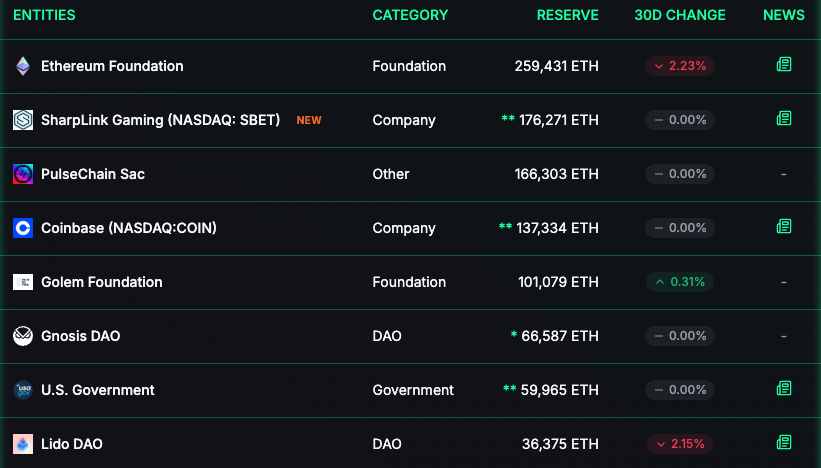

Ah, see how the mighty institutions clutch their reserves as if each ether were a golden ticket to existential redemption! Yes, my dear readers, in this shadowy ballet of power and avarice, the Ethereum Foundation sits enthroned atop a mountain of digital rubles—269,431 ETH, to be precise. One might say, were this Dostoevsky’s Petersburg, the Foundation would be the brooding landowner, while the rest scramble about the icy streets, pockets turned inside-out. 😏

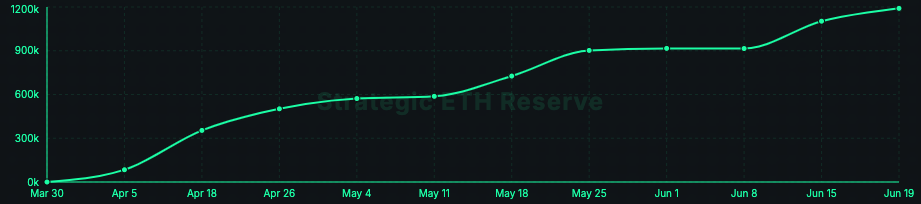

Bitcoin, the old czar of reserves, has long been the jewel in the crown. Yet do you not feel it? The rising, creeping ambition of Ethereum, gnawing away at the throne? On the mournful eve of June 19, the tally of institutional ETH reserves slithered up to 1.190 million—a sum that would buy many a soul or at least several nice dinner parties in St. Petersburg. Nearly $3 billion. More than 1% of the entire supply! Dostoevsky’s Raskolnikov surely would’ve had opinions about property crime in such an era…

As it always is in life and literature, inequality reigns. Five titans sweep up 70% of these reserves, as if in some comical farce. The Foundation—our antihero—grips the largest hoard. SharpLink, that respectable Nasdaq gaming concern, bought their ETH when the air was still heavy with June’s despair, and promptly staked 95% of it, presumably to impress their shareholders or their existential dread. Business is business—and staking is the vodka of corporate crypto strategy. 🥂

And then—enter Status, messenger of the Ethereum faith, sliding 23,066 ETH off the table on June 19, worth a cool $2.9 million. One wonders whether their notification tone now chimes with the sound of rubles hitting a tin cup.

Other players haunt the cryptic scene: PulseChain, Coinbase (ah, the perpetual merchant!), and the elusive Golem Foundation. Even the U.S. government finds itself with 60,000 ETH in its trembling hands, most of it purloined through noble asset seizures—a modern-day Dostoevskian plot twist if ever there was one.

More firms consider ETH reserves

Bitcoin sits atop the hierarchy—a bored czar watching Ethereum’s bold rise. Governments and corporations, always on the brink of an existential crisis, now gaze longingly at Ethereum. As the most venerable of altcoins, it entices them away from Bitcoin’s icy grip. Has the world lost its sense? Or merely diversified its portfolio? Who’s to say. 🤔

Recently, Michigan’s state pension plan, perhaps in a fit of midwestern ennui, tossed $10 million into Ethereum. On the public stage, Bit Digital, BTCS, Intchains Group, and KR1—each obsessed with crypto’s uncertain promise—join the grand, sometimes absurd procession. And always lurking nearby: the Strategic ETH Reserve initiative, peering into every wallet like a Dostoevskian detective, thirsting for transparency and perhaps a little drama along the way.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

2025-06-19 22:43