As a crypto investor with several years of experience under my belt, I find Jim Bianco’s insights on spot Bitcoin ETFs both intriguing and concerning. His analysis sheds light on aspects of these ETFs that many investors might not consider, such as the potential risks they pose to the market and investor behavior.

Market specialist and analyst Jim Bianco has raised warnings about the potential hazards of Bitcoin spot Exchange-Traded Funds (ETFs). His perspectives offer valuable insights into how these ETFs could impact the market and tackle particular worries surrounding investor conduct.

Minimal Involvement In New Bitcoin ETFs?

In a reflective social media update on X (previously Twitter), Bianco shared his growing apprehensions as new information comes to light. Of particular concern to him are the possible dangers that Bitcoin Exchange-Traded Funds (ETFs) may bring to the market.

Bianco brought attention to an intriguing finding: Investment advisors (IAs) collectively own around 35% of all Exchange-Traded Funds (ETFs). However, their holdings represent less than 1% of Bitcoin Spot ETFs. This discovery contradicts the widely held notion that baby boomers are flocking to invest in these types of ETFs.

As a financial analyst, I would rephrase Bianco’s description in the following way: “I described Bitcoin Spot ETFs as ‘orange chips’ that appeal strongly to inexperienced and fearful retail investors, often labeled as ‘degens.’ These individuals may be prone to making hasty decisions based on market fear or excitement.”

Traders holding large positions in cryptocurrency are nearing the point where their investments will no longer be underwater, which could lead to a wave of sell-offs.

An expert referred to a report by Citibank revealing that investment advisors own barely any new Bitcoin ETFs compared to their substantial investments in other non-equity ETFs like Gold (GLD) and Tech Leaders Income (TLT). Specifically, they hold 22% of their assets in GLD and a remarkable 40% in TLT.

According to Bianco’s assessment, the Bitcoin ETF holdings of wealth managers make up a tiny fraction, virtually indistinguishable from rounding errors.

Selling Pressure Looms?

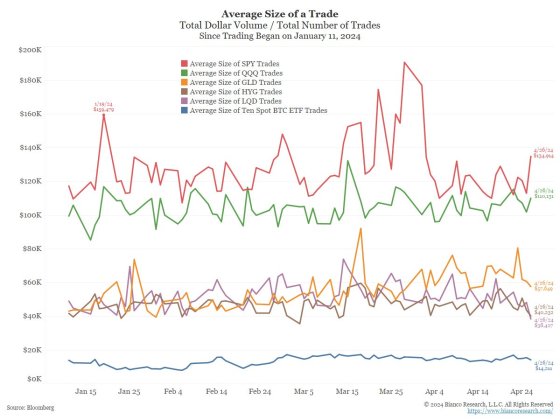

Bianco pointed out another important observation regarding the typical trade amount for Bitcoin ETF purchasers, with a focus on retail investors. His findings suggest that the average transaction value is quite small, at approximately $14,000, which is significantly less than the next smallest reported trade size.

Based on the observed pattern, it can be inferred that a substantial number of Bitcoin ETF investors are likely individual investors with a stronger inclination towards following trends.

As a researcher studying the behavior of retail investors in the cryptocurrency market, I’ve found that there’s a significant concern about their tendency to sell when the Bitcoin (BTC) price dips below their initial investment price of around $58,000. These investors, often referred to as “degen retail,” may panic and liquidate their holdings due to fear of losing more money. This selling pressure can potentially exacerbate market downturns and create further volatility.

As a researcher studying the behavior of traditional finance investors in relation to Bitcoin (BTC), I’ve noticed an interesting trend: when BTC dips below the $58,000 mark, these investors often feel compelled to sell. This pattern can be seen in historical data. Therefore, it’s crucial to keep an eye on this price level if looking to understand the actions of traditional finance players in the Bitcoin market.

As a crypto investor, I’ve noticed an intriguing trend: When Bitcoin’s price gets close to the average purchase price of retail investors, the inflow of funds into Bitcoin ETFs, excluding Grayscale’s GBTC, begins to reverse course and turns into outflows.

In simpler terms, Bianco drew an analogy between the current situation and a forest fire. Just as selling Bitcoin becomes rampant once its price drops below the original buying cost, causing market instability, so does a forest fire spread rapidly when a small flame triggers a larger inferno.

As an analyst, I would highlight Bianco’s advocacy for a shift from conventional finance methods towards embracing digital assets like Ethereum and Bitcoin through the creation of related Exchange-Traded Funds (ETFs).

As an analyst, I’d caution against placing blind faith in Bitcoin Exchange-Traded Funds (ETFs) as the sole catalyst for drawing in large numbers of investors, leading to a significant price surge, as was widely believed during the Bitcoin peak in March. The growing inflows in the ETF market are also noteworthy, but focusing solely on this approach could obstruct our main objective: building a solid foundation for digital finance.

Bianco recognizes the value of Bitcoin ETFs in the larger context of digital finance, but he advises exercising caution to prevent them from turning into a mere speculation instrument that might undermine the ultimate objective of creating a robust and stable financial infrastructure.

As I analyze the current market situation, Bitcoin (BTC) is presently priced at around $62,500. Over the last 24 hours, its value has decreased by approximately 2%. Furthermore, within the past week, BTC has experienced a decline of over 5%.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- BSW PREDICTION. BSW cryptocurrency

2024-04-30 01:12