As a seasoned crypto investor with a keen interest in Ethereum, I find this news extremely bullish. The prospect of Ethereum spot ETFs being approved by the SEC is a game-changer for the cryptocurrency market. This approval could lead to significant market inflows, potentially driving Ethereum’s price toward the $8,000 mark by the end of 2024.

Amidst the excitement and expectation, it is predicted that the US Securities and Exchange Commission (SEC) will give its approval to Ethereum spot exchange-traded funds (ETFs) from Standard Chartered, a renowned British bank specializing in cross-border transactions, this week.

As a crypto investor, I’ve been closely following the potential approval of spot Bitcoin and Ethereum exchange-traded funds (ETFs). If these ETFs are indeed approved, I believe it could lead to substantial market inflows. Experts predict that the influx could range from $15 billion to $45 billion in the first year alone. This is an exciting development for the crypto space, as it could attract a larger and more diverse group of investors to the market.

The projected investment surge into Ethereum could significantly enhance its market conditions, possibly pushing its value up to $8,000 or more by the year 2024’s end.

Implications Of Ethereum ETFs Approval:

Significantly, Standard Chartered’s optimistic perspective is reinforced by approaching deadlines for the initial offering of Ethereum SPOT ETFs. Specifically, VanEck’s deadline falls on May 23rd and Ark Invest/21Shares’ on May 24th.

As the Head of FX Research and Digital Assets Research at Standard Chartered Bank, I have conducted extensive research and analysis on these particular ETFs. Based on my findings, I hold a strong belief in their merits, estimating the probability of approval to be around 80% to 90%. Throughout my investigation, I have identified several key factors that support this confidence.

Following the green light, we anticipate that Ethereum-based exchange-traded funds (ETFs) will attract between 2.39 and 9.15 million ether, or approximately $15 billion to $45 billion in US dollars, during their first year of operation. This inflow percentage is comparable to our predictions for bitcoin ETF investments, which have proven to be on target.

If ETH ETFs are approved as expected, Kendrick noted that Ethereum might preserve its existing price relationship with Bitcoin, which is forecasted to hit $150,000 by late 2024. This prediction implies an Ethereum value of around $8,000 at the end of the year.

Additionally, Standard Chartered predicts Bitcoin will hit $200,000 by 2025’s end. This estimation could imply a significant increase for Ethereum as well, potentially reaching $14,000 within the same timeframe, in line with the bank’s earlier price projection from March.

Bullish Market Sentiment Amid Rising ETF Approval Odds

Due to the heightened probability of Ethereum Exchange-Traded Funds (ETFs) being approved, the value of Ethereum has soared, reaching a new peak of over $3,600 since April 19.

As an analyst, I can tell you that Ethereum’s market cap has experienced a significant surge, surpassing the $450 billion mark, representing a growth of over 20% within the last 24 hours.

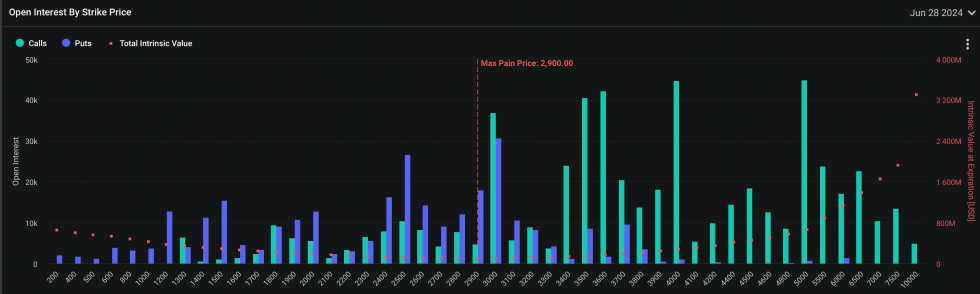

The market’s reaction to recent advancements has been extremely favorable, as indicated by derivative platforms like Deribit, where Ethereum call options have seen substantial wagers exceeding the $4,000 threshold. Traders’ preferred strike price for these options stands at an optimistic $5,000, demonstrating a robust bullish outlook.

Surprisingly, the likelihood of regulatory approval for spot Ethereum ETFs has risen sharply according to Bloomberg analysts, now standing at 75% – a marked upgrade from their previous prediction of 25%.

Following new reports, the SEC is encouraging exchanges to make prompt adjustments to their 19b-4 filings as the regulatory body’s position on this matter is shifting rapidly.

As a researcher following the developments of the Ether Exchange-Traded Fund (ETF) approval process, my team and I have recently raised our estimation of the likelihood of approval from 25% to 75%. We’ve picked up on some intriguing signals this afternoon that suggest the Securities and Exchange Commission (SEC) may be reconsidering its stance on this increasingly contentious issue. With this new information, we are among many in the industry who have been preparing for a potential denial but are now scrambling to adapt to this unexpected shift in circumstances.

— Eric Balchunas (@EricBalchunas) May 20, 2024

Based on Eric Balchunas’s analysis, there’s a possibility that approval will be granted as early as this Wednesday. This event could mark a significant change in the regulatory environment and possibly pave the way for additional increases in Ethereum’s price.

Featured image created with DALL·E, Chart from TradingView

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- USD CLP PREDICTION

- WQT PREDICTION. WQT cryptocurrency

2024-05-21 21:12