Ten years past, when Ethereum first ignited, it promised to reshape the very fabric of the internet, much like a revolutionary manifesto penned in the heat of passion. Now, it drives a colossal $75 billion decentralized realm, fueling everything from frivolous meme coins to the grand machinations of institutional finance, all with the relentless pulse of a heart that knows no rest. 😉

What started as the scribblings of a youthful cryptographer has evolved into the unyielding spine of global programmable finance. This chronicle delves into Ethereum’s pivotal triumphs, its harrowing trials, and its ceaseless metamorphoses—pondering, with a wry smile, what the forthcoming decade might hold for this tireless chain. 🤔

The Ethereum Genesis: Building a World Computer

In the year 2013, amid the digital wilderness, Vitalik Buterin—a figure akin to a modern-day idealist, driven by visions grander than those of mere mortals—conceived a blockchain surpassing Bitcoin‘s austere design. Joined by companions Gavin Wood, Charles Hoskinson, Anthony Di Iorio, and Joseph Lubin, he sketched a decentralized world computer, one that could execute smart contracts and nurture applications free from the chains of trust. 😏

By the summer of 2014, they amassed a fortune exceeding $18 million through a presale, a feat that might have made even the greediest tsar envious. On that fateful July 30, 2015, the genesis block was hewn, birthing an age of programmable blockchains. Buterin’s whitepaper unveiled smart contracts—self-enforcing codes that automate pacts without meddlesome intermediaries—a not just technical wizardry, but a profound philosophical leap toward decentralized harmony on a massive scale. 😂

With the tenth anniversary looming like a shadow on the horizon, memories flood back, including the role of co-founder Joseph Lubin, who carries the symbolic NFT Torch with all the gravity of a ceremonial relic.

I am honored to be asked to be a torch bearer for the run up to the 10th anniversary celebration of Ethereum’s launch and non-stop, essentially flawless, operation of the protocol — even as the protocol underwent many major upgrades “in flight” – without missing a block.

— Joseph Lubin (@ethereumJoseph) July 21, 2025

The DAO Hack: Crisis and Fork

Ethereum’s initial cataclysm struck with the swiftness of fate’s cruel hand. In 2016, The DAO, a decentralized venture fund, amassed $150 million in ETH, only to fall prey to a vulnerability in its smart contract, allowing a thief—later named as TenX CEO Toby Hoenisch—to pilfer 3.6 million ETH, a sum that, in today’s light, equates to roughly $11 billion. Oh, the irony of such ambition! 😅

The community grappled with a dilemma worthy of ancient tragedies: preserve the immutable sanctity of the blockchain or alter its course to rectify the injustice? A contentious hard fork, supported by over 85% of the network, undid the misdeed and restored the funds, while dissenters forged ahead with Ethereum Classic. This episode, laced with the bitterness of betrayal, reshaped Ethereum’s ethos, revealing the perils of unchecked code and igniting endless debates on governance. Truly, it proved that Ethereum was not merely lines of code, but a living, breathing community, fraught with human folly. 😉

ICO Boom: Ethereum Becomes a Fundraising Engine

In a twist as sardonic as life itself, the collapse of The DAO birthed Ethereum’s next frenzy: Initial Coin Offerings, or ICOs. The ERC-20 standard simplified token creation, turning Ethereum into a wild bazaar where projects like EOS, Tezos, and Bancor raked in billions. It was a decentralized gold rush, mocking traditional finance with its ease—anyone could launch a token, scammers and visionaries alike. 😏 The SEC descended like avenging angels, but Ethereum had discovered its calling: a platform for birthing new economic worlds, for better or worse. 😂

DeFi Summer: A New Financial Architecture

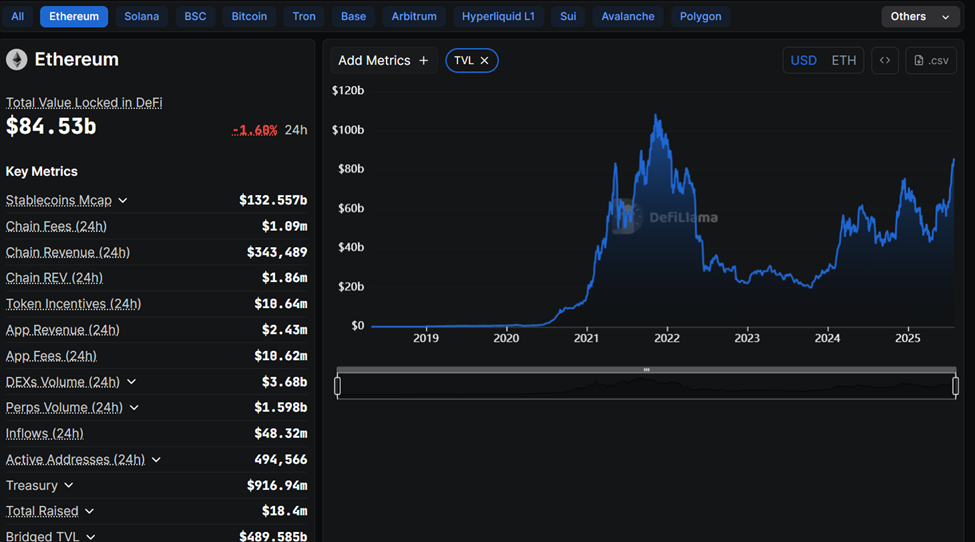

The year 2020 heralded yet another upheaval—DeFi, or Decentralized Finance, with protocols such as Uniswap, Aave, Compound, and MakerDAO offering borrowing, lending, trading, and yield farming without a hint of trust. The total value locked ballooned beyond $11 billion in what was dubbed “DeFi Summer,” a season of excess that showcased Ethereum’s composability, where applications interlocked like intricate clockwork. But ah, the cost! Fees soared, alienating the common folk and underscoring the dire need for scalability. 😩 Still, it was a testament to Ethereum’s power to redefine finance, not with gentle persuasion, but with the force of a storm. 😉

DeFi revealed Ethereum’s genius in allowing apps to build upon each other, yet it also exposed the network’s frailties, much like a grand edifice cracking under its own weight. The innovation was undeniable, rewriting financial rules with the audacity of a rebel poet. 😂

The Merge: From Energy Hog to Efficiency Pioneer

Come September 2022, Ethereum achieved a marvel akin to alchemical transmutation: The Merge shifted it from proof-of-work to proof-of-stake, slashing energy consumption by over 99.95% and rendering ETH deflationary through EIP-1559. It was a technical ballet performed mid-stride, aligning with the world’s green aspirations. Yet, scalability lingered like an uninvited guest, directing attention to Layer-2 solutions. 😏 In this, Ethereum mirrored the human spirit—ever adapting, yet never fully content. 😉

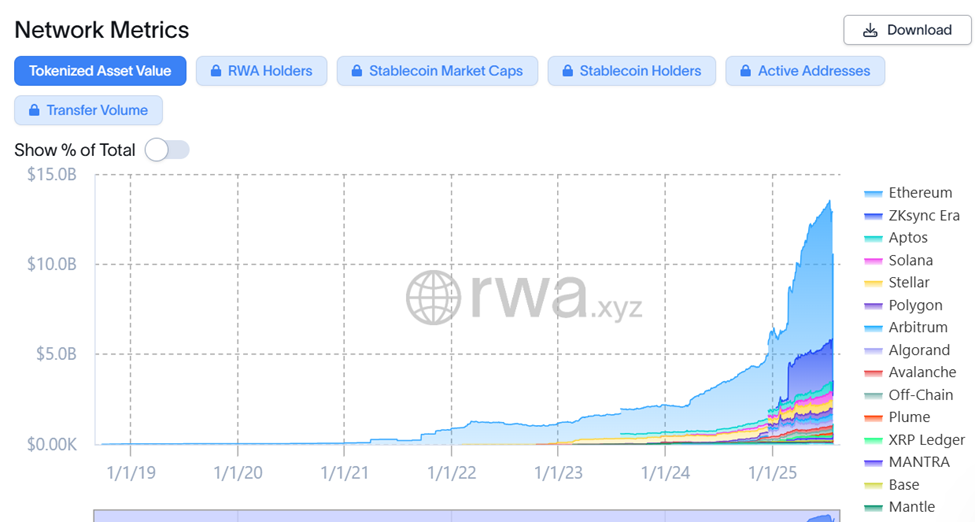

Post-Merge: Scaling the Settlement Layer

After The Merge, Ethereum’s path unfolded like a complex novel. In 2023, the Shapella upgrade permitted the withdrawal of staked ETH, a relief for many. By 2024, Dencun introduced proto-danksharding via EIP-4844, dramatically reducing Layer 2 data fees with ‘blobs.’ Rollups such as Arbitrum, Optimism, and Base flourished, boosting throughput to over 250 transactions per second. Institutions, ever the opportunists, took heed—witness BlackRock’s BUIDL fund, tokenized on Ethereum in 2024. 😂

“Ethereum started as a smart contract platform. Ten years later, it underpins a growing share of global finance: ETH ETFs in the US, ETH in corporate and DAO treasuries, and major institutions like BlackRock tokenizing funds on Ethereum,” Hart Lambur, Co-founder of Risk Labs, said in a statement to BeInCrypto.

The Pectra upgrade of 2025, with EIP-3074 and Verkle Trees, enhanced wallet experiences and data management, paving the way for wider adoption and modular designs. It was as if Ethereum, in its perpetual evolution, mocked the stagnation of lesser systems. 😏

Interoperability Is the Next Great Leap

Despite strides in scaling, Ethereum’s user experience remains a fractured mosaic, with transitions between Layer 2s as cumbersome and costly as crossing a vast, bureaucratic empire. 😩

“The real endgame is straightforward. A giant payments and exchange network that connects every blockchain. If most assets become tokenized—money, equities, bonds, real-world assets—Ethereum becomes the settlement and payment layer for all things of value on the internet,” Lambur explained.

This grand vision hinges on conquering the beast of interoperability, for Ethereum can scale admirably now, yet this very scaling has splintered the user journey, making inter-chain movements a tedious affair. Lambur quips with the wisdom of a sage: “Fix that, and Ethereum feels like one unified network again—closer to its original promise.” Indeed, the challenge is not merely technical but existential, wrapped in the sarcasm of progress. 😂

“The next battleground will be economic, where chains compete for liquidity like banks vying for deposits. Loyalty programs, rebates, and incentives to keep user assets chained,” he said, with a hint of amusement at the capitalist theater unfolding. 😉

This evolution could redefine DeFi’s economy, fostering a multi-chain world still anchored by Ethereum, much like a central figure in a sprawling saga who commands the stage. 😏

Shaping the Crypto Landscape

As the tenth anniversary dawns, Ethereum has not merely endured; it has sculpted the digital age, birthing smart contracts, igniting DeFi, spawning NFTs, and erecting DAOs. Its vast developer community, unblemished uptime, and chameleonic adaptability render it not just a blockchain, but the bedrock of a decentralized digital realm. 😂

ethereum has been online ten years straight with zero pauses and zero maintenance windows.

in that time:

– facebook went down for 14 hours

– aws kinesis froze for 17

– cloudflare dropped 19 datacenters

– alt L1s…well, you know.every centralised giant blinks, they rely on…

— binji (@binji_x) July 27, 2025

Lambur envisions a future where users seamlessly swap any asset across chains at minimal cost, unleashing a network effect for tokenized assets and setting the stage for Ethereum’s next act. From the ashes of the DAO hack to the heights of Wall Street’s tokenized funds, Ethereum’s journey is an epic tale of resilience and unchecked ambition. If Bitcoin is the steadfast gold of the digital world, Ethereum is the restless soul of Web3, growing not in spite of its chaos, but because of it. 😏

Thus, we reflect on a decade that has seen Ethereum evolve from a dreamer’s sketch to a cornerstone of modern finance, its story laced with humor in its follies and sarcasm in its triumphs. 😉

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-07-29 18:14