In the shadowy corridors of the cryptocurrency market, where fortunes are made and lost with the flick of a digital switch, Ethereum finds itself in a precarious position. The price, like a weary traveler, stumbles through a landscape of despair, yet there are those who, with a glimmer of optimism, dare to dream of a resurgence. Among them is the enigmatic analyst known only as NotWojak, who, with a flourish of bravado, proclaims a bullish forecast that stands in stark contrast to the prevailing gloom.

The Downtrend: A Dying Whisper

Ah, the Ethereum price, ensnared in a relentless downtrend, a veritable Sisyphean struggle. Yet, according to our intrepid analyst, the tide may soon turn, heralded by two elusive supply zones. The market has witnessed a series of liquidity sweeps, dragging the price to depths previously unimagined. But lo! A flicker of hope emerges, suggesting that a reversal may be on the horizon, like a phoenix rising from the ashes of despair.

Currently, the analyst identifies two critical supply zones: the $1,425 and $1,600 thresholds. The former has already been tested and found wanting, while the latter remains untouched, a tantalizing target for those brave enough to venture forth. Should the price ascend, this level could transform into a formidable barrier, a veritable fortress against further gains.

Despite the current dominance of sellers, with volumes flooding the market like a deluge, our analyst posits that the true bottom lies just shy of $1,350. Here, a potential support level may emerge, offering a glimmer of hope for a breakout that could send prices soaring.

The ambitious target for this breakout? A lofty $1,835, a mere 20% above the current level. If resistances crumble like stale bread, the path to further gains may be paved with gold—or at least a few shiny coins.

ETH On-Chain: A Tale of Woe

As the price of Ethereum plummets, so too does its profitability, with a mere 32% of investors basking in the glow of profit. Meanwhile, a staggering 65% languish in the depths of loss, and only 2% cling to the hope of breaking even, as reported by the ever-watchful guardians of on-chain data, IntoTheBlock.

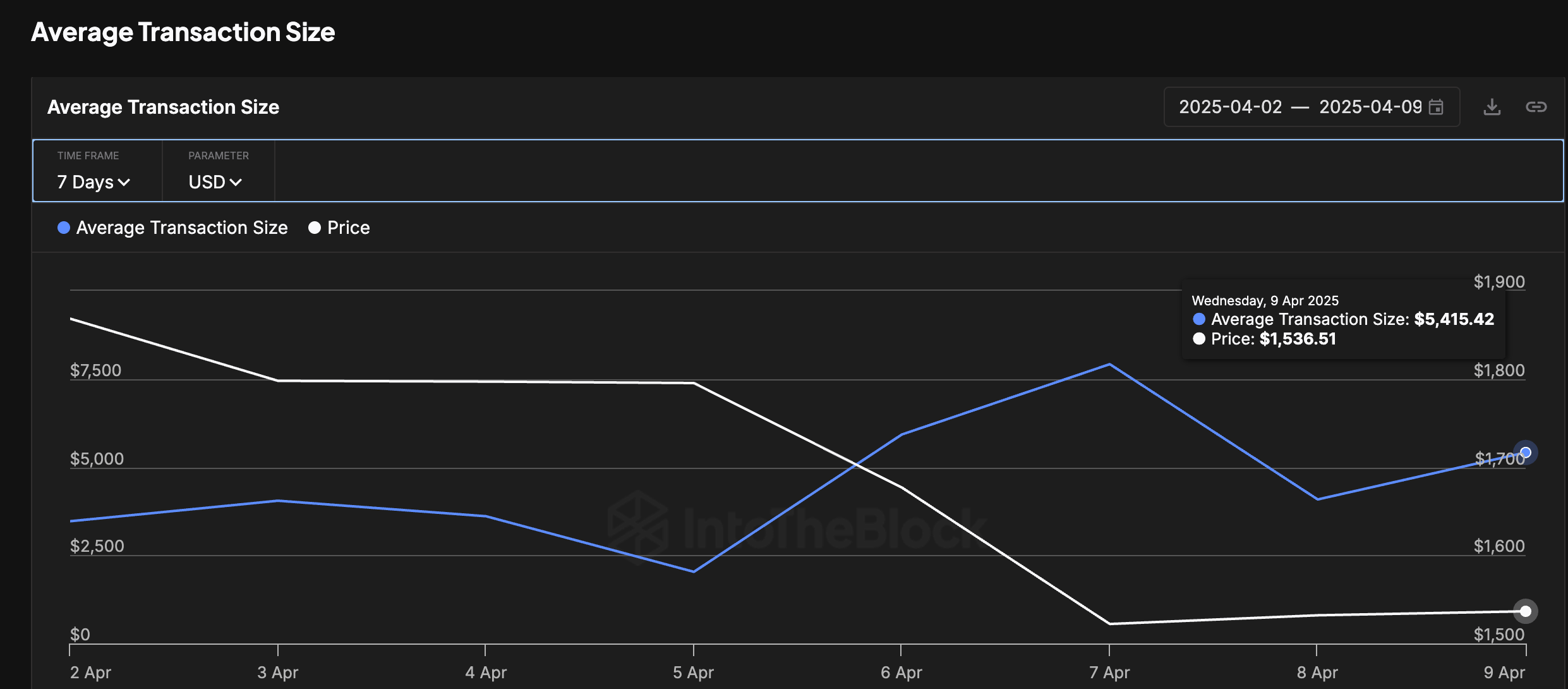

In this turbulent sea, Ethereum whales have been particularly active, their movements akin to sharks circling their prey. Large transactions surged from $4.8 billion to $6.48 billion by April 9, as the price dipped below the $1,500 mark, leaving many to wonder if these titans of finance are orchestrating a grand sell-off.

Moreover, the average transaction size has ballooned from $4,048 to $5,415, suggesting that investors are moving more coins than ever, perhaps in a desperate bid to escape the impending storm. Should this trend continue, the Ethereum price may face further calamities, a veritable cascade of misfortune.

As of this moment, the Ethereum price hovers at $1,544, a disheartening 4.56% decline in just one day. The market watches with bated breath, wondering if this is the end or merely a prelude to a grand resurgence.

Read More

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Silent Hill f 2025 Release Date Confirmed, And Pre-Orders Are Already Open

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Silent Hill f Reveals Release Date and Terrifying New Monsters

- Hollow Knight: Silksong Steam Update Excited Fans

2025-04-11 15:05