My dear Reader, it appears that Ethereum finds itself teetering on the edge of fortune and folly, trading close to $4,300, nay, testing the very supports within its long-standing ascending channel. The current scene is most critically poised; the coming days shall undoubtedly reveal whether ETH will gracefully ascend to new heights or tumble into a deeper slump, much like young Mr. Collins, who never quite knows his place in society.

Technical Analysis

By Shayan

The Daily Chart

On the daily spectacle, Ethereum remains within its noble ascending channel, though alas, the momentum has begun to dwindle, much like a gentleman’s flirtation after the first ball. The RSI, that spirited measure of strength, has formed a bearish divergence – despite ETH reaching higher highs, the RSI quietly declines, whispering of waning bullish fervor.

At present, price presses against the mid-support around $4,200 – a demand zone most reliable, like Lady Catherine’s opinion. If our brave bulls hold this ground, ETH may have the grace to challenge the $5,000 mark in the medium term. However, should it break below, it would expose the $3,800 bottom, inviting a more profound correction, possibly as awkward as a morning carriage ride gone wrong.

The 4-Hour Chart

As we turn to the shorter span, the weakness becomes more evident. The yellow trendline, which once directed ETH’s ascent, has been decisively broken – much like a stubborn suitor rejected at the door. Since then, the asset has been in a very tight range, with the broken trendline acting as a barrier and the midline of the channel providing modest support below, akin to a cautious chaperone.

This sort of compression often precedes a decisive act – one cannot delay forever. Unless ETH can rally with conviction past $4,500, the general inclination favors the downside, with $4,200 being the key battleground – quite like a dance where the partners hesitate before the final step.

Sentiment Analysis

By Shayan

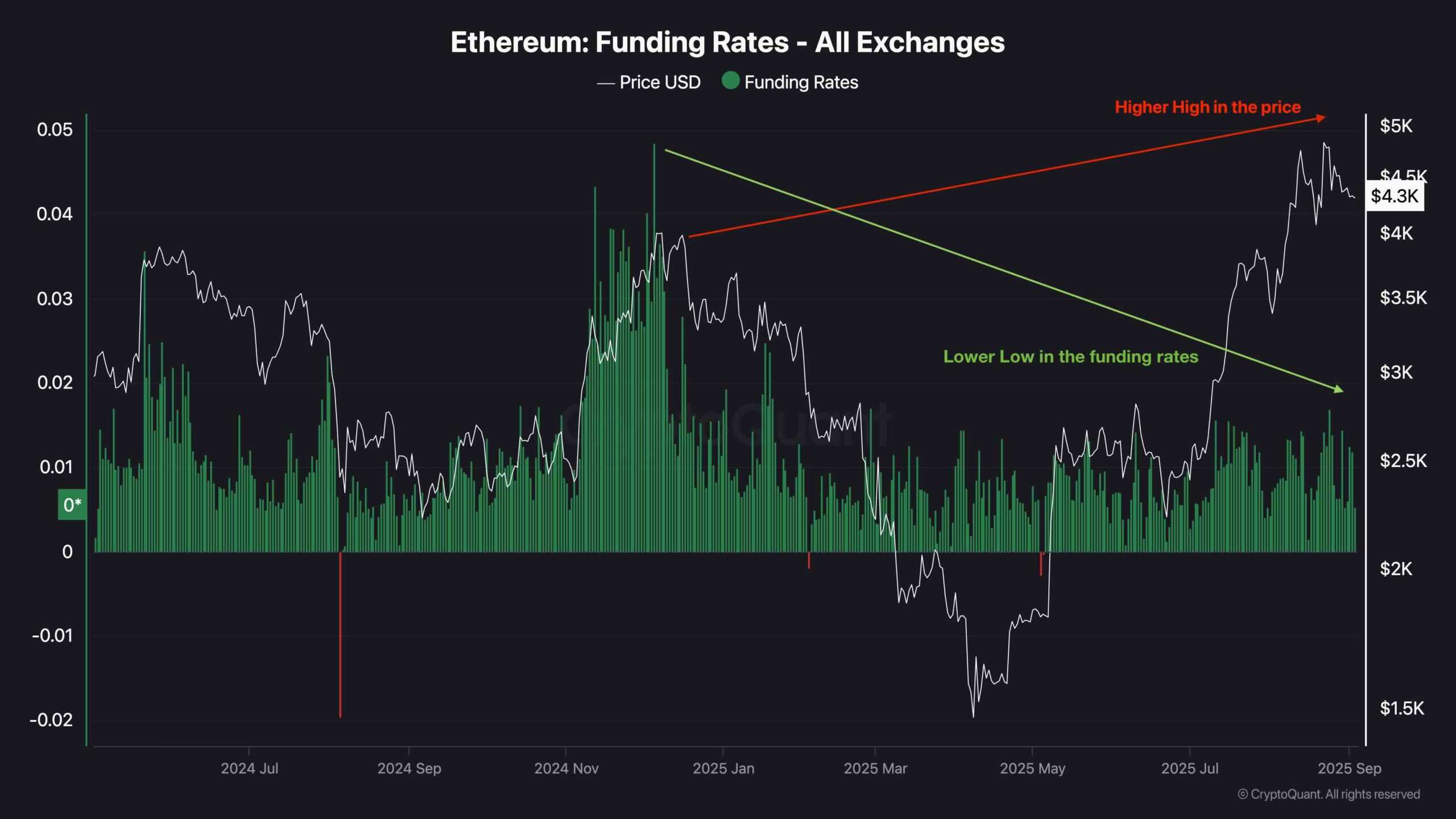

The funding rates across trading venues show an intriguing divergence from our darling Ethereum’s price. While ETH reached upward towards $4,900 – a lofty height indeed – the funding rates did not follow suit, peaking much lower than last cycle, when ETH flirted around $4,000. Such a pattern hints that traders may be less inclined to boldly leverage their positions, akin to a debutante declining to dance at the assembly.

This lower enthusiasm, despite the rising spot price, suggests waning speculative excitement. Such divergences are often precursors to exhaustion of bullish vigor, soon followed by sideways stasis or setbacks most unflattering. Without a revival in speculation, caution remains the order of the day, even should the broader outlook look promising.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-09-03 16:52