Ah, dear reader, gather round as we delve into the latest escapade of our good friend Ethereum, who has recently flipped a veritable coin to land on the sunny side of $3100 after a cheeky 2% jaunt upwards. It appears that this digital darling is currently caught in a rather genteel game of cat and mouse, having decided that the $3000 level is simply too cozy to abandon for the time being.

The current price action resembles a coiled spring, poised to unleash itself upon the world rather than succumbing to exhaustion; a thrilling prospect indeed! The short-term range of $2900 to $3400 is where all the fun and games are happening, and one can only wonder what delightful direction it shall take next.

The Inverted Head and Shoulders: A Fashion Statement or a Signal? 🤔

Upon consulting the daily chart (our dear analytics oracle), we find Ethereum lounging about the $3000 mark while giving a polite nod to the resistance at $3200. But fear not, for the chart appears to be wearing a bullish smile, hinting that it might just be gearing up for a triumphant leap towards the dazzling heights of $4800 in the not-so-distant future.

As we peruse the indicators, our old friends the RSI and MACD are maintaining a rather civil discussion, with the former comfortably above the neutral line and the latter merely twiddling its thumbs near equilibrium. Balance reigns supreme, my friends!

Now, let us cast our eyes to the weekly chart, which adds even more heft to our bullish aspirations. According to one of the sharpest minds in town, ETH seems to be donning an inverse head-and-shoulders pattern, consolidating like a fine wine near the upper volume shelf-how posh! 🍷

$ETHUSD $ETH Ethereum – Bullish Inverse Head & Shoulders – Weekly Chart

The inverse head & shoulders pattern continues to form. Price is near the top volume shelf and consolidating with higher lows.

Above $3400 and this gets moving. $ETHE $ETHA $FETH

– Donald Dean (@donaldjdean) January 11, 2026

This charming pattern typically indicates a transition towards a bullish phase once confirmed. A decisive weekly close above $3400 could validate our aspirations and send ETH soaring into the stratosphere. 🚀

However, should our dear Ethereum tumble below $2900, we may need to don our helmets and prepare for a deeper correction-oh, the horror!

On-Chain & Market Data: The Plot Thickens! 📈

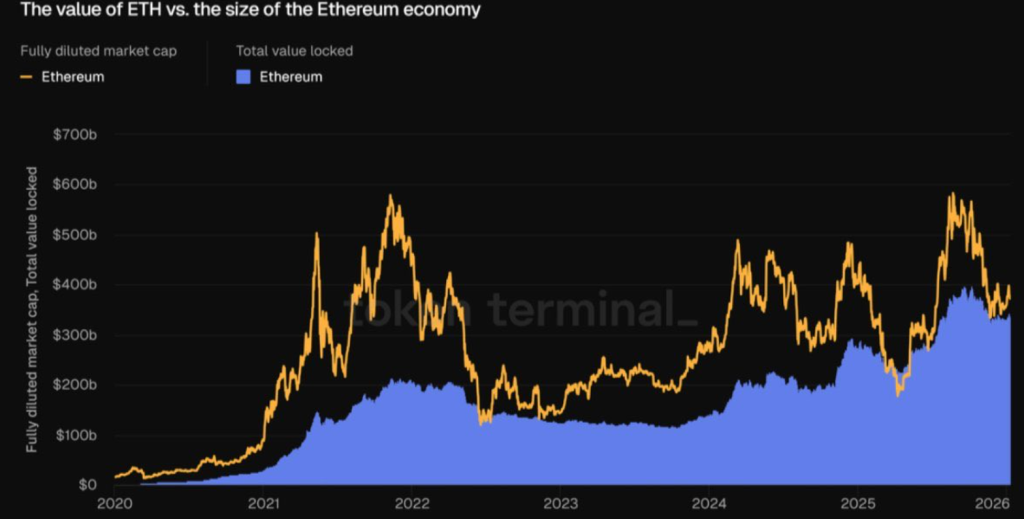

From the hallowed halls of validation, ETH’s market value remains a tad shy compared to the burgeoning Ethereum economy. The metrics suggest a widening gap between fully diluted valuation and on-chain activity, implying that our beloved price has yet to truly reflect the network’s economic prowess.

This divergence lends weight to the notion that ETH’s current consolidation is a sign of structural undervaluation rather than weakness-a silver lining if ever there was one!

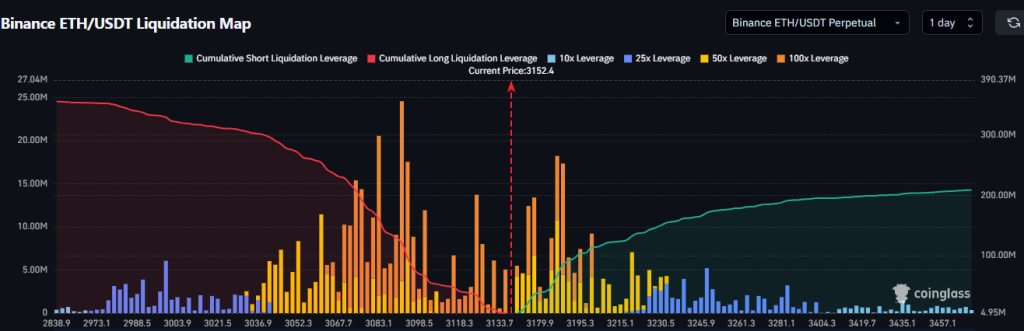

Meanwhile, liquidation map data reveals a delectable cluster of short-side leverage lurking above the current price of $3100. A modest upside of a mere 10-12% could send these shorts scurrying, unleashing a bullish stampede-how thrilling! 🐎

From a network perspective, ETH’s active addresses and transaction activity have settled down nicely, reinforcing the idea that Ethereum’s underlying usage is as steady as a well-oiled machine.

Final Thoughts: The Curtain Rises 🎭

As we conclude our tale, Ethereum price is coiling above the $3000 mark, with price compression, rising liquidation pressure, and a whiff of on-chain undervaluation, all pointing towards a potential explosion of volatility.

In this bullish chart setup, a clean break above $3400 would bolster our hopes, while a dip below $2900 may activate selling pressure ahead-let us keep our fingers crossed and our spirits high!

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

2026-01-12 11:33