As a seasoned crypto investor with several years of experience under my belt, the recent data on Ethereum investor profitability is an encouraging sign. The fact that 90% of all Ethereum investors are now in profit following the sharp surge above $3,800 is a positive development that instills confidence in the asset’s current bull run.

Approximately 90% of Ethereum investors have realized a profit based on on-chain data, given the significant price increase surpassing $3,800.

Ethereum Investors Overwhelming In The Green After ETF Rally

As an analyst studying the data from the market intelligence platform IntoTheBlock, I’ve noticed that recent gains in Ethereum (ETH) have resulted in a significant change in investor profits within the network.

To monitor the profitability of crypto holders, the analytics firm employs on-chain data analysis to determine the average purchase price for each blockchain address.

If the price of a given cryptocurrency is lower than its current market value for any specific investor’s address, it signifies that they are earning a profit, or have a profitable position, according to IntoTheBlock’s terminology.

From a researcher’s perspective, when the cost basis is less than the current market price of an asset, it implies that the holder has incurred a loss. Consequently, they are underwater or “out of the money.”

If the cost at which an investor typically buys a wallet containing a coin matches the current market value of that coin, it means the investor isn’t making any profit or loss – they’re simply covering their costs (“breakeven point”).

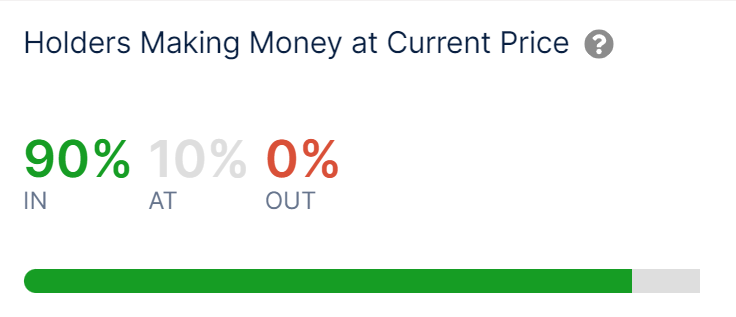

Here’s a description of the current profitability distribution among Ethereum users after its recent significant price increase:

Approximately 90% of the Ethereum network’s addresses currently hold their coins with a profit, as evidenced above, after the significant price increase in this asset.

It’s intriguing to note that every wallet connected to the blockchain currently holds balanced funds, implying no one is in a losing position at the moment. However, approximately 10% of the investors find themselves at the break-even point.

Previously, it’s been observed that investors in the black tend to dispose of their assets more frequently than those experiencing losses. Consequently, significant surpluses of profitable investors in the market have often signaled an increased likelihood of selling activity, resulting in potential selloffs.

Due to this circumstance, it’s more likely for peak prices in Ethereum (ETH) to materialize at higher profitability rates. This is because a significant number of ETH investors currently hold profits. Consequently, a major sell-off event might ensue, potentially halting the ongoing price surge.

As a researcher studying financial markets, I’ve observed that during periods of bull markets, an asset tends to deliver substantial returns to investors for some time due to robust demand. However, it’s essential to remember that such gains don’t last indefinitely. Eventually, a market top is reached when the influx of buyers begins to wane, making way for profit-taking.

Despite this, the chances of brief market cooldowns increase if Ethereum’s profitability persists for an extended period. The future direction of Ethereum’s price is uncertain, and it remains to be seen whether the excitement surrounding spot ETFs can offset any potential sell-offs in the market.

ETH Price

Ethereum experienced a surge of over 22% within the last 24 hours, pushing its price to new heights not seen since approximately two months ago, with the cryptocurrency currently being traded near $3,800.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-05-21 18:42