In the grand theater of the cryptocurrency market, Ethereum (ETH) has taken a dramatic plunge of 30% over the past fortnight, a reflection of the broader malaise that grips the global economy, beset as it is by the tumult of tariff wars. The astute analyst, Ali Martinez, forewarns that ETH may yet descend further, perhaps to the fabled threshold of $1,200, a price point that seems to mock the dreams of its ardent supporters.

More Pain For Ethereum, But A Recovery Is Possible

As the world’s second-largest cryptocurrency grapples with the weight of economic pressures, it has suffered yet another 8.3% decline in the last 24 hours, languishing in the mid-$1,000 range. One cannot help but wonder if this is the end or merely a prelude to a grand comeback.

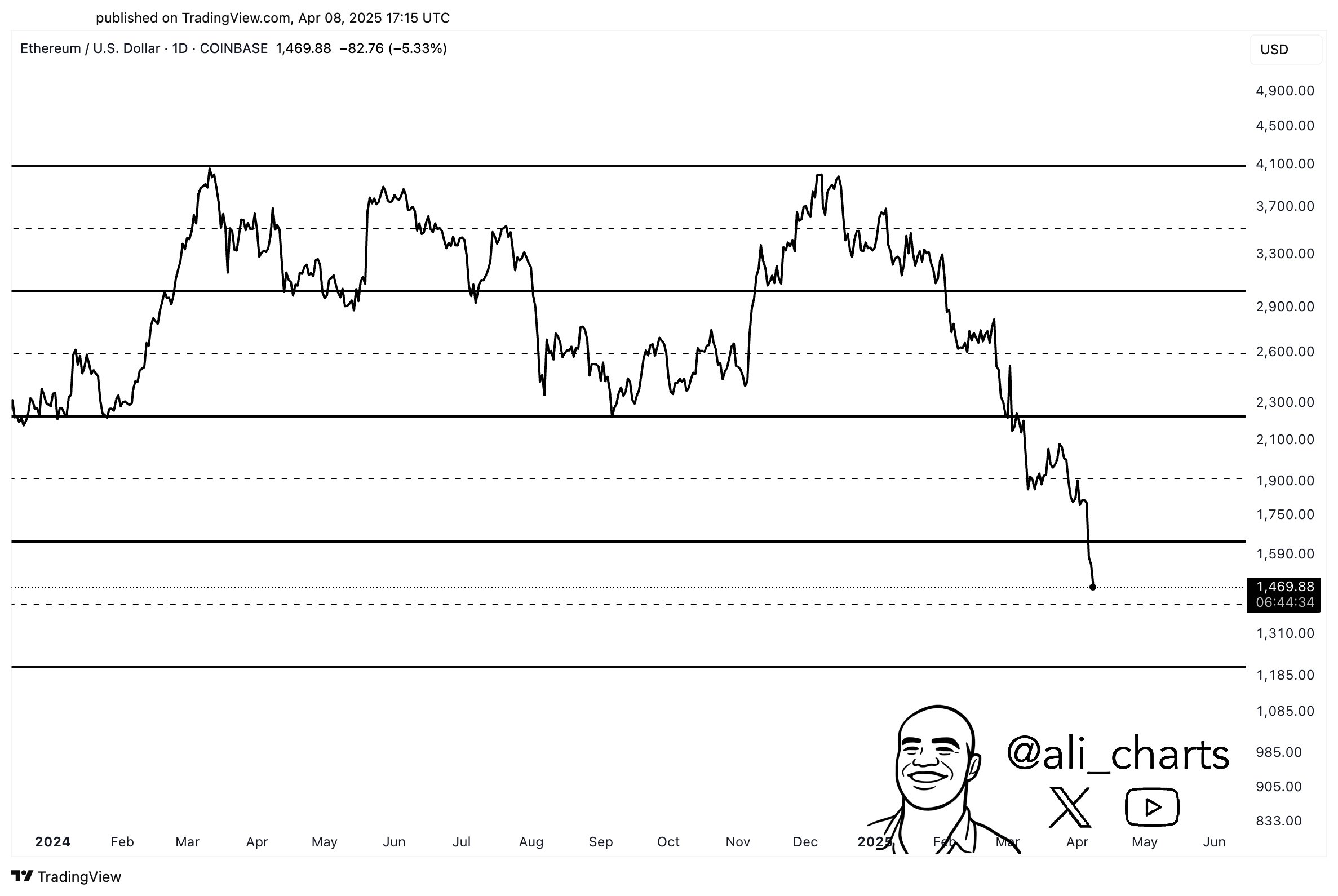

Martinez, with the wisdom of a seasoned sage, suggests that ETH might find solace at the $1,200 mark, a beacon of hope amidst the storm. He has shared a chart that illustrates the digital asset’s descent through various support levels since December 2024, when it basked in the glory of $4,000. Ah, the sweet taste of nostalgia!

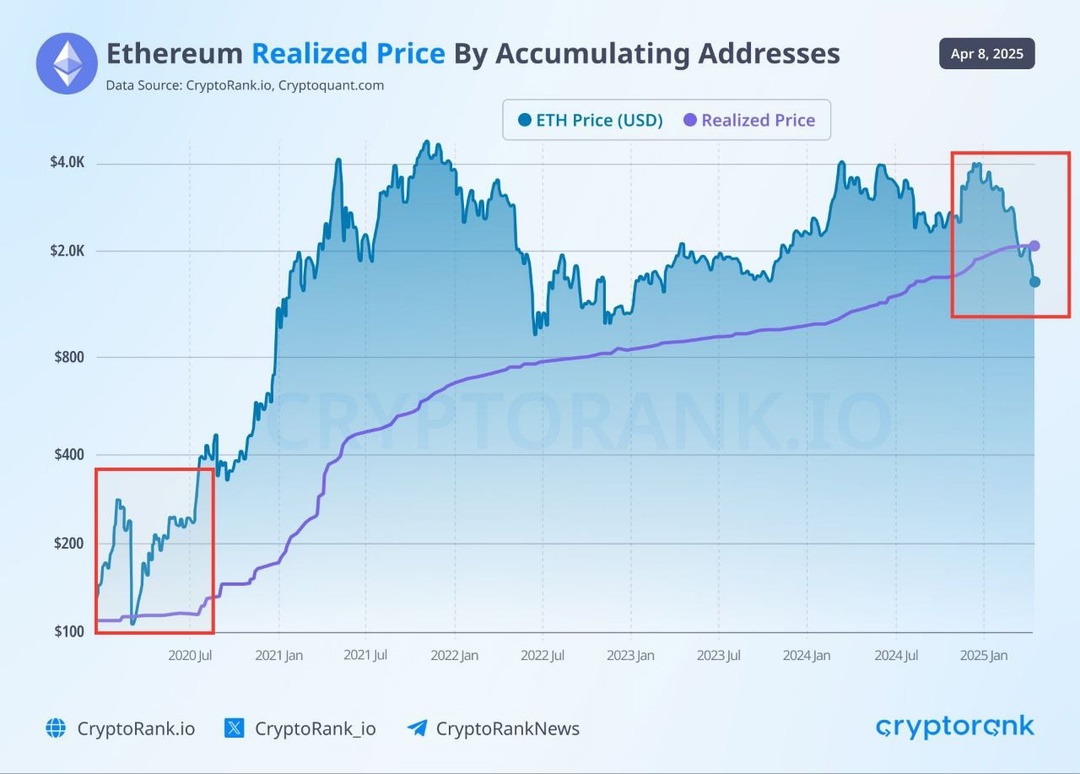

Meanwhile, the illustrious Carl Moon has noted that ETH currently trades below its realized price of $2,000. He recalls the dark days of March 2020, when ETH plummeted from $289 to a mere $109, a tale that sends shivers down the spine of any investor.

Yet, in a twist of fate, Moon also reminds us that ETH rebounded swiftly after that steep decline. Perhaps, dear reader, this current price level is a golden opportunity for those brave enough to invest for the long haul.

For the uninitiated, the realized price for accumulation addresses—illustrated in the aforementioned CryptoRank chart—represents the average price at which long-term holders acquired ETH. This metric has historically served as a bastion of support, a fortress against the tides of market volatility.

Is ETH About To Surprise The Market?

As the Ethereum Fear & Greed Index languishes at a dismal 20, indicating “extreme fear” among investors, one might wonder if the market sentiment has reached its nadir. Yet, amidst this pervasive gloom, some on-chain metrics and historical patterns whisper of a potential bullish reversal, a surprise that could catch many investors off guard.

Crypto analyst Mister Crypto has drawn parallels between ETH’s current plight and its past, suggesting that a price rally could be on the horizon by Q2 2025. Hope springs eternal, does it not?

Moreover, Ethereum’s Market Value to Realized Value (MVRV) Z-score hints at an undervaluation at the present price. The last time it was this undervalued—back in October 2023—it experienced a remarkable rally of 160%. Oh, the irony of fate!

However, not all indicators shine brightly. The rising ETH exchange reserves raise concerns about potential sell pressure from holders. As of now, ETH is trading at $1,457, down 8.3% over the past 24 hours, leaving many to ponder the wisdom of their investments.

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Top 8 UFC 5 Perks Every Fighter Should Use

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- USD ILS PREDICTION

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- How to Get 100% Chameleon in Oblivion Remastered

2025-04-09 22:36