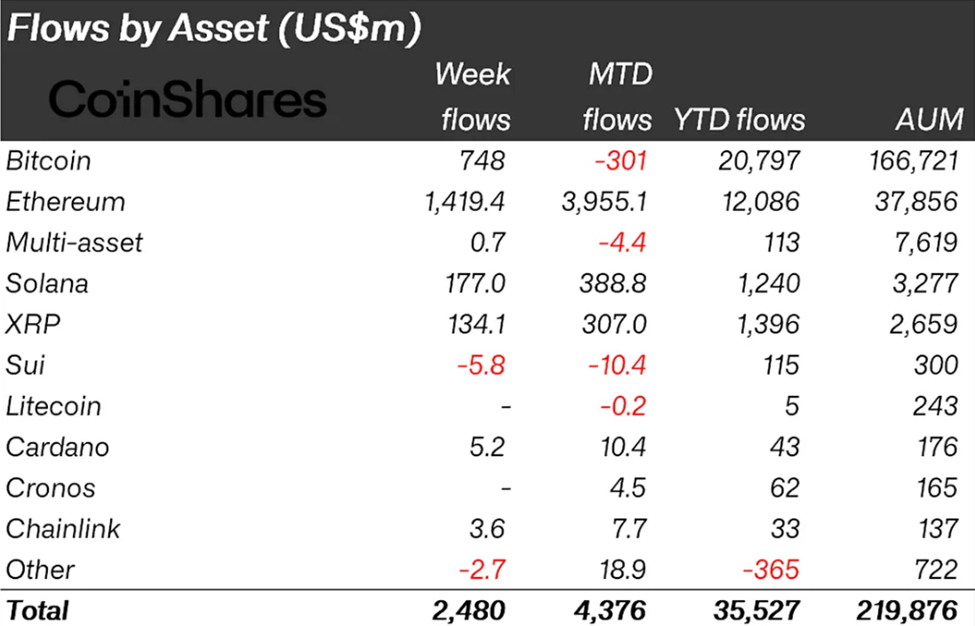

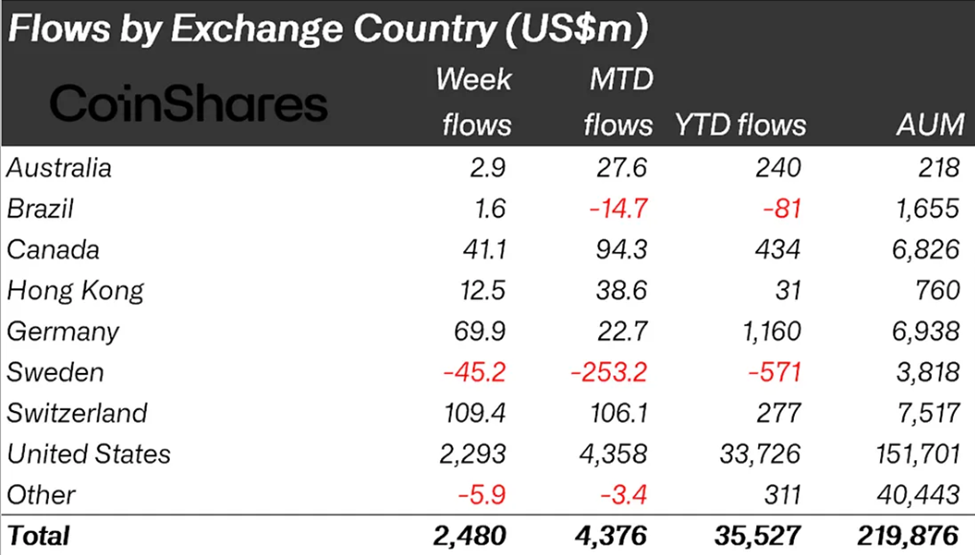

Ah, the capricious winds of fortune! Ethereum, that mischievous sprite of the crypto realm, has once again seized the reins, galloping through August with the grace of a drunken Cossack. Behold, its prowess pushed crypto inflows to a staggering $2.48 billion last week! 🌪️✨ The month’s tally swelled to $4.37 billion, and the year-to-date coffers now brim with $35.5 billion. What a spectacle!

Yet, alas! Amidst this carnival of greed and glory, the total assets under management (AUM) took a tumble, slipping 10% to a mere $219 billion. Friday’s macroeconomic phantoms, those spectral harbingers of doom, cast their shadow once more. 👻💼

Ethereum’s Triumph: Bitcoin Trails in the Dust as August Roars On

The latest tome from CoinShares, that oracle of digital lucre, proclaims Ethereum’s dominance with the fervor of a village gossip. Last week, it lured $1.4 billion into its embrace, while Bitcoin, poor soul, managed a paltry $748 million. Such is the fate of the once-mighty king! 👑→🐌

Ethereum, that wily siren, has amassed $3.95 billion in August alone, riding the waves of altcoin euphoria. Meanwhile, Bitcoin weeps bitter tears, with net outflows of $301 million. The fickle heart of the market beats for Ethereum, it seems! 💔→💃

Yet, James Butterfill, the sage of CoinShares, laments that last week’s inflows could have soared higher, were it not for the market’s tempestuous tantrums and Friday’s Core PCE data, that grim reaper of optimism. 📉☠️

“Core PCE rises to 2.9% YoY. Inflation, that stubborn specter, refuses to vanish! Q2 GDP revised up to 3.3%. And yet, some dream the Fed will cut rates? Folly! The data scoffs, but politics may yet force its hand,” declared David Kudla, the grand vizier of Mainstay Capital Management. 🎭📊

Analysts, those soothsayers of the modern age, whisper that Friday’s retreat was but a fleeting bout of profit-taking, not a harbinger of doom. Inflows, they say, remain as diverse as a Gogol novella. 🧙♂️📈

The previous week, a tempestuous affair, saw $1.43 billion flee in terror, the largest exodus since March. Bitcoin, ever the tragic hero, led the retreat with $1 billion, while Ethereum, ever resilient, limited its losses to $440 million. A tale of contrasting fates! ⚔️🛡️

Month-to-date, Ethereum basks in $2.5 billion in net inflows, while Bitcoin wallows in a $1 billion outflow. The divergence is as stark as a Gogol protagonist’s inner turmoil! 😵💫💸

Investor sentiment, that fickle mistress, swung wildly with the winds of monetary policy. Early pessimism over the Fed’s machinations sparked $2 billion in outflows, but lo! Jerome Powell’s dovish coos at Jackson Hole revived spirits, sparking $594 million in inflows. Ethereum, ever the beneficiary, danced to the tune! 🕊️→🎶

Ethereum’s ascendancy is undeniable: YTD inflows account for 26% of total AUM, compared to Bitcoin’s meager 11%. The network’s ecosystem, a bustling bazaar of DeFi wonders, has captured the hearts of investors. 🌐💖

Despite Friday’s minor stumble, the broad inflows herald a renaissance of faith in digital assets, Ethereum leading the charge. Altcoin optimism, fueled by ETF whispers, paints a picture of selective growth, even as Bitcoin grapples with its demons. 🎨🚀

Read More

- EUR USD PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Xbox Game Pass September Wave 1 Revealed

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-09-01 16:43