- ETH has shattered its erstwhile bastion of support, prompting slumbering leviathans to shake off their holdings.

- MVRV ratio has metamorphosed into the negative, historically a signpost for neglect and prospective treasure troves.

Ah, Ethereum [ETH], that capricious minx, finds herself under pressure, like a lobster caught in a steamer. Long-term holders (LTHs), once guardians of the digital realm, are turning their backs and offloading their precious tokens with the nonchalance of a child discarding a broken toy. Just recently, after a three-year snooze fest, “another” noble Ethereum OG—let’s call him Sir Sell-A-Lot—unleashed a torrent of 7,974 ETH upon the world, priced at a delightful $1,479, totaling a staggering $11.8 million. 💸

Now, whilst ETH’s mood swing is in keeping with the grand circus of the market, its monthly performance reveals a melancholic tale. A steep 17.52% decline is a siren’s song, echoing the heavy toll these mass sell-offs have exacted, tragically branding ETH as the frailest of high-cap assets—poor thing!

The catalyst? A breach, my dear Watson!

ETH limply dipped below the treasured $1,500 threshold, a realm unseen for two entire revolutions of the sun. In a flurry of strategic de-risking moves akin to a game of chess with invisible pieces, slumbering whales resumed their dances, unwinding positions and giddily front-running impending losses like sprightly gazelles dodging a lazy lion.

According to AMBCrypto—our oracle of crypto wisdom—the exits of these aquatic giants reflect a most curious distribution pattern. They offload their treasures in tantalizingly choreographed phases like a grand ball, rather than throwing a wild, drunken party. 🍾

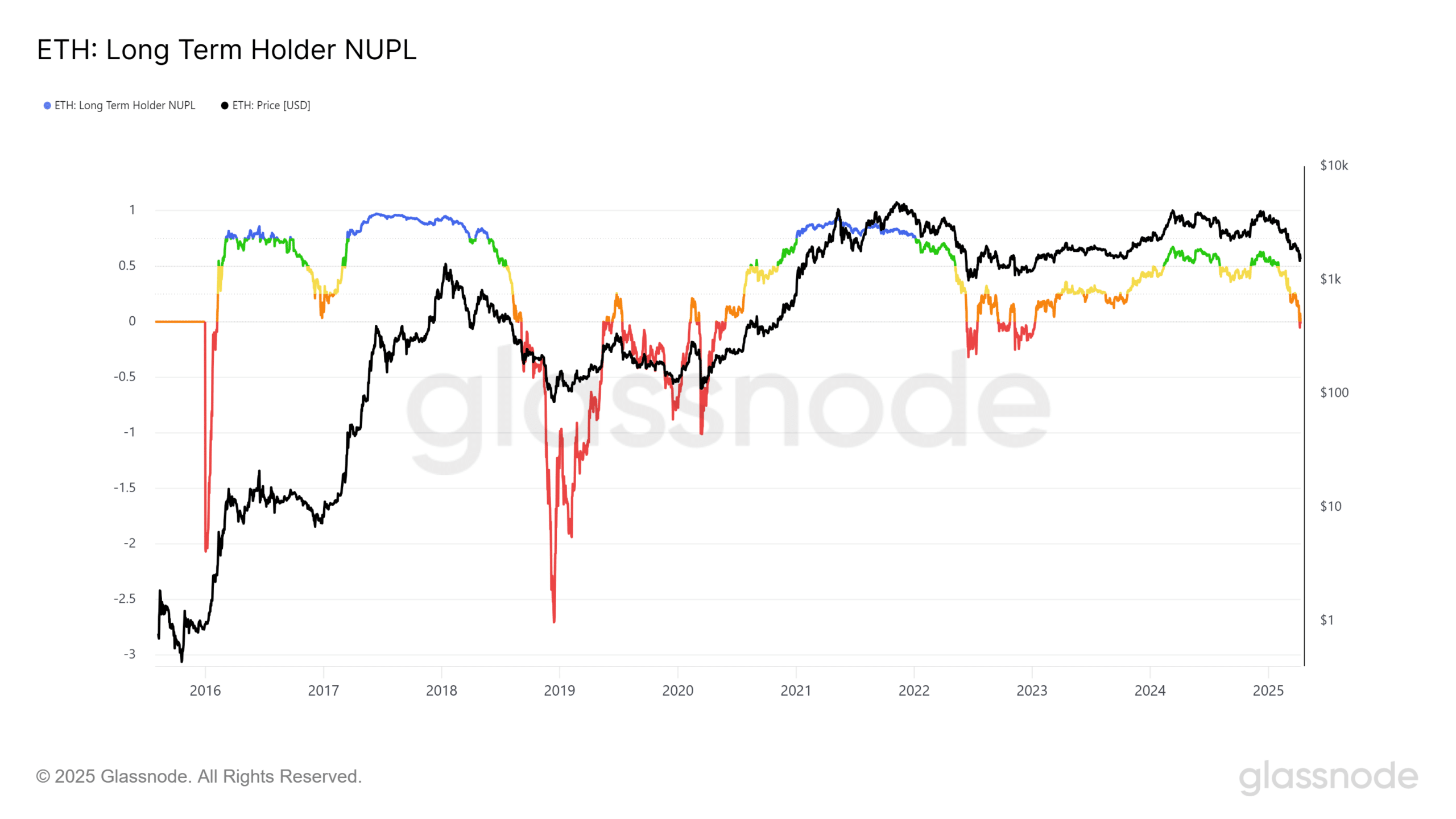

Behold, a chart peeks through the clouds below.

Ethereum’s LTH NUPL (Net Unrealized Profit and Loss) has also sauntered into the red for the first time in a triad of years—oh, what scandal! The last such escapade transpired in 2022, when ETH whales, in a fit of doubt, capitulated as ETH dipped below $1,500 on 10 June. A dizzying plunge to the depths of $883 ensued—not a sight for the faint of heart!

As Ethereum wobbles precariously on this battleground once more, the specter of a full-scale capitulation looms larger than life. Is this $11.8 million worth of dormant whale sell-off merely the initial domino to tip over? The plot thickens!

On-chain metric flickers with undervaluation🚦

As I pen these reflections, Ethereum’s Market Value to Realized Value (MVRV) ratio rests at a curious 0.76—one might say it’s trading at a 24% discount, a veritable bargain in this chaotic bazaar. The present price of $1,549 merely reflects 76% of the overall realized value, leaving ETH holders dangling perilously over the abyss—such a stigma!

Historically, these undervaluation zones have predated vigorous resurgences. In the summer of 2022, for instance, ETH engaged in a month-long flirtation with the flatline before soaring 85% to grace the tombs of $2,020 by the 13th of August.

Nevertheless, the thundering clouds of market fear are a malevolent wild card this time around. Just last month, Ethereum reserves experienced net inflows of around 2 million ETH across spot exchanges, revealing a jittery investor class shying away from the seductive dip.

Absent a grand reversal in this accumulation waltz, Ethereum seems poised on a tightrope, vulnerable to deeper corrections below the $1,400 threshold. Especially since our slumbering whales persist in their strategic unwinding. And lo! With long-term holders de-risking and market liquidity hanging by a thread, the structure of Ethereum mirrors its tragic breakdown of 2022—another capitulation could very well be on the horizon. 🎭

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Top 8 UFC 5 Perks Every Fighter Should Use

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Silent Hill f 2025 Release Date Confirmed, And Pre-Orders Are Already Open

2025-04-11 14:18