As the final week of the first quarter of2025 dawned upon us, the cryptocurrency market found itself in a rather gloomy disposition, much like a heroine of a tragic novel. The markets in China and Japan, having suffered considerable losses, set a rather somber tone for the day, akin to a ball where the music has been discontinued prematurely.

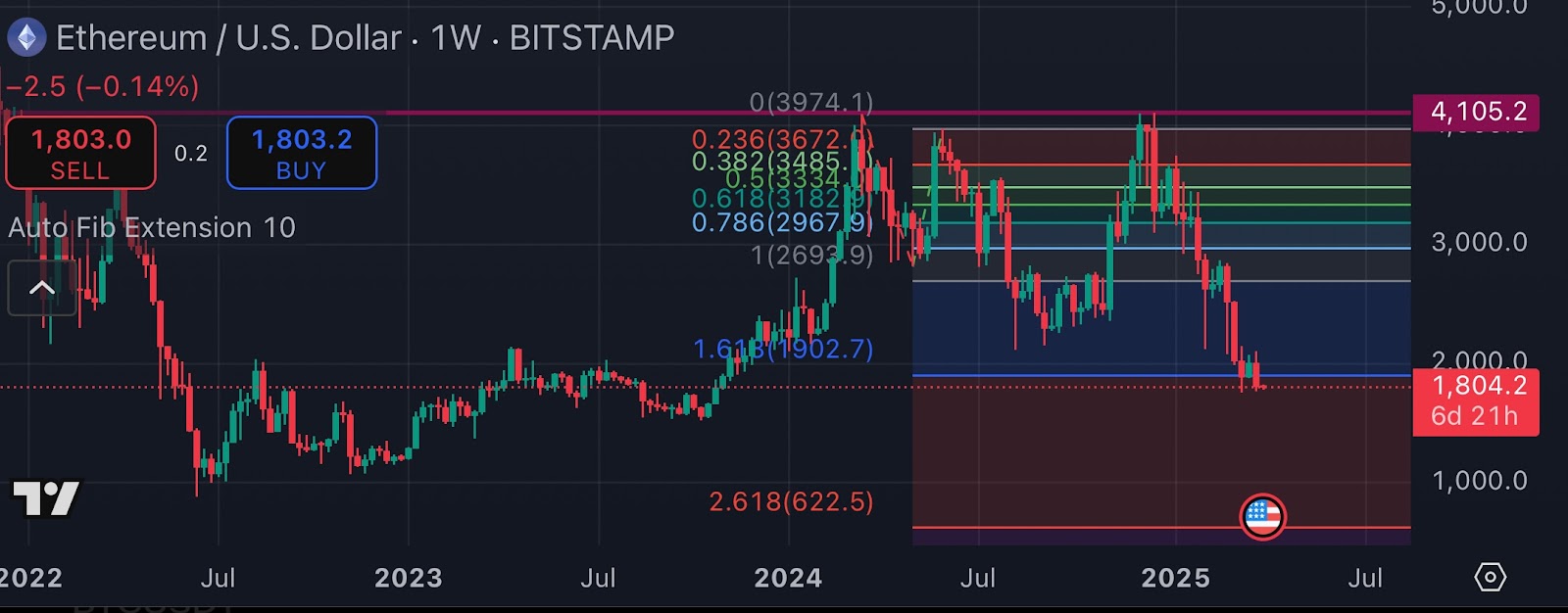

The entire cryptocurrency market cap, a measure as capricious as the weather in an English countryside, descended by nearly4 percent within the past24 hours, settling at approximately $2.74 trillion at the time of this narration. Ethereum, our protagonist, saw its price plummet over9 percent the previous week, leaving it to meander around the rather unimpressive figure of $1,809 on the31st of March,2025. This large-cap altcoin, with a fully diluted valuation of about $218 billion, continued to endure a most unfavourable narrative.

Whales in Distress: A Most Unfortunate Turn of Events

For the first instance since October2024, it has been revealed that the U.S. spot Ether ETFs are to record a monthly net cash outflow of nearly $409 million in March2025, a revelation as shocking as an unexpected betrayal in a drawing-room. Amidst growing apprehensions of further market volatility, on-chain data has brought to light a significant whale depositing6,131 ETH, valued at approximately $10.94 million, to the Binance exchange earlier today, an event that has stirred the societal pot considerably.

A whale just deposited6,131 $ETH($10.94M) to #Binance.

— Lookonchain (@lookonchain) March31,2025

Simultaneously, another whale, a major crypto investor of considerable repute, who had leveraged long $110 million of ETH on MakerDAO, now faces the precipice of liquidation should the altcoin’s price descend to $1,793. The narrative thickens with each passing moment.

The Path Ahead: A Dance with Uncertainty

Having encountered a formidable resistance level around $4,105 over the past twelve months, Ethereum’s price has remained ensnared in a bearish outlook, a predicament most dire. Following last week’s close below $1,907, which coincided with the1.618 weekly Fibonacci Extension, Ether’s price now stands confirmed in a possible macro bear market, with the threat of capitulation below $1,000 looming large.

As investors, much like characters fleeing a scene of scandal, abandon the crypto market for the perceived safety of gold and stablecoins, Ethereum’s price faces formidable headwinds in the forthcoming quarter. With the April2 reciprocal tariff by the United States casting a long shadow, the fear of a further selloff permeates the global markets, leaving us all in a state of suspenseful anticipation.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Obsessed with Solo Leveling? Meet Super Cube, China’s Jaw-Dropping Answer to Anime

2025-04-01 08:56