just before the cryptocurrency embarked on a 75% surge over the following two months. This rally, much like a well-rehearsed symphony, began with a similar reserve base and was accompanied by a steady stream of outflows, as if the market was preparing for a grand performance.

While similar reserve levels have appeared in the past, the July-October correlation is particularly noteworthy, as both periods were marked by a rising tide of prices. 📈

For token TA and market updates: If you find yourself yearning for more insights into the cryptic world of tokens, consider signing up for Editor Harsh Notariya’s Daily Crypto News newsletter. It’s like a daily dose of market wisdom, delivered straight to your inbox. 📧

Adding to this symphony of parallels, aggregated exchange netflows remain decidedly negative. On July 16, a net of 147,400 ETH was withdrawn from exchanges, a clear indication that more users are opting to take their Ethereum into their own hands, perhaps to hold it dear or tuck it away in cold wallets. This behavior, often a harbinger of long-term commitment, suggests that the market is more inclined to hold rather than sell. 🤝

The moral of the story? Ethereum’s price is showing a remarkable ability to absorb profit-taking while still maintaining a steady demand. The supply on exchanges remains tight, a condition that naturally reduces the immediate sell pressure. 🛡️

Futures Market: A Quiet Optimism

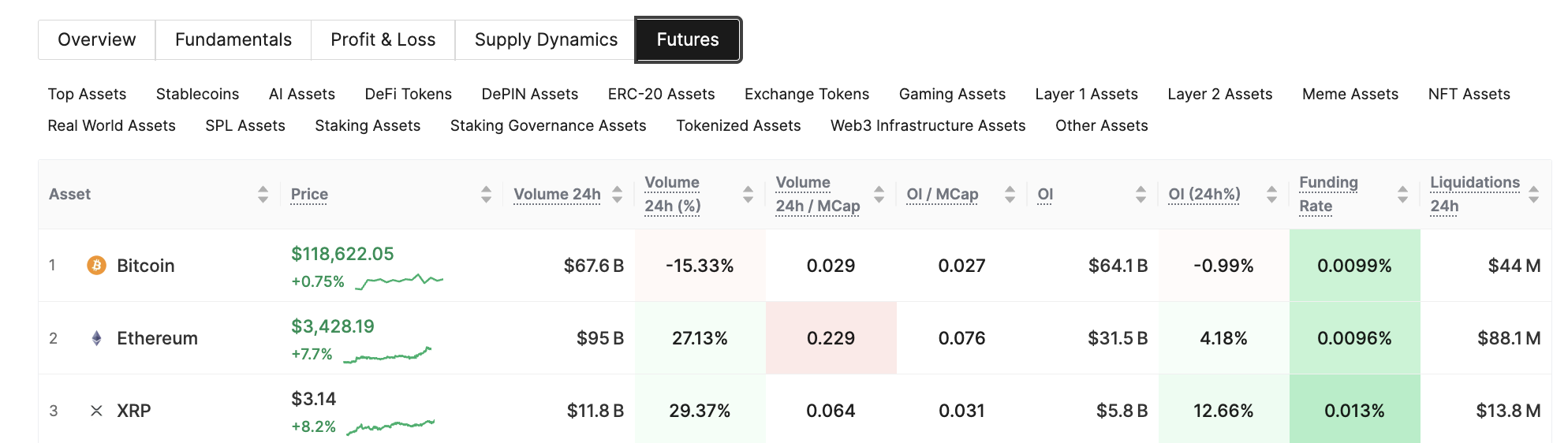

While the spot markets are basking in the glow of consistent outflows and a tight supply, the derivatives market is quietly echoing this optimism, though without the usual fanfare. Over the past 24 hours, Ethereum’s futures trading volume has surged by 27.13%, and open interest has climbed by 4.18%, signaling that new positions are being opened as traders begin to lean into the rally. 📊

But here’s where the plot thickens; despite the growing exposure, the funding rate remains a placid 0.0096%, suggesting that the market is not overly biased toward longs. The funding rate, a measure of the periodic payments between long and short traders, remains near neutral, indicating a delicate balance between the bulls and the bears. This equilibrium makes any rally sustainable without the fear of short or long squeezes. 🤹♂️

ETH Price: A Breakthrough and a Bullish Projection

The decline in exchange reserves, the persistent outflows, and the neutral funding conditions are beginning to manifest directly in Ethereum’s price. ETH has broken above the $3,298 resistance, a level that aligns closely with the 0.786 Fibonacci extension level. This breach, like a knight breaking through the enemy’s defenses, suggests strength in the spot market and confirms the alignment between on-chain activity and price momentum. 🛡️

This current Trend-based Fibonacci setup, which begins at the $1,388 levels (the low made in early April) and moves to the previous swing high of almost $2,870, before retracing to the next swing low of almost $2,130, charts the next possible lead for the ETH price. 📈

The current rally mirrors the conditions seen in October 2024, when ETH, much like a phoenix, rose from similar reserve levels and soared more than 75%. If history is to repeat itself, Ethereum’s next target sits at $4,541.88, marked by the 1.618 Fib level, a potential 32% upside from current levels. Should this come to pass, a march towards the 75% level and a new all-time high might not be far behind. 🚀

However, the bullish thesis holds only if the ETH price sustains above $3,047, a level that has served as a strong support over the past week. A breakdown below $2,870, the 0.5 Fibonacci level, would invalidate the bullish setup, especially if it coincides with rising inflows or a reversal in exchange reserve trends. Such a scenario would signal renewed sell pressure and potentially cap the upside momentum. 🚨

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- INR RUB PREDICTION

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-07-17 19:56